Driven by restored investor confidence, the market value of AI and prominent data cryptocurrency has recovered by about 80% after a notable decline.

Over the last three weeks, the market valuation of cryptocurrency projects and tokens related to artificial intelligence and big data has increased by 79.7%, indicating that investors are once again feeling optimistic.

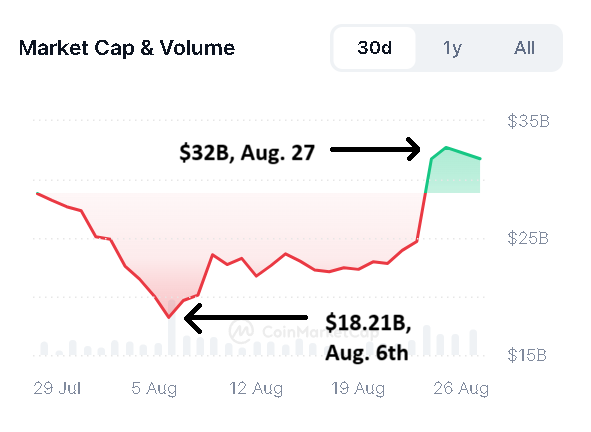

The combined market capitalization of artificial intelligence and big data cryptocurrency projects fell to a yearly low of $18.21 billion on August 6. This was primarily because of their indirect reliance on the underperforming price of Bitcoin BTC$62,361 and broader cryptocurrency markets. At the time, TradingView statistics showed that the price of Bitcoin had dropped precipitously below $50,000.

Significant impact from the Bitcoin market

The market capitalization of the AI and extensive data token ecosystem easily surpassed $38 billion on August 25, coinciding with the price rebound of Bitcoin, according to statistics from CoinMarketCap.

As of August 27, the leading AI and big data tokens by market capitalization include Bitsor (TAO) at $2.8 billion, Artificial Superintelligence Alliance (FET) at $3.4 billion, Internet Computer ICP$8.00 at $3.8 billion, and Near Protocol NEAR$4.75, which is valued at $5.5 billion.

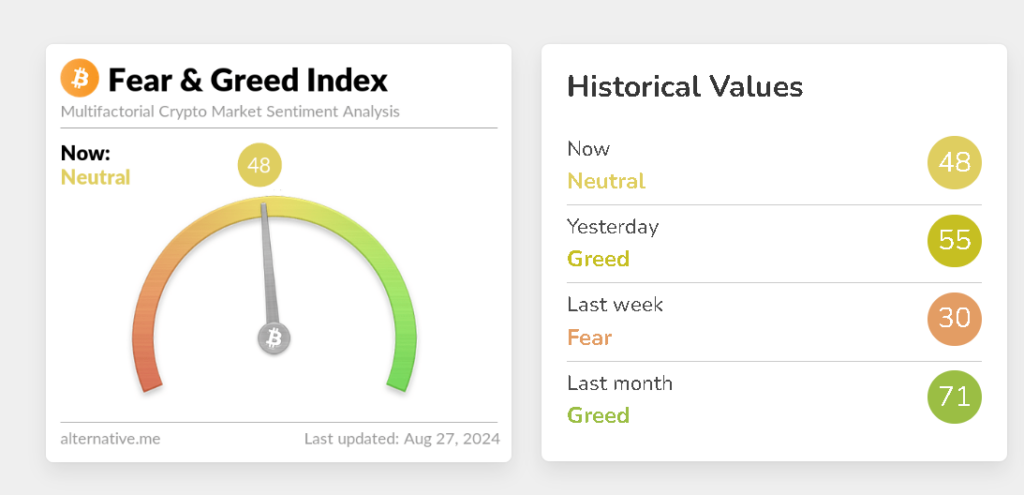

The Crypto Dread & Greed Index by Alternative.me hit “extreme fear” levels during this period, indicating that market volatility had a detrimental effect on investors’ sentiment.

AI token prices rise as investor mood improves.

However, as markets rebounded and cryptocurrency investors tried to recover losses, the sentiment shifted back to “neutral.”

The Fear & Greed Index is now a practical tool for financial decision-making, designed to gauge cryptocurrency investors’ feelings.

Lookonchain, a onchain analytics platform, saw the significant increases and reported odd whale transaction activity in FET in an August 26 X post.

Before paying $2.38 million Tether USDT$1.00 to repurchase 1.79 million FET tokens from Binance at a higher price of $1.33 on August 25, it was reported that a whale “seemed to regret selling” at a lower price.