Circle CEO Jeremy Allaire disclosed four of the most significant reasons he is “more optimistic” than ever about stablecoins and cryptocurrency

According to Circle CEO Jeremy Allaire, stablecoins may constitute 10% of “global economic money” within the next decade or more.

Although it may be considered an audacious assertion, Allaire identified numerous variables that could increase the adoption of stablecoins within the next “10+ years…”

“The majority of the world’s largest payments companies are currently utilizing this technology and are investigating ways to broaden its application as the advantages of public chains and stablecoins become more widely recognized,” Allaire wrote in a post on June 19 on X.

Allaire stated that the addressable market size is in the “billions,” and the promise of banking the unbanked, lowering remittance costs, and enabling seamless cross-border commerce can be fulfilled by unleashing digital currency on blockchains.

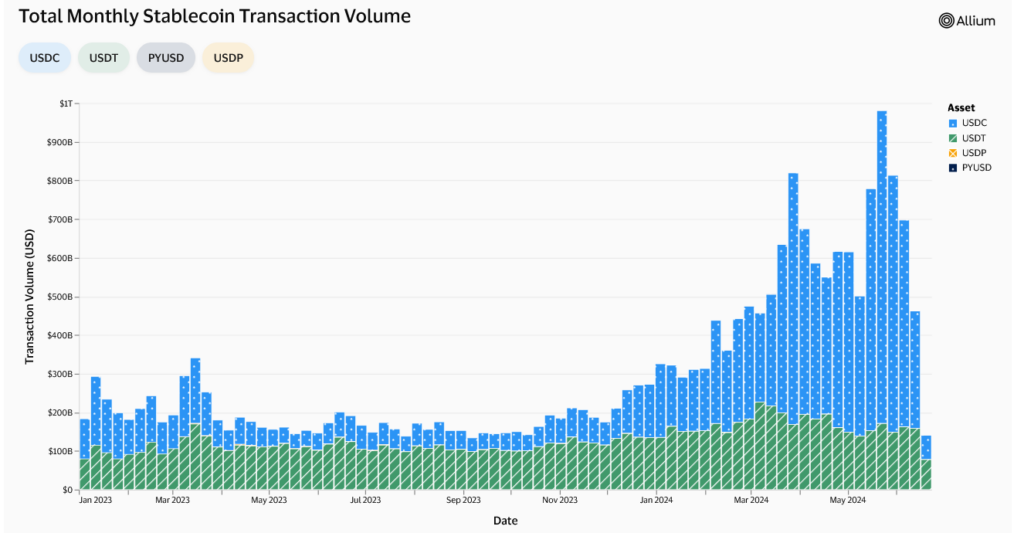

He observed that stablecoins are becoming a more widely accepted form of digital money and will comprise a “growing portion” of the $100 trillion global electronic money market by the end of 2025.

“What does it look like when 10% of global economic money is stablecoins and when credit intermediation moves from fractional reserve lending to onchain credit markets”

[This] is feasible within the next decade or more,” Allaire stated.

According to data from the World Population Review, the stablecoin market, valued at $162 billion, is presently 0.2% of the $80 trillion money market.

The remaining $5 trillion is derived from mints, while savings, money market, and checking accounts account for approximately $26.4 trillion, $25 trillion, and $23.6 trillion, respectively.

For Allaire’s 10% prediction to be realized by 2034, the stablecoin market must expand at a minimum of a compounded annual growth rate of 47.7%. However, the estimate does not account for developing the USD 80 trillion Coin USDC $1.00.

— the stablecoin issued by Allaire’s Circle that is pegged to the United States dollar—has a market capitalization of $32.8 billion, making it the second-largest stablecoin in the world, following Tether (USDT) $1.00 according to CoinGecko data.

Allaire’s optimism is not restricted to the stablecoin market.

In the next decade or more, cryptocurrency adoption could reach “billions of users” across “millions of applications,” with a significant increase in the execution of commerce and financing through smart contracts on public blockchain infrastructure.

He even believes certain on-chain organizations could outperform certain multinational corporations during that timeframe. However, he did not clarify the specific sectors and methods by which this could be achieved.