Google’s GCUL blockchain targets cross-border payments, challenging Ripple, Circle, and Stripe with scalable, neutral financial solutions.

Google Cloud has recently introduced a new Universal Ledger (GCUL), a Layer-1 blockchain platform designed for cross-border settlements. With this move, Google is challenging the existing market participants, such as Ripple, Stripe, and Circle, who provide infrastructure for instant settlements worldwide. The technology behemoth disclosed that they have developed GCUL to be user-friendly, adaptable, and secure.

Dominant players such as Ripple, Circle, and Stripe will be challenged by Google’s GCUL

Google Cloud Universal Ledger (GCUL), a novel Layer-1 blockchain network, is intended to simplify asset settlements and cross-border payments. This development has occurred as the technology behemoth investigates opportunities in the blockchain and crypto industry, and has recently increased its stake in Bitcoin miner CleanSpark.

According to Rich Widmann, the Global Head of Strategy for Web3 at Google Cloud, GCUL is specifically designed for financial institutions and includes Python-based smart contracts.

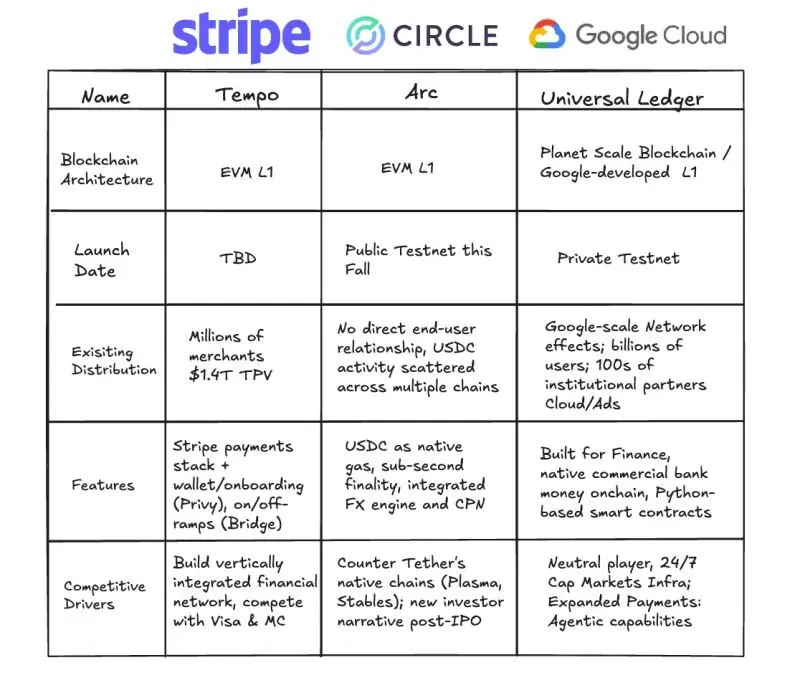

Additionally, he distributed a chart that contrasted the superiority of GCUL over existing competitors such as Circle and Stripe. Widmann mentioned in his most recent LinkedIn post that GCUL would capitalize on Google’s extensive distribution network and function as a neutral infrastructure layer.

In contrast to proprietary networks, where Tether would not operate on Circle’s blockchain and Adyen would likely not adopt Stripe’s, he added that GCUL is open for any financial institution to build on.

Following an earlier partnership with CME to pilot tokenized assets, the network operates in a private testnet. The three primary attributes of Google Cloud Universal Ledger are as follows:

Simple: GCUL is provided as a service with a unified API, simplifying the integration process across various asset types and currencies.

Flexible: GCUL offers programmability that facilitates digital asset management, payment automation, and high performance and scalability for various use cases.

Secure: GCUL is designed to comply with regulatory requirements, incorporating KYC-verified accounts and compliant transaction fee structures. It operates within a private, permissioned environment.

Seeking a Piece of the Tokenized Market

Recently, the blockchain-based tokenized market has been expanding rapidly, and traditional market players are now interested in gaining a market share. Google’s entry into the tokenized asset market with GCUL will also pit it against Ripple’s XRPL infrastructure. XRPL experienced a 2,260% increase in tokenized RWAs, as reported.

Traditional financial actors are demonstrating a growing interest in tokenized assets. DBS, the largest bank in Singapore, announced last week that it intends to introduce tokenized structured notes to Ethereum.