The petrodollar agreement is the focal point of attention, as the future of the US dollar is contingent upon Saudi Arabia’s decision to either accept the currency for global trade or provide opportunities for local currencies

The oil and gas sector anticipates that the Chinese yuan will be pivotal in transactions. The US dollar is confronted with uncertainties as local currencies attempt to displace it from its status as the world’s reserve currency.

Saudi Arabia’s foremost hydrocarbon trade partner is China, which executes billions of transactions annually. China’s influence in the energy sector is significant, accounting for 20% of Saudi Arabia’s oil exports as of 2024.

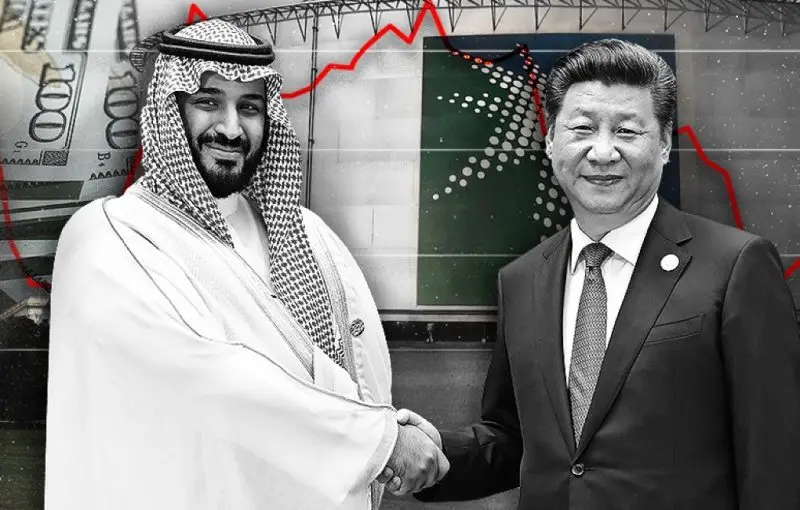

The US dollar’s prospects are jeopardized by the end of the petrodollar agreement and China’s close ties with Saudi Arabia. Saudi Arabia’s acceptance of the Chinese yuan for crude trade could result in a paradigm shift in the global oil sector.

A Comparison of the US Dollar and the Chinese Yuan

Despite terminating the petrodollar agreement, Saudi Arabia requires the US dollar for oil more than the Chinese yuan.

Nevertheless, Hung Tran of the Atlantic Council asserted that the United States’ influence is diminishing as China forges closer relationships with Saudi Arabia.

He explained that Saudi Arabia might consider adopting the Chinese yuan in addition to the US dollar.

Saudi Arabia’s most significant oil customer is now China, which accounts for over 20% of the kingdom’s oil exports. Tran wrote that Beijing has established intimate, trade-driven relationships throughout the Middle East, where US influence has waned.

If that occurs, the Chinese yuan will progressively gain traction, resulting in a decline in the value of the US dollar. Saudi Arabia is currently in control of the demise of the petrodollar, which has the potential to influence the future of the US dollar significantly.

Tran summarized, “How Saudi Arabia addresses the petrodollar is a significant indicator of the financial future.”