Bitcoin ETFs see record inflows, reaching $1.4 billion in two days. Fidelity tops with $220.6M, followed by BlackRock. Total Bitcoin ETF investments hit $15.3B.

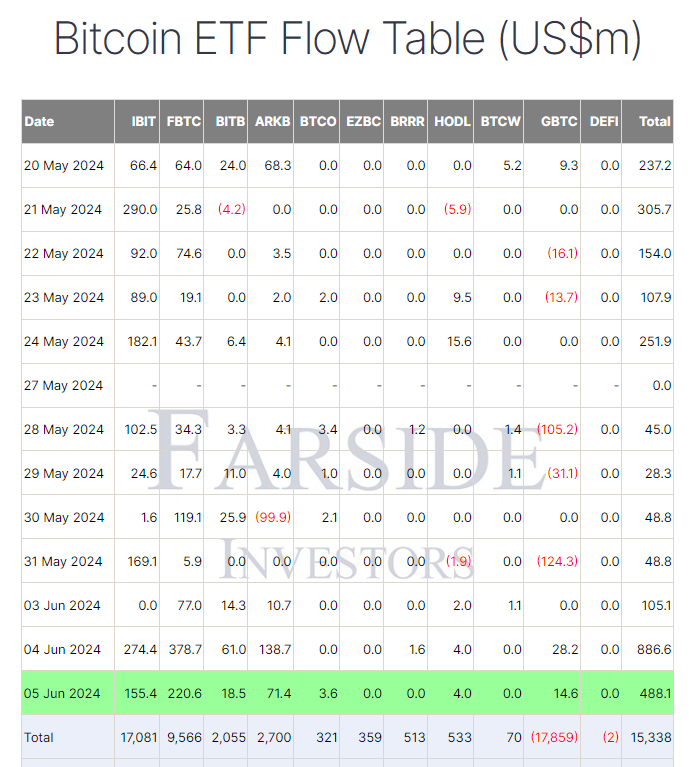

Farside data indicates that on June 5, exchange-traded funds (ETFs) that track Bitcoin (BTC) had significant inflows, culminating in a noteworthy accumulation of $488.1 million. With 17 trading days in a row, this ties the record for the longest string of inflows. Only in the last two days have inflows increased to $1.4 billion.

According to farside data, Fidelity FBTC topped the inflows, boosting its net inflow to $9.6 billion with $220.6 million. With a close second place of $155.4 million, BlackRock’s IBIT ETF saw its total inflow reach $17.1 billion. Bitwise’s BITB ETF reported an influx of $18.5 million, bringing its entire value to $2.1 billion, while ARK’s ARKB ETF received inflows of $71.4 million, bringing its total value to $2.7 billion. Grayscale’s GBTC still has a net outflow of $17.9 billion, even with a $14.6 million inflow. $15.3 billion has been invested in Bitcoin ETFs overall.

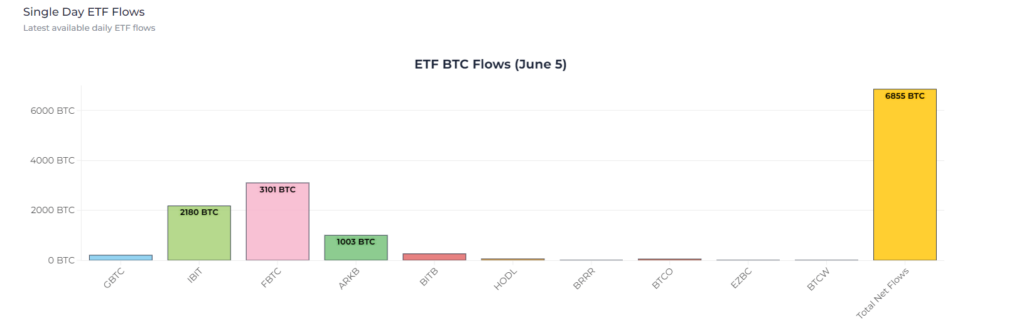

In terms of Bitcoin, 6,855 BTC were accumulated on June 5, according to heyapollo data.