In the third quarter of 2024, thirty percent of venture capital funding went to AI businesses, according to Stocklytics.

Artificial intelligence firms saw substantial financial inflows throughout the quarter despite an overall fall in venture capital funding.

In the last ninety days, Artificial intelligence businesses have raised $11.8 billion in funding, which makes up thirty percent of all venture capital funding in the third quarter of 2024, according to statistics provided by the analytics company Stocklytics.

The jump happened despite the US tightening export limits on Artificial intelligence chips, uncertainty surrounding valuation, and previously low earnings from startups, which presented investors with a mixed bag.

The data shows that while investors pick and choose which Artificial intelligence businesses to support, their total interest is still high.

“Except the absolute record of $29.6 billion raised in Q2 2024, the $11.8 billion of fresh capital is close to quarterly figures seen throughout 2023 and 2024,” said Neil Roarty, an analyst with Stocklytics.

The number of deals decreased, with a 28% year-over-year dip in total transactions to 79 in the third quarter from 110 in 2023.

Roarty says, “The bigger deals have kept sentiment in the sector positive.” Also slowing down was the overall VC funding activity, which decreased by 13% annually.

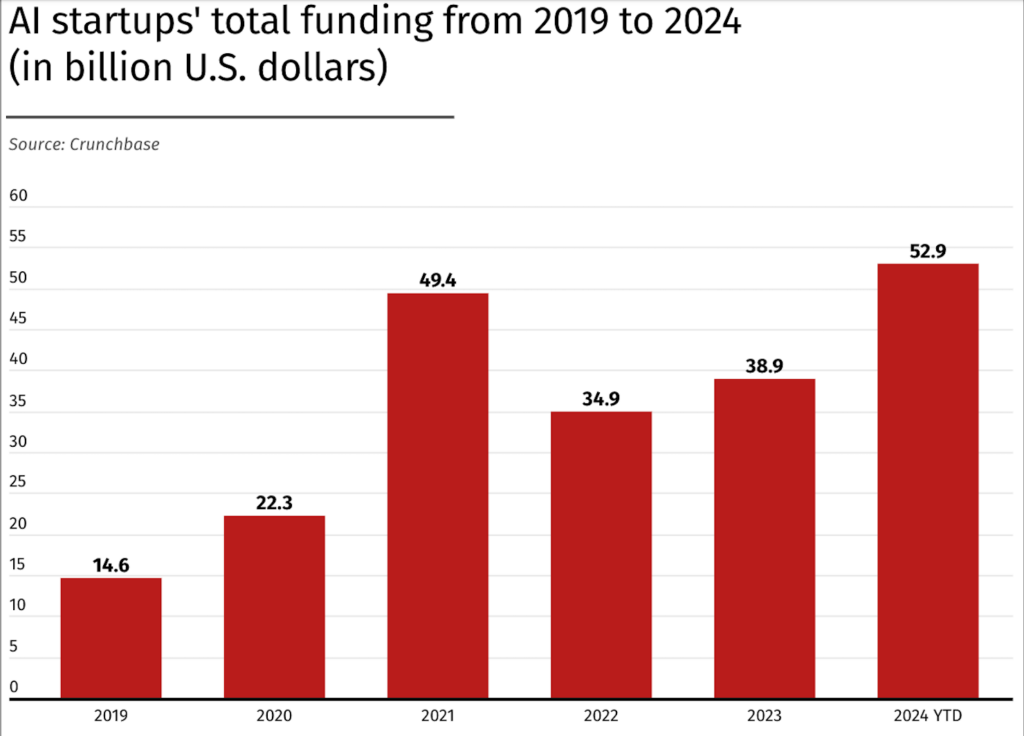

According to data from Crunchbase, investors have invested about $53 billion in the artificial intelligence space this year, 35% more than they did in the first three quarters of 2023. OpenAI’s recent $6.6 billion round at a $157 billion valuation is one of the company’s notable deals.

Based on the data from this quarter, the total investment amount for the Artificial intelligence industry has surpassed $241 billion, with about $155 billion, or nearly 65% of that amount, coming from US enterprises. Asian Artificial intelligence startups have raised $53 billion, compared to $30.2 billion from European Artificial intelligence enterprises.

The combination of blockchain and artificial intelligence is one of the leading betting methods used by venture capitalists.

Pantera Capital’s portfolio manager Cosmo Jiang previously told Cointelegraph, “I am particularly excited about opportunities at the convergence of Artificial intelligence and Crypto, although even that distinction will sound dated in a few years.”

A new venture fund focused on Artificial intelligence and cryptocurrency firms was established by investment manager VanEck on October 9. The fund has $30 million available for pre-seed and seed-stage companies.