Despite the fact that Nvidia’s stock experienced a $430 billion decline in market capitalization, cryptocurrencies associated with artificial intelligence (AI) experienced a surge in the past week

Nvidia, a company closely monitored by crypto speculators, is frequently regarded as an indicator of the AI cryptocurrency market.

Google Finance data shows Nvidia’s stock price has declined by 11.08% over the past five trading days. Nvidia manufactures computer processors that numerous AI companies utilize to operate their AI models.

However, CoinMarketCap data indicates that Fetch.AI (FET) and SingularityNET (AGIX) have experienced a 23.46% and 20.83% increase in value over the past seven days, respectively, in contrast to the broader crypto market’s subsequent decline.

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have experienced a 9.17% and 4.23% decline in the past seven days, respectively.

The stock of Nvidia experienced a decline in response to concerns regarding the recent sale of a substantial number of shares by its president, Jensen Huang, and other executives.

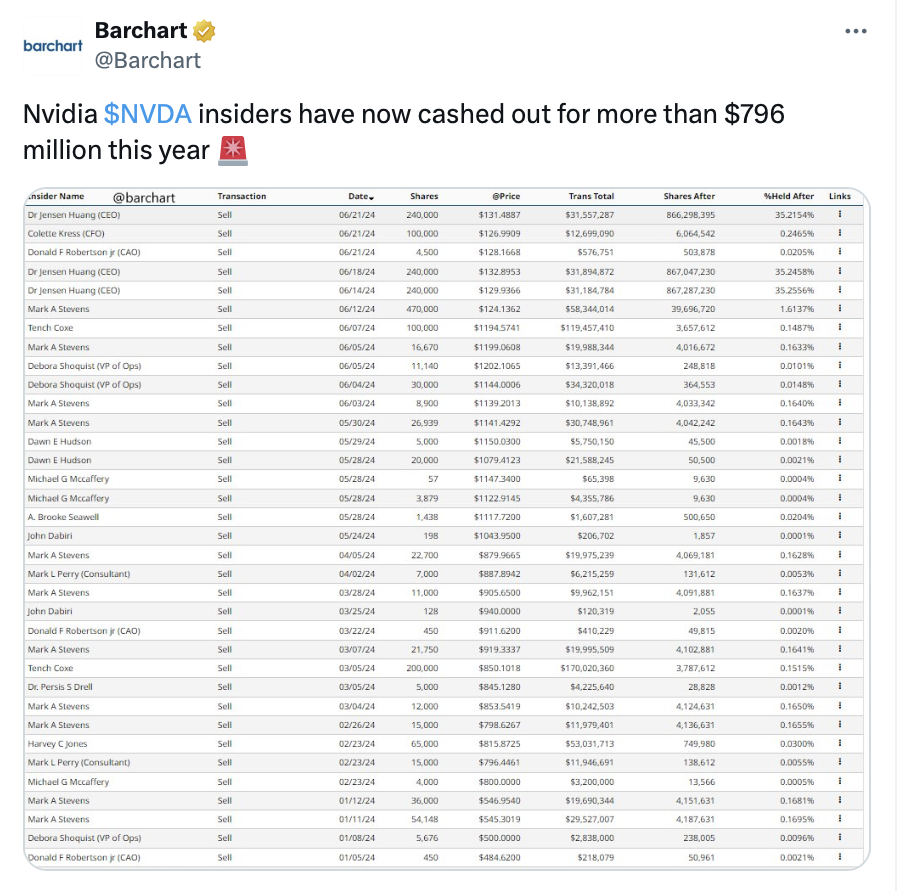

According to a filing with the United States Securities and Exchange Commission (SEC) on June 21, Huang has liquidated $79.38 million in Nvidia stock since June 13, which has garnered the attention of trading research firms.

Global Markets Investor, a trading resource account, stated in a June 23 post that Nvidia’s executives have been selling their shares at the fastest pace ever.

Additionally, another research firm has reported that the total value of shares sold by Nvidia executives this year is almost at the billion-dollar mark.

Barchart stated, “Nvidia insiders have now cashed out for over $796 million this year.” However, portfolio analyst “Oguz O” refuted this assertion, asserting that “most of them are pre-planned and do not bother me.” This is common when an executive contracts with a brokerage firm to sell stock at specific prices.

As of June 24, Nvidia’s market capitalization is $2.903 trillion, a decrease of nearly 13% over the past five trading days since it reached its all-time high of $3.34 trillion, as per YChart data.

The most recent instance of parallel movement between AI crypto tokens and Nvidia was the publication of Nvidia’s earnings report for the final quarter of 2023.

Nvidia reported revenue and earnings of $22.1 billion and $12.3 billion in Q4 2024, which are 265% and 769% higher than Q4 2023, on Feb. 21.

Sam Altman, CEO of OpenAI, experienced a 240% increase in the value of his Worldcoin (WLD) during the month. Arkham Intelligence, a blockchain AI analytics firm, experienced a 211% increase in the value of its native token, ARKM, during the same period.

Like other AI tokens, these tokens also experienced an increase in value last week. Arkham is up 16.34%, trading at $1.96 over the same period, while Worldcoin is up 9.07% over the past seven days, trading at $0.005 at the time of publication.