For the first time in five weeks, after hawkish fed, there were net withdrawals totaling $580.6 million from U.S. spot Bitcoin ETFs (BTC -0.95%).

With $274.3 million leaving the higher-fee fund, Grayscale’s converted GBTC ETF topped the outflows. Next in line were FBTC from Fidelity and ARKB from Ark Invest, which saw net outflows of $146.3 million and $149.7 million, respectively.

The only fund to have net inflows last week was BlackRock’s IBIT, which brought in $41.6 million. The remaining U.S. spot Bitcoin ETFs saw net outflows of zero for the week. Since trading started in January, there have been $15.1 billion in net inflows into the ETFs.

Before last week, the spot Bitcoin ETFs had seen a record 19 days of gains, bringing in over $4 billion in net inflows. According to cryptocurrency trading company QCP Capital, the run ended last Monday with $64.9 million in net outflows following a bitcoin price decline due to conflicting outlooks on the U.S. economy from the unemployment and non-farm payroll data. This uncertainty caused investors to shift away from riskier assets.

Before the FOMC meeting on Wednesday, the ETFs witnessed another $200.4 million in net outflows on Tuesday. Last week, the lone day of net inflows saw $100.8 million in inflows. Spot Bitcoin ETF net withdrawals of $226.2 million and $189.9 million occurred on Thursday and Friday, respectively, after the Federal Reserve kept interest rates at 5.5% and signaled that only one rate drop would happen in 2024 due to ongoing inflationary pressures.

An unexpectedly hawkish FOMC meeting

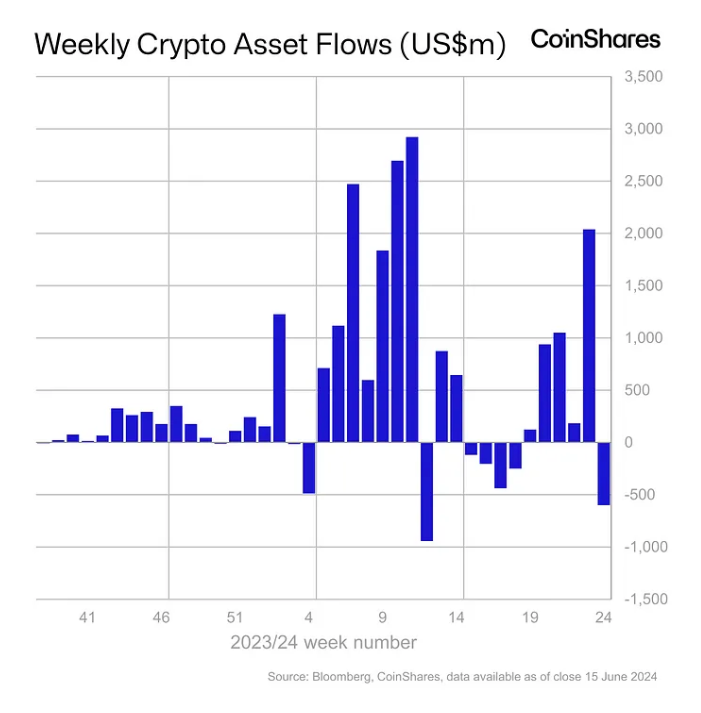

According to CoinShares’ most recent report, net outflows of $600 million in digital asset investment products occurred globally last week, the highest amount since March 22.

According to CoinShares Head of Research James Butterfill, “the outflows were entirely focused on bitcoin, seeing $621 million outflows, and the bearishness also prompted $1.8 million inflows into short-bitcoin.”

A more hawkish-than-expected FOMC meeting, according to Butterfill, was probably the cause of this, leading investors to reduce their holdings in fixed-supply assets.

Global assets under management decreased from $100 billion to $94 billion last week as a result of the net outflows and a 5% decline in bitcoin’s price during a more significant sell-off in the cryptocurrency market, according to Butterfill.

According to CoinShares, global trade volumes for digital asset investment products were $11 billion last week, less than this year’s $22 billion weekly average. The weekly trading volume of the U.S. spot Bitcoin ETFs was $8.73 billion, a considerable decrease from the peak of $32.69 billion recorded during the week of March 4–8.

Cumulative spot Bitcoin ETF trading volumes are now close to $300 billion.

Products using ether defy the norm.

Contrary to the general trend, ether-based investment products had net inflows of $13 million last week worldwide.

After going live, Ethereum ETH-1.052% spot ETFs might take in between 10 and 20% of the money flowing into Bitcoin ETFs, according to Bitfinex, which cited past parallels in the introduction of gold and subsequently silver ETFs.

May 23 saw the approval of 19b-4 forms for eight spot Ethereum ETFs from companies, including Fidelity and BlackRock, by the U.S. Securities and Exchange Commission. Before trading may start, the issuers’ S-1 registration statements must become effective, a procedure that could take several weeks.

SEC Chair Gary Gensler projected last week that S-1 certifications for spot Ethereum ETFs might happen by the end of the summer.

Eric Balchunas and James Seyffart, analysts for Bloomberg ETFs, raised their spot estimate for the data launch of Ethereum ETFs to July 2 on Thursday. I’ve heard that issuers received comments on S-1s from [SEC] personnel today, and they’re pretty mild—nothing serious—and they ask to have them back in a week. They have a fair opportunity to implement them the following week and clear their schedule in time for the holiday weekend. Though anything is possible, this is currently our best estimate, said Balchunas.