LinkedIn is becoming an alternative to Twitter or X, expanding right beneath our collective noses

Elon Musk bought Twitter in fall 2022, and since then, competitors have flooded the market. These competitors range from smaller firms to open source apps to well-funded efforts like Threads from Instagram.

According to statistics from traffic analytics provided by the digital intelligence platform Similarweb, the amount of web traffic that LinkedIn received in March was 10.6% higher than last year, while X received 15.2% lower.

X’s online traffic has decreased by 10% compared to November 2022, the months immediately following Musk’s takeover of Twitter. On the other hand, LinkedIn’s web traffic has increased by 18%.

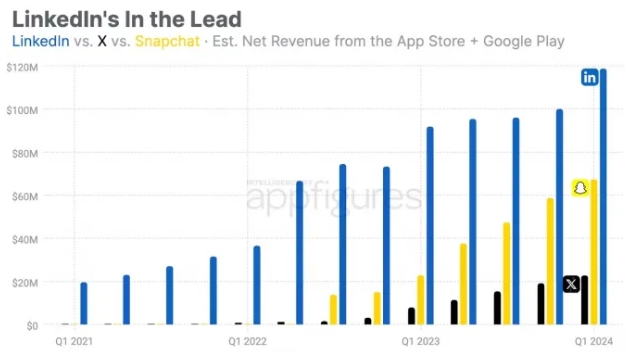

The strategy appears to be successful. Additionally, Appfigures highlights the fact that LinkedIn’s mobile app is generating more revenue than X and Snapchat combined across both iOS and Android platforms.

Given that LinkedIn’s subscriptions are more expensive, beginning at $29.99 per month and going up to as much as $69.99 per month on the app stores, this comparison does need to reflect the situation accurately.

On the other hand, the monthly subscriptions offered by X run from $4 to $22, and users can pay for more expensive annual subscriptions that are also available. On the other hand, Snapchat Plus may be purchased for just $3.99 per month or $29.99 per year.

In March, Twitter/X received 727.6 million unique visits from all over the world, which represents a decrease of 7.5% compared to the previous year. The total number of LinkedIn users was much lower, coming in at 269.2 million, but according to Similarweb, that number was up 11.1% from the previous year.

The company also discovered that, as of March, LinkedIn’s global Android app usage had increased by 14% since November 2022, while X’s usage had decreased by 20% during the same time period.

On the other hand, Appfigures, another source of app data, does not observe the same pattern across mobile devices. Its data suggests that LinkedIn’s monthly downloads increased by 10% year-over-year, whilst X’s downloads decreased by 24%.

However, Appfigures credits this decline to Twitter’s rebranding to X rather than other consumer behavior. According to the company, LinkedIn’s average number of downloads has remained unchanged before and after Musk’s takeover of Twitter.

However, considering that people spend most of their day working on their desktops and laptops, it is unsurprising that some business professionals may have transferred some of their web usage from X to LinkedIn due to Twitter’s transition.

Now, with features such as games (introduced today) and short-form videos coming to LinkedIn, it is evident that the social network’s owner, Microsoft, is trying to attract the attention and interest of users who used to network via Twitter, notably the younger millennials and members of the Gen Z population.

In other words, LinkedIn does not need to sell as many memberships to increase its revenue, and it has not had any trouble in the past competing with X or Snapchat on mobile devices.

According to Appfigures, the revenue generated by LinkedIn’s mobile app has been steadily increasing, going from $20 million in the first quarter of 2021 to $91 million in the first quarter of 2023. It has reached its highest quarter ever, with app sales of $119 million as of the first quarter of 2024.

X and Snapchat, on the other hand, brought in $23 million and $67 million, respectively, during the first quarter. Still, their combined revenue was just $90 million, less than LinkedIn’s.

There was no comment from LinkedIn regarding third-party data.