As Bitcoin proponents aim to solidify $69,000 as support, BTC momentum increases, crossing $70,000 with a 4% rise. Key levels: $66K and $72K.

At the Wall Street opening on June 3, Bitcoin BTC$69,269 crossed $70,000 as the uptrend from the previous daily close persisted.

Bitcoin price: $69,000 is still the significant resistance level.

Cointelegraph Markets Pro and TradingView data indicated that the day’s BTC price increase was getting close to 4%.

Bulls started the week with a new attempt to return Bitcoin to solid support at $69,000, the location of its previous all-time high from 2021 and a crucial psychological level.

Famous trader Skew observed a price premium on perpetual swaps when analyzing the state of exchange order books.

He posted a portion of the message, “Spot market still in control here, pay close attention around $70K,” on X (previously Twitter.

“Would like to see continued decline in perp premium towards more of a spot premium.”

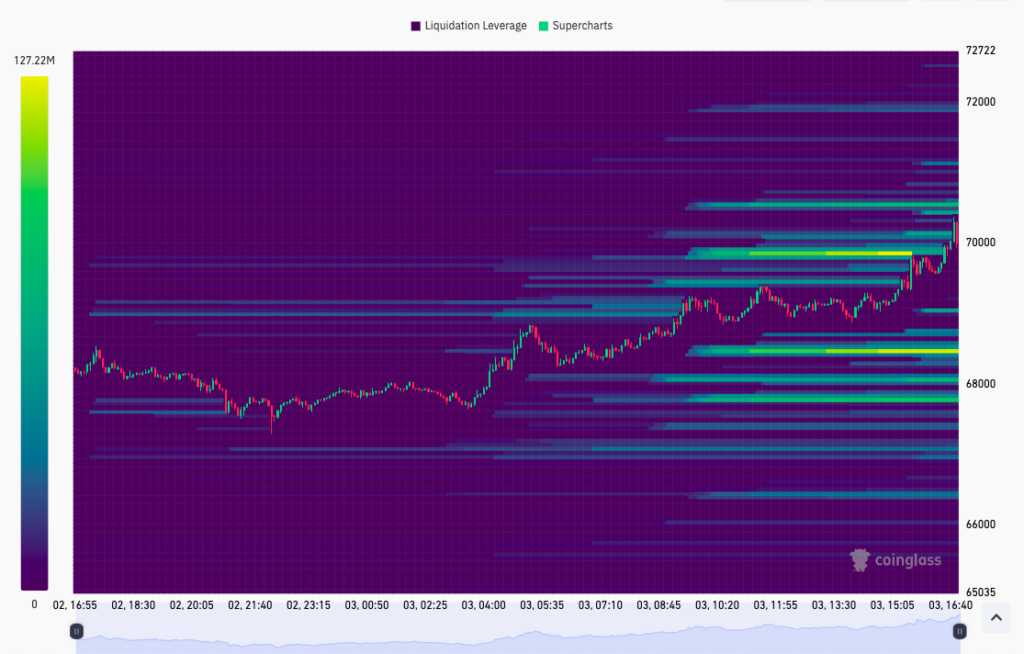

As of the time of writing, there was little close resistance left as BTC/USD was eating into overhead liquidity above $70,000, according to the most recent data from tracking portal CoinGlass.

The $66K and $72K levels are still significant from a liquidity standpoint. Observe those levels,” fellow trader and analyst Daan Crypto Trades said in response to the information.

Meanwhile, the comparatively quick rise in Bitcoin has prompted new calls for a return to price discovery.

Trader Kaleo maintains that the goal for BTC/USD is now $100,000, over three months after it reached its most recent all-time highs.

He announced to his X followers that day, “It’s time for round 2,” and included a graphic that illustrated the rise to the top and the ensuing period of consolidation.

“$100K is a magnet.”

The Ethereum ETF uplifts sentiment in the cryptocurrency market.

QCP Capital, a trading firm, expressed optimism that the current market conditions will remain good for Bitcoin and altcoins.

In its most recent market report to Telegram channel members, it contended that opening spot Ether ET$3,782 exchange-traded funds (ETFs) in the US would be advantageous for the cryptocurrency space overall.

This month, we anticipate seeing the historic event.

The market will likely be optimistic while waiting for the ETH spot ETF to generate fresh demand. The report stated that ETH volumes are still trading 15% higher than BTC volumes, so the options market undoubtedly reflects this.

“Another reason for persistent bullishness is speculators increasing long positions in other crypto majors in anticipation of additional spot ETF approvals in the near future.”

ETH/USD opened at $3,849, new all-time highs for the month.