Hong Kong’s new Bitcoin & Ether ETFs surpass $200M in assets but lag behind US debuts.

Since their inception on April 30, Hong Kong spot Bitcoin and Ether exchange-traded funds (ETFs) have amassed over $200 million in total assets.

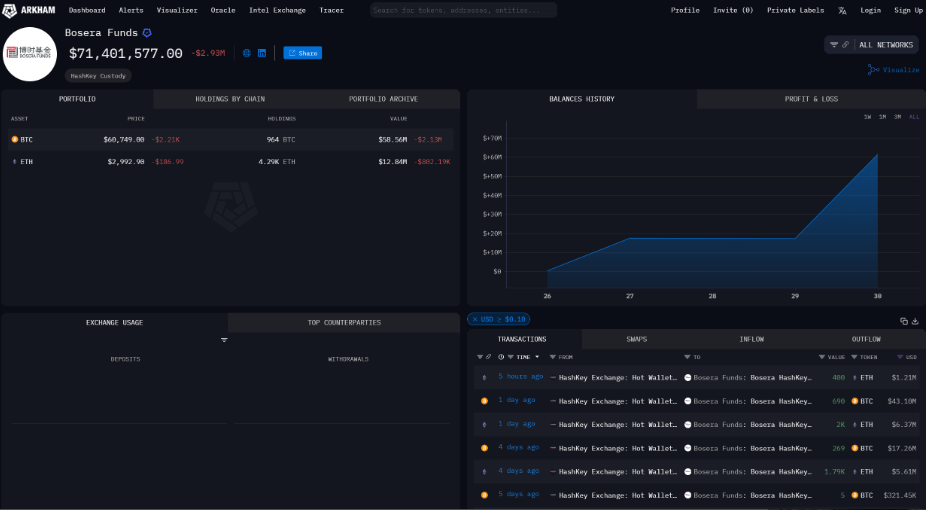

Arkham Intelligence data indicates that the Bosera HashKey spot Bitcoin and Ether ETFs have amassed a combined $71.94 million in assets under administration, or 964 Bitcoin and 4,290 Ether, respectively. In the interim, Bloomberg senior ETF analyst Eric Balchunas disclosed that ChinaAMC-established spot Bitcoin and Ether ETFs had accumulated a combined asset value of $123.61 million.

As of the publication date, the Hong Kong Stock Exchange still needs to update the asset management data for the spot Bitcoin and Ether ETFs issued by Harvest Global, the third ETF issuer. Despite this, the combined revenue generated by these two ETFs has amounted to $23 million.

When compared to their counterparts in the United States, where spot Bitcoin ETFs attracted nearly $4 billion in assets under management during their first week of debut and $4.5 billion in volume on January 12 alone, the first day of trading on Wall Street, the value of the assets solicited is negligible.

Balchunas remarked, “We attempted to caution everyone to have lower expectations regarding Hong Kong.” “However, when localizing numbers, this became a MAJOR: “On Day One, the ChinaAMC bitcoin ETF raised $123 million, which ranks it sixth out of 82 ETFs launched in Hong Kong over the past three years and in the top 20% overall,” he continued.

HashKey, meanwhile, reported that “significantly, non-Hong Kong nationals who satisfy local regulatory requirements, such as passing customer due diligence, may also subscribe to or purchase units in the ETFs.” Furthermore, unlike their U.S. counterparts, Hong Kong crypto ETFs permit investors to subscribe for ETF units directly with BTC and ETH, and vice versa.

A survey conducted by OSL, a Hong Kong-regulated cryptocurrency exchange, on April 28 revealed that 76.9% of crypto-savvy respondents in the city intend to invest in Bitcoin and Ether ETFs, which are relatively new. “This optimistic investor sentiment strongly indicates the increasing recognition and significance of digital assets in the region’s economy. Hong Kong is re-establishing itself as the epicenter of digital assets,” remarked Gary Tiu, executive director and head of regulatory affairs at OSL.

Even with the widespread acclaim, access to Hong Kong’s crypto ETFs is limited to the city’s estimated 6.4 million adult residents. Mainland Chinese investors, numbering in the billions, can utilize the innovative ETFs if they possess a valid residence permit for Hong Kong.