The sentiment of the market remains intricate due to the subtle fluctuations in Bitcoin derivatives that are influenced by ETF inflows and outflows

Despite the absence of the typical volatility in the derivatives market, the mild fluctuations observed in the past few days have still managed to reveal subtle market trends.

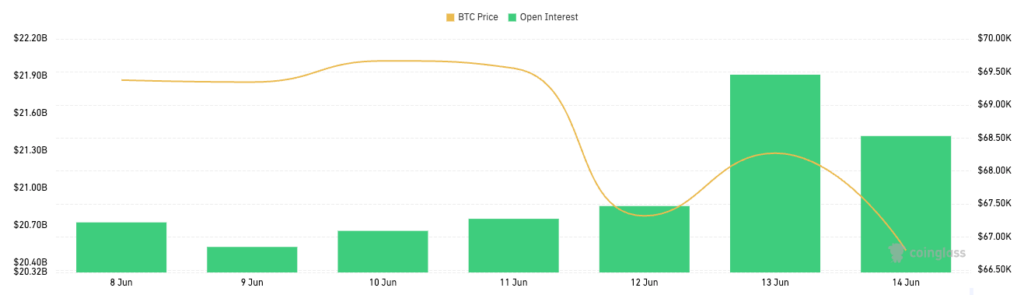

Bitcoin options open interest increased from $20.85 billion on June 12 to $21.91 billion on June 13 and then decreased to $21.42 billion on June 14. This increase occurred between June 12 and June 14.

The initial increase in options open interest and a subsequent decline indicate a complex market sentiment when analyzed with price.

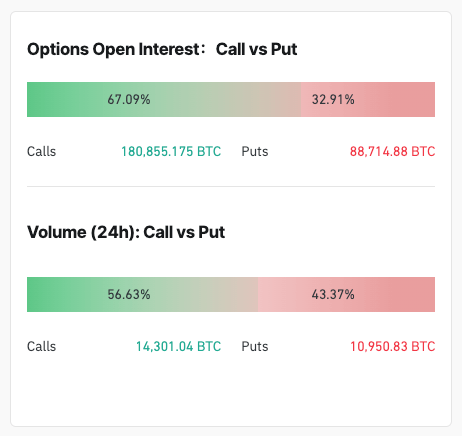

After a brief recovery on June 13, Bitcoin plummeted from $69,555 on June 11 to $66,780 on June 14. Despite the price decline, the overall favorable sentiment is indicated by the predominance of call options (67.17%) over put options (32.83%) as of June 14. This favorable outlook was further bolstered by the 24-hour volume for options on June 14, which was 59.88% call volume despite the declining price environment.

The broader crypto market was influenced by several factors, which resulted in these subtle variations in OI. Bitcoin ETFs have experienced a combination of inflows and outflows in the past few days.

The market’s significant drop is illustrated by the $100 million inflows into Bitcoin ETFs and the abrupt $226 million outflow in response to Ethereum ETF news. The diminishing open interest in futures indicates that this outflow likely contributed to the decreased demand for Bitcoin futures.

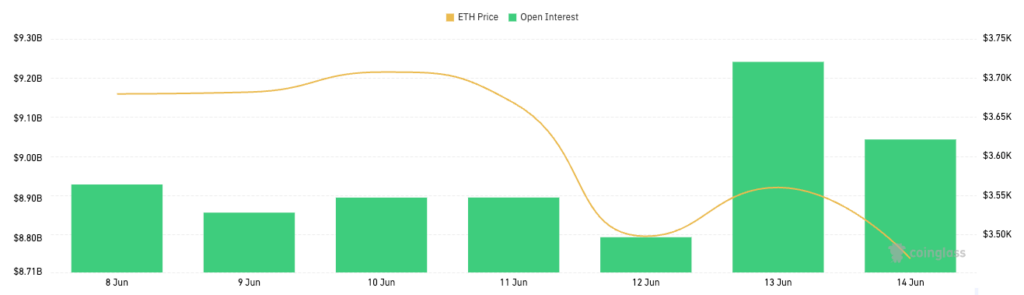

The SEC’s Chair, Gary Gensler,’s decisive statement that Ethereum ETFs would be authorized this summer redirected investor attention and capital toward Ethereum, subsequently affecting the Bitcoin derivatives market. This sentiment change is evident in Ethereum’s futures and options market, where open interest has increased in the past few days.

Investor perception was also influenced by MicroStrategy’s issue of convertible notes to buy more Bitcoin. The company’s persistent faith in Bitcoin is demonstrated by Michael Saylor’s most recent action, which may impact investors in the derivatives market. The dominance of call options demonstrates their capacity to sustain and grow bullish positions in the face of a flat price.

The markets for Bitcoin futures and options are directly impacted by ETF outflows. Withdrawals from Bitcoin ETFs may result in less demand and liquidity in the futures market, lowering open interest. The data clearly shows this relationship, as we see a decrease in future open interest after substantial ETF outflows.

The correlation between futures open interest and ETF flows demonstrates the significance of institutional participation and sentiment in influencing market direction.

Open interest has been tempered by Bitcoin’s sideways trajectory and lack of notable volatility throughout this time. There may be fewer opportunities for profit for traders when the price stays reasonably consistent, which would decrease trading activity and future open interest.

The observed reduction in futures open interest can be attributed to a time of market consolidation, as suggested by the constant price range of Bitcoin from June 10 to June 14, with minimal changes.