Bitcoin price dropped as Whales have sold $1.2 billion worth of BTC through brokers, and Bitcoin ETF outflows have totaled $460 million.

The price of Bitcoin has been under constant selling pressure for the past two weeks and is currently resting at approximately $65,500. Nevertheless, on-chain data indicates that the Bitcoin price correction may still need to conclude, and it may not be until $60,000 that the BTC price experiences a bullish trend reversal.

Bitcoin Price Drop to $60,000 Much Likely

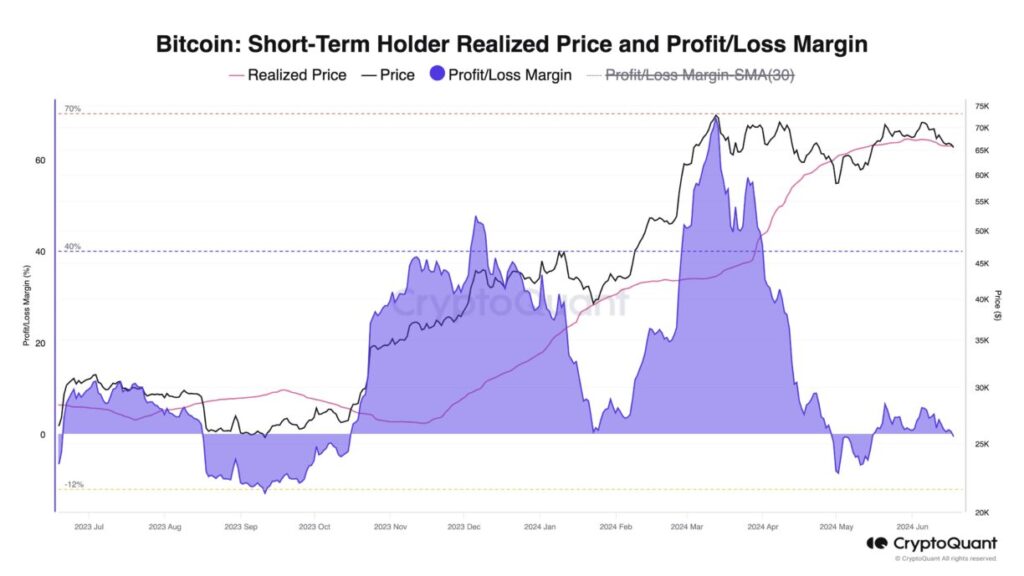

Julio Moreno, Head of Research at CryptoQuant, has indicated that the Bitcoin price has declined below its short-term support levels, as noted in the on-chain realized price of the cryptocurrency. Consequently, he proposed that the price of BTC could experience an additional decline to $60,000.

The analyst also emphasized that the primary demand dynamics currently lack momentum, including stablecoin liquidity, interest from US investors, and buying by large traders, and more investors are needed.

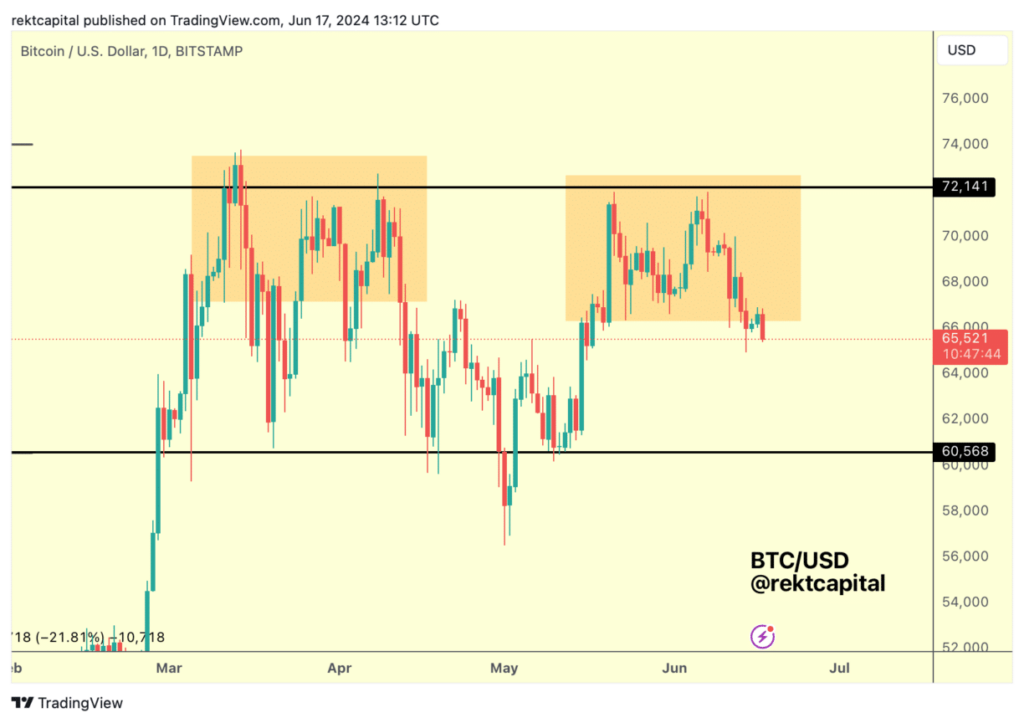

According to Rekt Capital, an additional crypto analyst, the BTC price is prone to forming price action clusters near the Range High resistance, which is approximately $71,600.

This eventually leads to a price retracement to the downside, which generates price action clusters near the Range Low support area, which is approximately $60,600.

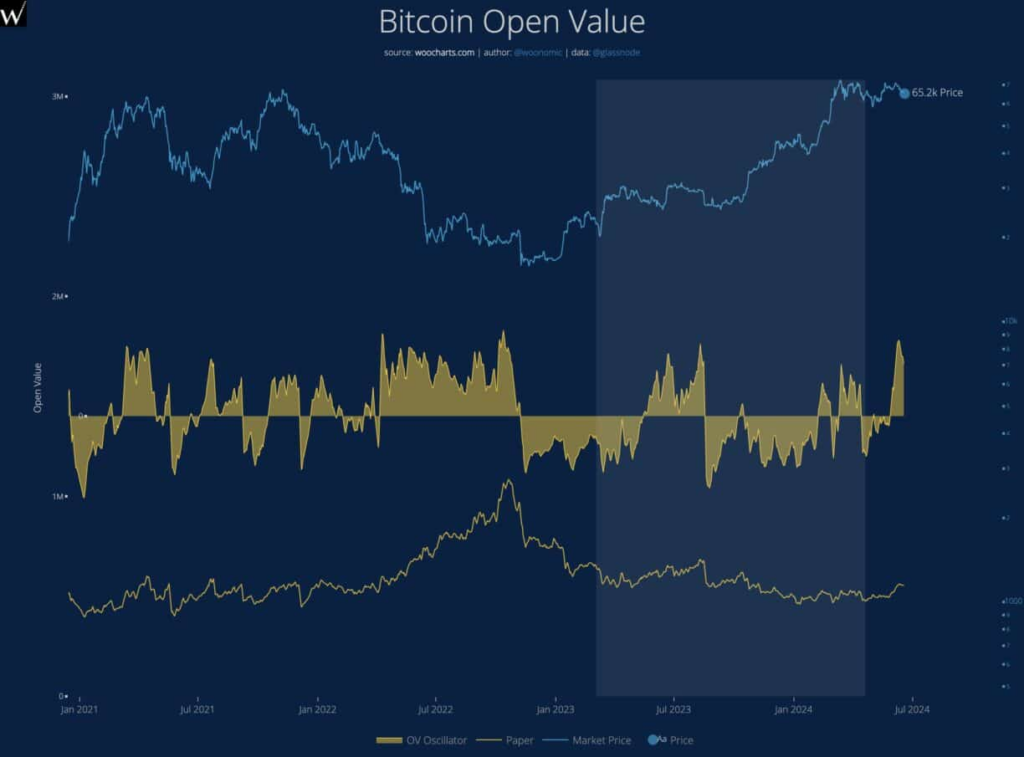

According to Bitcoin analyst Willy Woo, the solid yellow chart below, which represents a z-score oscillator, indicates that there is still a significant amount of open interest in Bitcoin futures wagers.

This oscillator underscores the local significance of these wagers. Woo declared that Bitcoin’s upward trajectory would necessitate many liquidations before it could recommence its bullish climb.

Consequently, numerous on-chain indicators indicate that there is still a degree of volatility in the Bitcoin price that must be resolved before initiating a significant upward trend.

Bitcoin Miners Selling

The Bitcoin miners have been selling in large quantities, particularly following the Bitcoin halving event in April, as CoinGape reported, to cover the operational costs. According to Ki Young Ju, CEO of CryptoQuant, miners have generated $550 million in profits this year within the Bitcoin price range of $62,000-$70,000.

At the same time, the long-term billionaires have sold $1.2 billion worth of BTC through brokers in the past two weeks. In the same time frame, the outflows of Bitcoin ETFs have increased significantly, reaching up to $460 million.

Ju cautioned that brokers could begin depositing Bitcoins to exchanges, resulting in further downside if the $1.6 billion sell-side liquidity is not absorbed over the counter.