Bitcoin ETF recorded over $102 million in inflows into BlackRock’s IBIT $20 billion spot on May 28, while Grayscale’s ETF continued to lose ground.

According to reports, the Grayscale Bitcoin Trust (GBTC) has been eclipsed by BlackRock’s IBIT spot BitcoiBitcoin ETPs Hold Over 1 Million BTCn exchange-traded fund as the biggest exchange-traded fund globally that tracks the price of Bitcoin.

BlackRock’s iShares Bitcoin Trust, or IBIT, saw inflows of $102.5 million as of May 28’s closing bell, while GBTC saw outflows of $105 million.

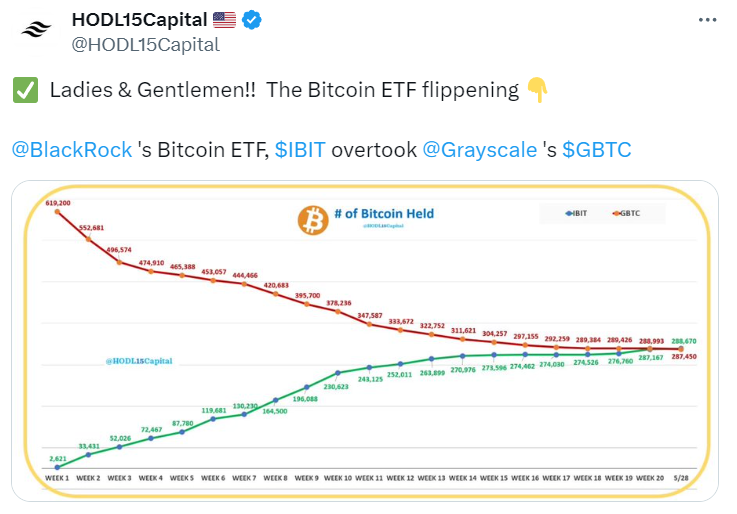

According to data from HODL15Capital and the Apollo Bitcoin Tracker, the inflow is said to have increased BlackRock’s spot Bitcoin ETF to 288,670 Bitcoin BTC$68,120 held. In contrast, Grayscale now holds 287,450 bitcoins, despite starting at 620,000 bitcoins at its conversion in January.

According to a Bloomberg report from May 29 that used its own collected data, the fund had $19.68 billion in Bitcoin as of Tuesday, compared to Grayscale’s $19.65 billion. At $11.1 billion, Fidelity’s ETF offering lagged.

HODL15Capital posted, “There is a new king in the land of Bitcoin ETFs and BlackRock.”

BlackRock’s ETF has absorbed the majority of inflows into all 11-spot Bitcoin ETFs since both ETFs started on the same day in January.

Currently trading at $68,550, Bitcoin is up 1.1% for the day, as per CoinMarketCap data.

According to recent regulatory filings, BlackRock’s bond-focused and income funds purchased shares of its spot Bitcoin exchange-traded fund (ETF) during the first quarter of this year.

According to documents made with the Securities and Exchange Commission on May 28, BlackRock’s Strategic Income Opportunities Fund (BSIIX) acquired $3.56 million worth of the iShares Bitcoin Trust (IBIT), and its Strategic Global Bond Fund (MAWIX) paid $485,000 for the same investment.

Currently, spot Bitcoin ETFs around the world hold over one million Bitcoins worth over $68 billion, or roughly 5.10% of the total amount of Bitcoin in circulation.

Analysts estimate that spot Ether ETH$3,831 ETFs might go live as early as mid-June, so all eyes are on this development.

The last step needed before the ETFs may start trading on their stock exchanges is the S-1 approval process.