AI startup EthonAI raises $16.5M to enhance manufacturing with data analytics, identify product flaws, and improve factory operational efficiency.

A potentially vast amount of data that may be analyzed to provide insights on bottlenecks and other areas for improvement has been generated as factories and manufacturing facilities have become “smarter” through the use of sensors, robotics, and other linked technology. Or to speed up procedures that would otherwise require much manual labor.

However, much of the data that has been produced needs to be more structured and accessible immediately. Big data analytics has long been a standard in sectors like finance and logistics, but the manufacturing sector still needs to embrace it fully. This has resulted in an unexplored insight gold mine and, more recently, a developing market for technology meant to record and interpret a wide range of production data.

Oden Technologies, a New York-based company formed in the United Kingdom, raised $28.5 million in Series B financing last month to support the expansion of its manufacturer data analytics platform. Daedalus, a German startup, raised $21 million to implement AI in factories that produce precise goods. Additionally, Belgium’s Robotvision raised $42 million to incorporate computer vision intelligence into industrial machines.

It’s now EthenAI’s turn. The Swiss company revealed on Thursday that it had raised CHF 15 million ($16.5 million) in a Series A fundraising round, with funding also coming from Founderful, General Catalyst, and Earlybird.

EthonAI identifies product flaws.

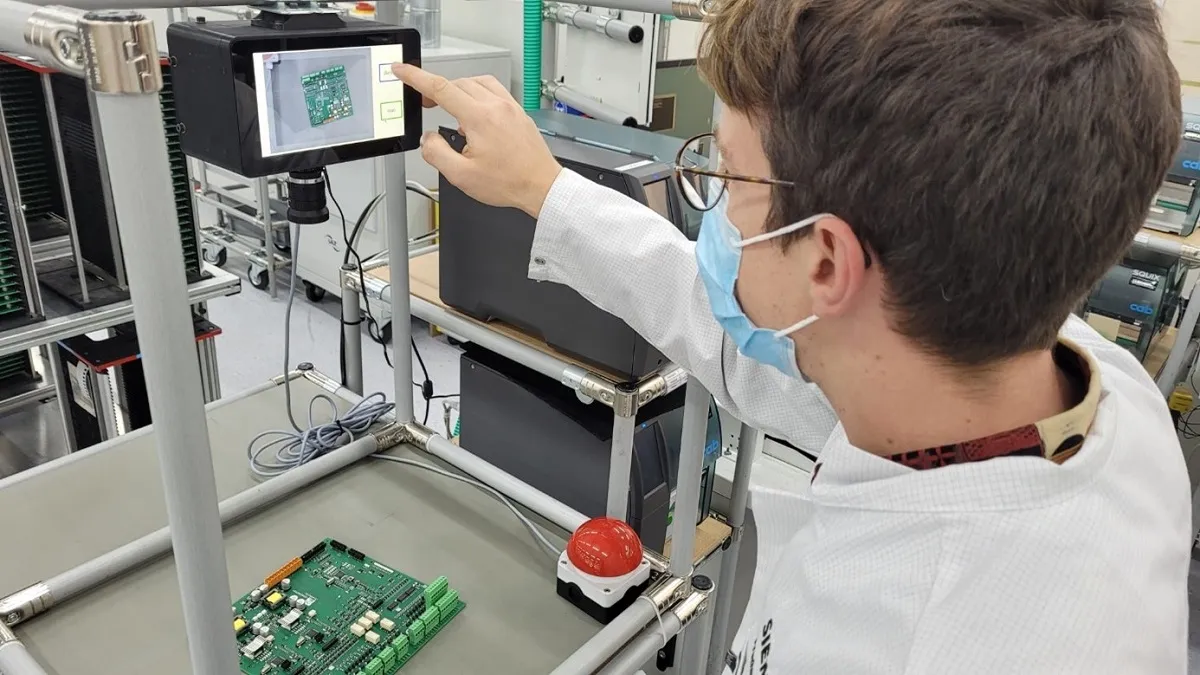

In 2021, CEO Julian Senoner and CTO Bernhard Kratzwald founded EthonAI in Zurich. The company’s Inspector software can identify product surface defects during manufacturing and assembly. For example, in electronics manufacturing, customers can provide imagery of defect-free products, which EthonAI can use to train AI models for specific use cases. Apple recently acquired DarwinAI, a startup that automates component production’s visual quality management process.

More broadly, though, EthonAI can create a picture of what is and isn’t working well in a company’s manufacturing setup by combining data from sensors to line stops. It can even compare performance across several facilities to identify areas that may benefit from change.

Over its three years in business, Siemens and Lindt, a manufacturer of chocolate, are among the notable clients that EthonAI has acquired.

Analyzing EthonAI’s target markets further indicates that one area of concentration is semiconductor manufacturing, even though the company hasn’t disclosed any specific clients in this sector. On the other hand, low yield is a well-known issue in the chip industry, as silicon wafer flaws can reduce the quantity of real, usable chips produced. Apple reportedly struck a deal with chipmaker TSMC last year, with inferior yield rates (only 55%). Apple agreed to pay just for known-good wafers, saving billions of dollars.

For its part, EthonAI claims to collaborate with a “leading semiconductor producer” that uses its platform to combine various datasets for analysis and identify links between equipment, processes, and yield rates that were not previously recognized.

Senoner stated in a news release that “manufacturing is at a critical juncture, and companies that fail to adapt to AI risk falling behind.” “AI is the key to unlocking insights to drive operational excellence in the mountains of data that factories produce.”