The web3 job market is booming, and earning in tokens instead of salaries offers faster payments, lower fees, and global access—here’s what you need to know

- 1 Introduction

- 2 State of Play in 2025: Who Actually Pays in Tokens

- 3 Compensation Models That Work

- 4 Compliance Snapshot by Region

- 5 Conclusion

-

6

FAQs

- 6.1 Is earning in tokens instead of salaries legal in the US and EU?

- 6.2 How are token wages taxed?

- 6.3 Do accounting rules now favor crypto on balance sheets?

- 6.4 Which stablecoins work best for payroll?

- 6.5 Can employees split pay between tokens and fiat?

- 6.6 Are DAO contributors subject to payroll compliance?

Introduction

Earning in tokens instead of salaries, it is rapidly becoming a serious payroll strategy for on-chain startups and even traditional firms exploring digital asset exposure.

According to a 2024 PwC survey, over 18% of blockchain-focused employers already offer partial token compensation, a number expected to double as regulatory clarity matures.

The appeal is clear: token-based payroll provides faster settlement, borderless payments, and the opportunity for employees to align incentives with the projects they help build.

Yet, this shift is not without risks. Token volatility and unclear tax treatment remain top concerns for both employers and staff.

For instance, one surprising finding is that U.S. workers who received crypto wages during 2023 faced an average of 38% higher portfolio volatility than peers in traditional cash-based payrolls.

But change is coming: the FASB ASU 2023-08 rule now requires companies to mark crypto assets to fair value starting after December 15, 2024, offering transparency to public companies adopting token compensation.

Meanwhile, Europe’s MiCA rollout in 2024–2025 is building compliant stablecoin rails that could normalize crypto payroll across borders.

The practical takeaway? Mainstream employers should begin evaluating token compensation frameworks today—whether stablecoin salaries for risk-averse staff or equity-like token incentives for innovation teams—because earning in tokens instead of salaries may soon shift from an optional perk to a competitive necessity.

State of Play in 2025: Who Actually Pays in Tokens

The rise of tokenized payroll is now a real, measurable trend shaping how organizations compensate talent worldwide. While mainstream adoption is still in its early stages, several segments of the crypto economy have gone all-in on crypto compensation adoption, with stablecoin payroll leading the charge.

Protocol foundations

Protocol foundations remain at the forefront. Layer-1 and Layer-2 ecosystems, such as Ethereum, Solana, and Avalanche Foundations, frequently pay contributors and ecosystem grantees in native tokens.

This approach not only aligns developer incentives but also strengthens token utility by embedding compensation into the project’s economic cycle.

For many technical teams, receiving tokens directly represents a form of equity-like ownership in the protocol’s growth.

DeFi and infrastructure startups

DeFi and infrastructure startups are another active segment. Startups building decentralized exchanges, custody tools, and Web3 infrastructure often lean into tokenized payroll, offering team members stablecoins for predictable expenses and project tokens as long-term incentives.

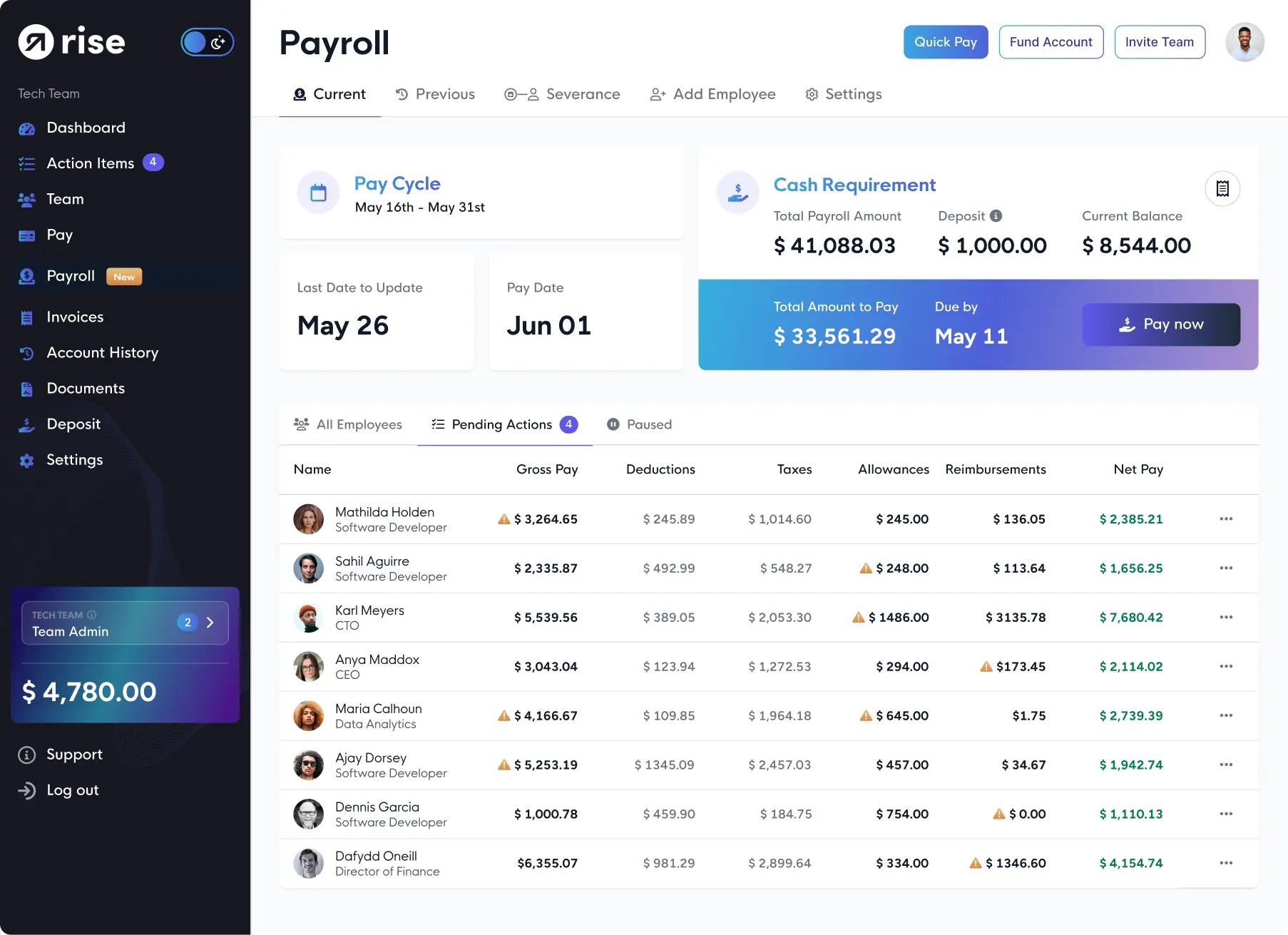

Platforms such as RiseWorks illustrate the momentum: the company has already facilitated over $650 million in payroll volume, serving hundreds of companies paying employees and contractors in both local currencies and stablecoins.

DAOs (Decentralized Autonomous Organizations) pioneered the idea of flexible, borderless payroll. From governance contributors to community managers, DAOs routinely distribute governance tokens or stablecoins to a globally distributed workforce.

This model has since influenced startups and even hybrid Web2–Web3 firms experimenting with distributed payroll.

Cross-border contractor marketplaces

Cross-border contractor marketplaces are rapidly expanding tokenized payroll adoption. Platforms targeting freelancers and remote contractors—especially in emerging markets—now integrate crypto payment rails, reducing fees and settlement delays.

Conversion-at-deposit options also play a role: Coinbase and other exchanges allow workers to receive crypto even if employers still pay in fiat, bridging the gap between traditional payroll systems and crypto-native compensation.

The “why now” is clear. In the United States, the FASB ASU 2023-08 update mandates fair-value accounting for crypto assets starting after December 15, 2024, giving employers more confidence in balance sheet reporting.

In Europe, MiCA’s staged rollout is establishing compliant rails for stablecoin payrolls, setting a regulatory template for cross-border use.

Combined with the growing contractor-first hiring model in tech, tokenized payroll is emerging as both a compliance-friendly and worker-centric solution.

Compensation Models That Work

As Web3 organizations mature, compensation models are evolving far beyond traditional payroll. Startups and DAOs are experimenting with stablecoin salaries, hybrid pay packages, token-based incentives, and micro-contracts.

Each approach balances risk, liquidity, and long-term alignment differently, giving both employers and contributors flexibility. Let’s break down the most effective structures shaping the Web3 job market today.

Stablecoin-denominated pay for volatility control and instant settlement

One of the earliest fixes to crypto payroll volatility was the adoption of stablecoin pay. Instead of receiving salaries in ETH or BTC, contributors increasingly prefer USDC or USDT. These stablecoins peg to the U.S. dollar but serve different strategic purposes.

- USDC is widely favored for compliance, backed by Circle’s transparent reserves and strong banking partnerships. Treasury teams prefer it because audits are regular, and regulators view it as a safer option.

- USDT, issued by Tether, remains the liquidity king across exchanges, making it easier for workers in emerging markets to cash out. However, its reserve transparency has been questioned, leading some compliance-conscious firms to avoid it.

Platforms like Bitwage make it simple for global teams to receive stablecoin pay directly, bypassing traditional banking rails and enabling instant settlement. For remote-first Web3 companies, this removes friction and ensures contributors don’t see their earnings evaporate during a market dip.

Mixed packages: fiat base plus token top-ups or bonuses

Not every contributor is ready to live fully on-chain. Many projects balance stability and upside by offering a fiat base salary alongside token top-ups or performance-based bonuses.

This model provides predictable income while still aligning team members with project growth. For instance, a developer might receive 70% of their compensation in fiat and 30% in governance tokens.

Performance bonuses tied to token price milestones or protocol adoption encourage long-term engagement without risking short-term financial security.

Token warrants and SAFT-adjacent structures for pre-TGE teams and advisors

For contributors joining before a token generation event (TGE), companies often use token warrants—contracts granting the right to receive tokens once they’re issued. Unlike direct token grants, warrants avoid early issuance and potential securities complications.

These agreements typically define:

- Strike price or conversion terms

- Vesting schedules (linear, milestone-based, or hybrid)

- Cliffs and lockups to prevent premature liquidation

Advisors, early hires, and contractors benefit by securing upside without the company violating securities laws. Tools like Pulley help track equity and token warrants, while firms such as TokenMinds and LegalVision provide structuring and legal guidance.

This SAFT-adjacent (Simple Agreement for Future Tokens) approach ensures both compliance and incentive alignment.

DAO bounties and micro-contracts with on-chain proofs

In decentralized communities, traditional salaries don’t always make sense. Instead, many DAOs rely on bounties—task-based payments released when contributors deliver proof of work on-chain.

This micro-contract structure lowers hiring friction, attracts a global talent pool, and rewards contributors for specific deliverables.

To manage long-term commitments, DAOs also implement structured vesting schedules:

- Cliffs delay token distribution until a contributor proves long-term engagement.

- Lockups prevent token dumping immediately after a TGE.

- Linear vesting releases tokens gradually over time, while milestone-based vesting ties payouts to protocol achievements.

- Clawbacks and blackout windows protect the treasury by reclaiming or pausing allocations if performance or compliance issues arise.

These mechanisms mirror corporate equity plans but are coded into smart contracts for transparency and enforcement.

Compliance Snapshot by Region

Crypto payroll isn’t just about choosing the right compensation model — compliance rules vary dramatically across jurisdictions.

Employers must balance tax treatment, accounting standards, and regulatory frameworks when paying contributors in tokens or stablecoins. Below is a region-by-region breakdown of the current landscape.

United States

Tax treatment

In the U.S., the Internal Revenue Service (IRS) makes it clear: virtual currency wages are wages. If an employee is paid in Bitcoin, ETH, or stablecoins, the fair market value (FMV) at the time of receipt must be included in gross income and reported on a W-2.

Employers are required to withhold income tax, Social Security (FICA), and federal unemployment tax (FUTA), just as they would for fiat salaries.

For contractors, crypto payments are treated as self-employment income and reported on Form 1099-NEC. Employers must also track FMV fluctuations, which can add operational complexity when salaries are paid in volatile tokens.

Accounting treatment

On the accounting side, the Financial Accounting Standards Board (FASB) recently finalized a new standard requiring most crypto assets to be measured at fair value with changes recognized in net income.

This rule replaces the older “indefinite-lived intangible” treatment that forced impairment losses but not upward revaluations.

The new rule, effective for fiscal years beginning after December 15, 2024, is a major planning consideration for Web3 companies. Firms will need enhanced disclosures around holdings, gains, and losses.

Resources like DART (Deloitte Accounting Research Tool) offer implementation guidance to prepare treasury teams for the transition.

European Union

MiCA regime

In the EU, the Markets in Crypto-Assets Regulation (MiCA) has ushered in the first comprehensive crypto framework. As of 2024, MiCA’s stablecoin provisions are in force, requiring issuers to meet strict capital, reserve, and governance standards.

For employers, this means payroll choices may be limited to authorized issuers, narrowing which stablecoins can be used for employee pay.

The Crypto Asset Service Provider (CASP) regime is phasing in through 2026, with transitional authorizations allowing existing providers to operate while they adjust.

This transitional period gives employers flexibility but also creates uncertainty around long-term payroll tooling.

Regulators such as ESMA (European Securities and Markets Authority) and advisory firms like InnReg are publishing interpretive guidance, helping HR and finance teams navigate MiCA payroll compliance requirements.

Employers must weigh cross-border friction carefully — a stablecoin permitted in one EU state may face scrutiny in another.

United Kingdom

Tax treatment

The UK treats crypto payroll as employment income if paid to staff, meaning it counts as “money’s worth.”

The HMRC (Her Majesty’s Revenue & Customs) guidance specifies that crypto earnings are subject to income tax and National Insurance Contributions (NIC) when they are “readily convertible assets” (RCAs).

This means if tokens can be sold on an exchange for cash, they trigger withholding and reporting obligations.

Employers must calculate payroll withholding based on the pound sterling value of tokens at payment. Legal practitioners such as Burges Salmon advise that compliance hinges on whether tokens qualify as RCAs, making recordkeeping and valuation critical.

For contractors or freelancers, payments in crypto may not fall under PAYE withholding but are still taxable as income, with capital gains considerations on later disposals.

Compliance call-outs

Even with these frameworks, compliance is in flux. Employers should closely monitor:

EU debates on stablecoin supervision: Ongoing discussions, highlighted in outlets like the Financial Times, may further restrict which issuers can serve payroll needs across borders.

U.S. enforcement signals: IRS scrutiny of crypto payroll reporting continues to intensify, particularly around 1099 and W-2 filings.

UK RCA rules: Classification of tokens as “readily convertible assets” remains a hot compliance gray area, with implications for both startups and DAOs employing UK-based talent.

Conclusion

Web3 is quietly reshaping how people work and get paid. With stablecoins, token warrants, and on-chain payroll platforms, earning in tokens instead of salaries has shifted from a fringe experiment to a credible option for companies and workers alike.

The benefits are clear: instant cross-border payments, reduced fees, and ownership-driven incentives that traditional payroll can’t match.

Yet, this new model comes with responsibilities. Employers must navigate complex tax rules, regulatory frameworks like MiCA, and fair-value accounting standards, while workers need to weigh volatility risks, vesting terms, and long-term liquidity.

The bottom line? Token-based pay is not replacing fiat overnight—but it is becoming a powerful complement. For forward-looking firms, offering compensation in tokens signals innovation and flexibility.

For workers, it opens doors to global opportunities and equity-style upside. In a world where work is borderless, earning in tokens instead of salaries may soon be less of a trend and more of a standard.

FAQs

Is earning in tokens instead of salaries legal in the US and EU?

Yes. In the US, the IRS permits token wages but requires reporting at fair market value (FMV) on a W-2, with income tax, FICA, and FUTA withholding. In the EU, salaries in tokens are allowed under MiCA, but only through compliant issuers and registered CASPs. Transitional authorizations extend into 2026, per ESMA and InnReg.

How are token wages taxed?

Token wages are taxed on their FMV at the time of receipt. In the US, they are treated as income and later disposals may trigger capital gains. In the UK, HMRC applies “readily convertible asset” rules, making such wages subject to income tax and NIC when tokens can be traded for fiat.

Do accounting rules now favor crypto on balance sheets?

Yes. The FASB now requires fair-value accounting for most crypto assets, effective for fiscal years after Dec 15, 2024. This removes impairment-only treatment, allowing both gains and losses to flow through earnings. Guidance from DART stresses disclosure and valuation controls.

Which stablecoins work best for payroll?

USDC is favored for compliance due to Circle’s disclosures and regulatory oversight, though employers must consider freeze and blacklist risks under USDC terms. USDT offers greater liquidity but faces reserve transparency concerns. Treasury teams must balance compliance with accessibility when building a stablecoin treasury.

Can employees split pay between tokens and fiat?

Yes. Many crypto payroll providers support “convert-on-payday,” letting employees choose a percentage of their salary to keep in tokens while the rest is automatically off-ramped to fiat.

Are DAO contributors subject to payroll compliance?

Yes. DAO bounties and task-based payments are taxable income at FMV when received. Proper reporting is required, and tools or third-party providers often help generate compliant records.