Ethereum has been under investigation by the SEC since 2023, raising questions about regulations for the cryptocurrency.

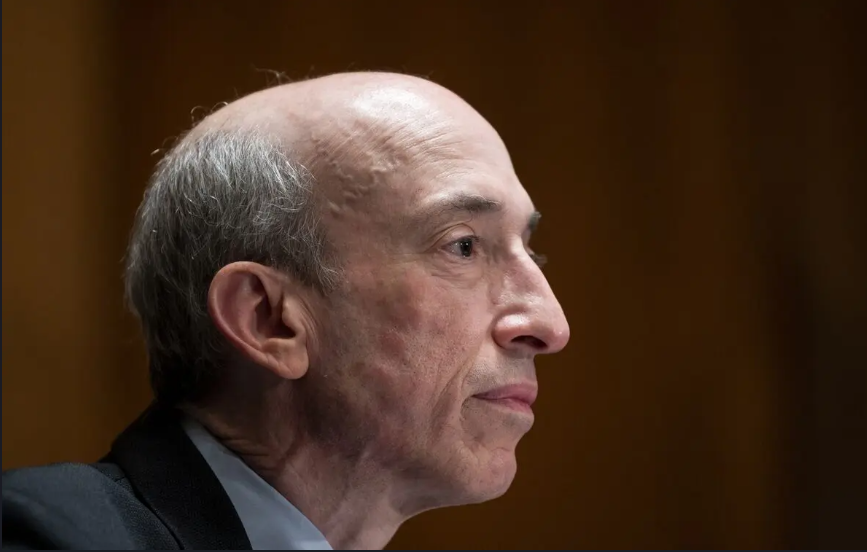

Amid the ongoing regulatory inquiry surrounding the second largest cryptocurrency, the US Securities and Exchange Commission (SEC) has been investigating Ethereum since 2023, according to new court filings. In fact, according to the filings, the agency and chairman Gary Gensler have been attempting to contest the security status of the asset for the past year.

Consensys, a developer of Ethereum software, initiated legal proceedings against the SEC last week. Nonetheless, they provide a thought-provoking depiction of the agency’s perspective regarding cryptocurrency. In particular, they observe that since early 2023, they have been constructing a case against the asset. In contrast, development is crucial given the abundance of Spot Ethereum ETF applications that the agency must contend with.

Since 2023, the SEC has endeavored to contest the security status of ETH.

In terms of regulation, the digital asset market has been confronted with constant change. Indeed, investors from the United States have encountered challenges stemming from the industry’s ambiguity in this domain. This is mainly attributable to the SEC’s continued emphasis on enforcement-oriented regulation.

Court documents indicate that the SEC has been investigating Ethereum since March 2023. Reportedly, the agency has spent over a year constructing a case to contest the security status of ETH.

In March of last year, the SEC director of the Division of Enforcement, Gurbir Grewal, reportedly authorized an investigation order. Thus, the agency can investigate Ethereum’s purchase and sale. In the presence of a formal investigation order, the SEC could issue subpoenas and collect witness statements under oath.

The revelation explains Gensler’s refusal to respond to a recent congressional testimony regarding whether Ethereum was a security or commodity. Consensys reports that Gensler “refused to acknowledge that his SEC had already clandestinely solidified its power grab” via the investigation order.

The SEC has been observed to refer to particular digital assets as securities in lawsuits lodged against cryptocurrency exchanges. In the litigation against Coinbase and Binance in 2023, security was referenced for over ten assets. ETH, nonetheless, was not among them.