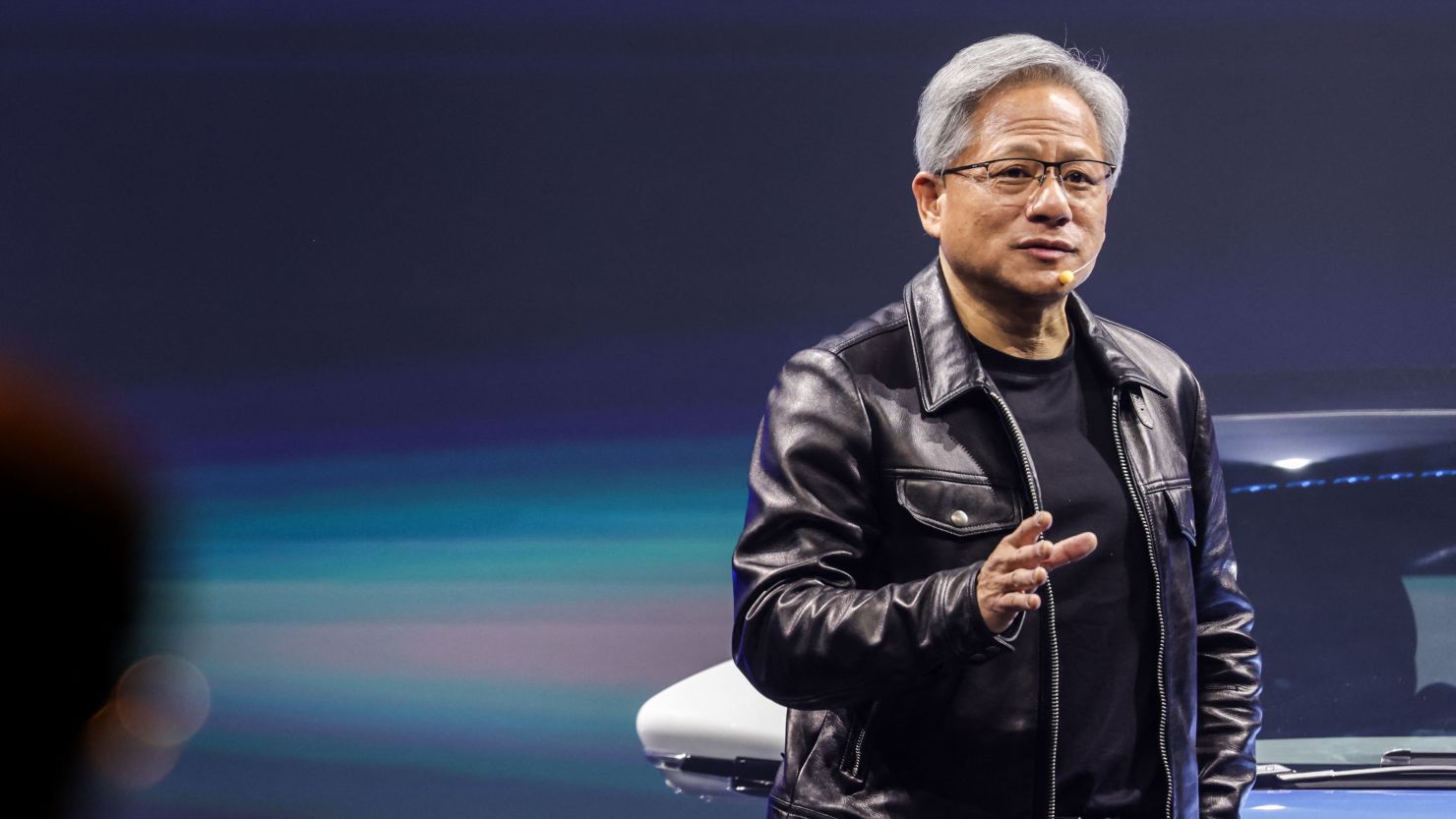

The U.S. Supreme Court heard Nvidia’s attempt to dismiss a securities fraud complaint accusing the artificial intelligence chipmaker of misrepresenting its cryptocurrency sales on Monday

The justices accepted Nvidia’s appeal, which was initiated after a lower court reinstated a proposed class action lawsuit filed by shareholders in California against the company and its CEO, Jensen Huang.

The Stockholm, Sweden-based investment management firm E. Ohman J: or Fonder AB is the plaintiff in the lawsuit, seeking unspecified monetary damages.

Based in Santa Clara, California, Nvidia is a high-flying corporation that has become one of the largest beneficiaries of the AI boom, and its market value has increased significantly.

In 2018, Nvidia’s processors gained popularity for crypto mining, which entails solving intricate mathematical equations to protect cryptocurrencies such as Bitcoin.

The plaintiffs in a 2018 lawsuit accused Nvidia and its top executives of violating the Securities Exchange Act of 1934, a U.S. law.

The plaintiffs alleged that Nvidia made statements in 2017 and 2018 that fraudulently underestimated the extent to which its revenue growth was derived from crypto-related purchases.

The plaintiffs contended that these omissions deceived investors and analysts interested in comprehending the impact of crypto mining on Nvidia’s business.

The lawsuit was dismissed by U.S. District Judge Haywood Gilliam Jr. in 2021; however, it was revived by the 9th U.S. Circuit Court of Appeals in a 2-1 ruling.

The court is located in San Francisco. The 9th Circuit determined that the plaintiffs had sufficiently alleged that Huang made “false or misleading statements and did so knowingly or recklessly,” thereby permitting their case to proceed.

Nvidia urged the justices to consider its appeal, contending that the 9th Circuit’s decision would facilitate “speculative and abusive litigation.”

In 2022, Nvidia consented to pay $5.5 million to U.S. authorities to resolve allegations that it failed to adequately disclose the effects of crypto mining on its gaming business.

The justices consented to hear a similar request from Meta’s Facebook to dismiss a private securities fraud litigation. The lawsuit accuses the social media platform of misleading investors in 2017 and 2018 regarding misusing its user data, the company, and third parties.

The decision was made on June 10. After a lower court permitted a shareholder lawsuit initiated by Amalgamated Bank, Facebook filed an appeal.

The Supreme Court will hear the Nvidia and Facebook cases during its upcoming term, which commences in October.