The continued failure of the $69,000 support level to maintain its stability is causing concern among analysts; however, there is still a possibility of a BTC price turnaround

During the June 11 Asia trading session, Bitcoin traded below $68,000 due to the warning of additional BTC price declines.

The absence of “heavy” support for the offer coincides with the weakness of the price of BTC.

After the daily close, Bitcoin BTC experienced a 3% decline, reaching a low of $67,320 on Bitstamp, according to Cointelegraph Markets Pro and TradingView data.

Bitcoin supporters could not prevent a downward movement by leveraging the thin liquidity of the exchange order book, as they lacked support at the critical $69,000 level.

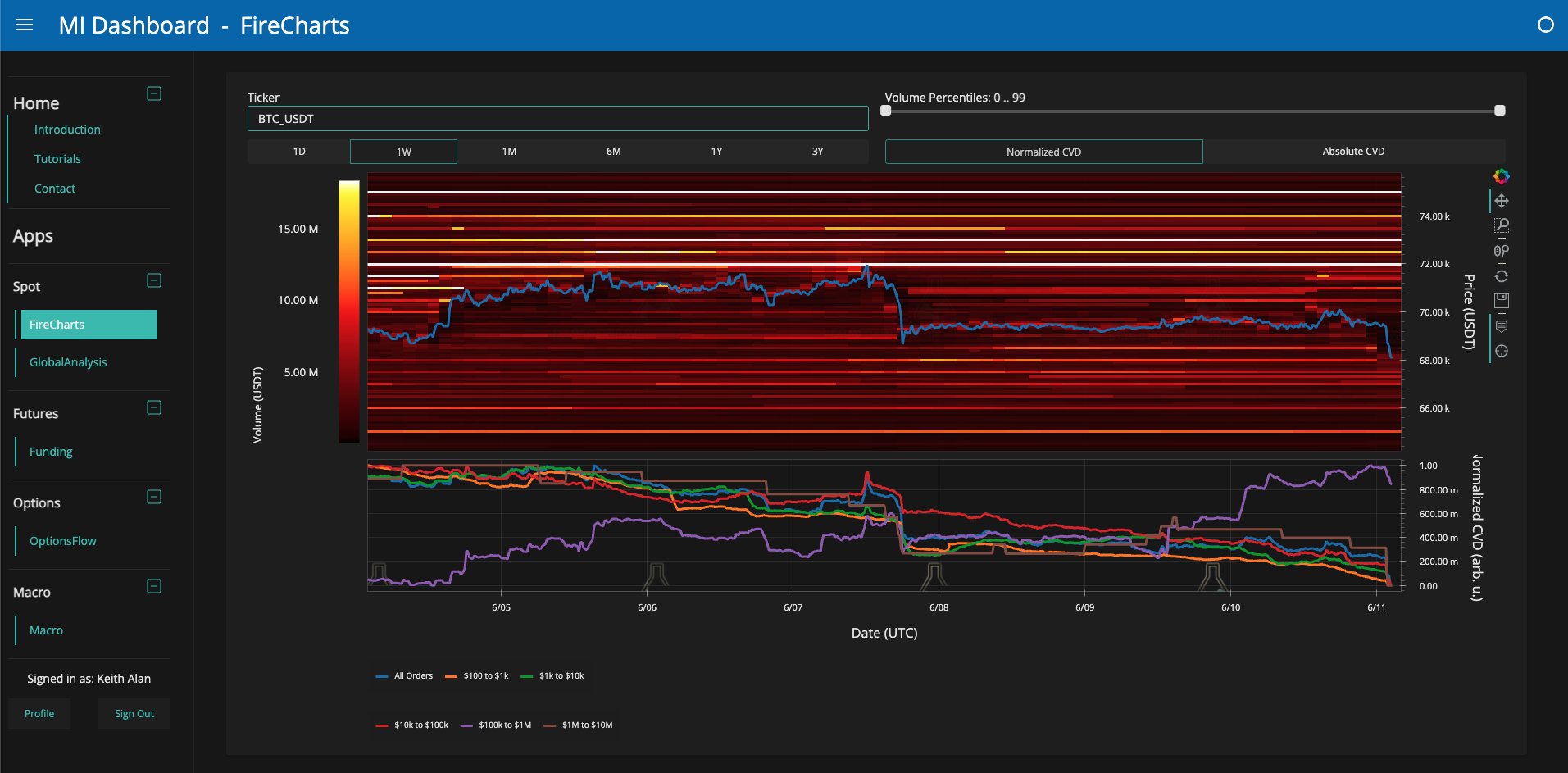

On the previous day, Keith Alan, the co-founder of the trading resource Material Indicators, had cautioned that insufficient offers could serve as a warning sign for the strength of the Bitcoin price.

“Certainly, we have some laddered bid support in this, but it is not a significant concentration. It is not even significant down to $60,000, if I may be sincere,” he stated in his most recent YouTube update.

As illustrated in the accompanying chart, the order book liquidity for the BTC/USDT pair on Binance, the largest global crypto exchange.

In a subsequent post on X, Material Indicators observed that Bitcoin had formally rejected $69,000 as support and had also relinquished the 21-day moving average, a critical short-term trendline, with the most recent decline.

“The R/S Flip at $69k and support at the 21-Day Moving Average have both been invalidated,” it stated.

“This move isn’t over. In fact I expect these killer whale games to continue up to and through JPow’s comments on Wednesday and economic reports on Thursday.”

The primary potential volatility catalyst for Bitcoin and crypto price action this week, as reported by Cointelegraph, is the latest interest rate decision and accompanying press conference by Federal Reserve Chair Jerome Powell, as well as the Consumer Price Index (CPI) and Producer Price Index (PPI) of the United States.

“The CPI/PPI has been at the high end of this range thus far, and the FOMC has led to local lows,” added prominent trader Skew. In a subsequent post on X, Material Indicators observed that Bitcoin had formally rejected $69,000 as support and had also relinquished the 21-day moving average, a critical short-term trendline, with the most recent decline.

“The R/S Flip at $69k and support at the 21-Day Moving Average have both been invalidated,” it stated.

“Interesting few days ahead.”

Diverse perspectives regarding Bitcoin’s endorsement

Credible Crypto, a fellow trader and commentator, suggested in his market analysis that the consequence of the down move may not be as radical as a trip to $60,000.

The appetite for BTC could prevent investors from falling below $65,000 as large-volume traders add and remove liquidity from the market at will.

He summarized to X subscribers, “We continue to observe spot absorption on every downward movement, even on shorter timeframes.”

Credible Crypto observed that the overhead resistance at $72,000 was “pulled immediately” when Bitcoin began to reverse.

“What is the probability that we will run ahead of the range lows and 62-65k and then reverse course from here?” He concluded, “I believe they are satisfactory.”

“No guarantees of course, but we will know soon enough with developing PA over the next 24 or so hours.”