Amdax plans a Bitcoin treasury firm and Euronext listing, joining Europe’s growing wave of corporate Bitcoin adoption.

As more European businesses embrace Bitcoin strategies like their US counterparts, Dutch cryptocurrency service provider Amdax is preparing to launch a Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

On Monday, Amdax announced the establishment of AMBTS B.V., a privately held business with autonomous governance that would function as a stand-alone enterprise.

AMBTS wants to acquire 1% of all Bitcoin circulation to create a “1% Bitcoin treasury company.”

To boost its Bitcoin holdings, grow equity value, and improve Bitcoin-per-share metrics for investors, the company intends to raise cash gradually through the markets. S

ince Bitcoin is now selling above $115,800 this week, it would take more than $24 billion to acquire 1% of the total supply.

In 2020, the Dutch Central Bank registered Amdax as the first cryptocurrency service provider.

On June 26, the Dutch Authority for the Financial Markets (AFM) granted the platform a Markets in Crypto-Assets Regulation (MiCA) license, making it one of the first Dutch crypto service providers to do so.

According to the release, to “make a head start with the Bitcoin accumulation strategy,” Amdax and AMBTS intend to acquire money from private investors in an initial fundraising round.

According to Amdax, their platform provides customers with expert-managed portfolio methods, automatic investing, and trading opportunities for 33 cryptocurrencies.

By writing, Cointelegraph had not heard back from Amdax regarding the company’s planned capital raising or future Bitcoin investments.

Europe’s Corporate Usage Of Bitcoin Is Increasing

Bitcoin is becoming a major treasury reserve asset for more European businesses.

However, Lucas Wensing, CEO of Amdax, says Bitcoin exposure is still “relatively small in investment portfolios.” He went on to say:

“With now over 10% of bitcoin supply held by corporations, governments and institutions, we think the time is right to establish a Bitcoin treasury company with the aim to obtain a listing on Euronext Amsterdam, as one of the leading exchanges in Europe.”

At least 15 European businesses have openly announced Bitcoin’s inclusion in the company balance sheet.

These include Bitcoin Group, situated in Germany, with 3,605 BTC; Smarter Web Company, based in the UK, with 2,395 BTC; The Blockchain Group, based in France, with 1,653 BTC; and Satsuma Technology, based in the UK, with 1,126 BTC.

The H100 Group of Sweden, Samara Asset Group, CoinShares International Limited, 3U Holding, Advanced Bitcoin Technologies, Phoenix Digital Assets, Baultz Capital, Vanadi Coffee, Aker ASA, K33, and Refined Group are among the other European businesses that have less than 1,000 Bitcoin.

Bitcoin Keeps Doing Better Than Expected

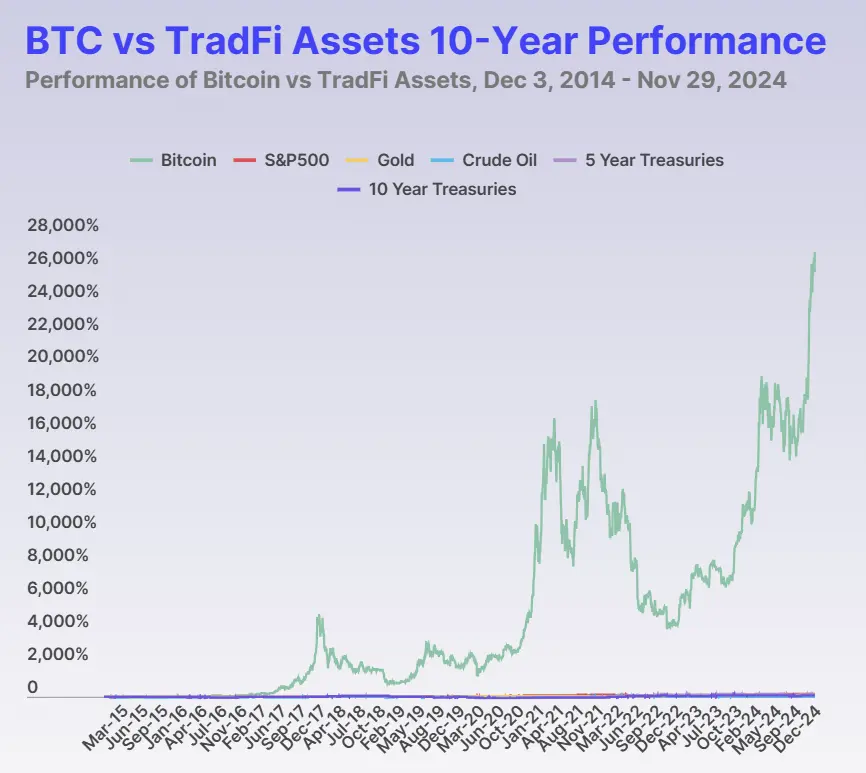

According to CoinGecko, Bitcoin has risen more than 26,900% over the last ten years, outpacing all other major asset classes.

The S&P 500 has gained 193%, gold has gained 125%, and crude oil has gained 4.3%.

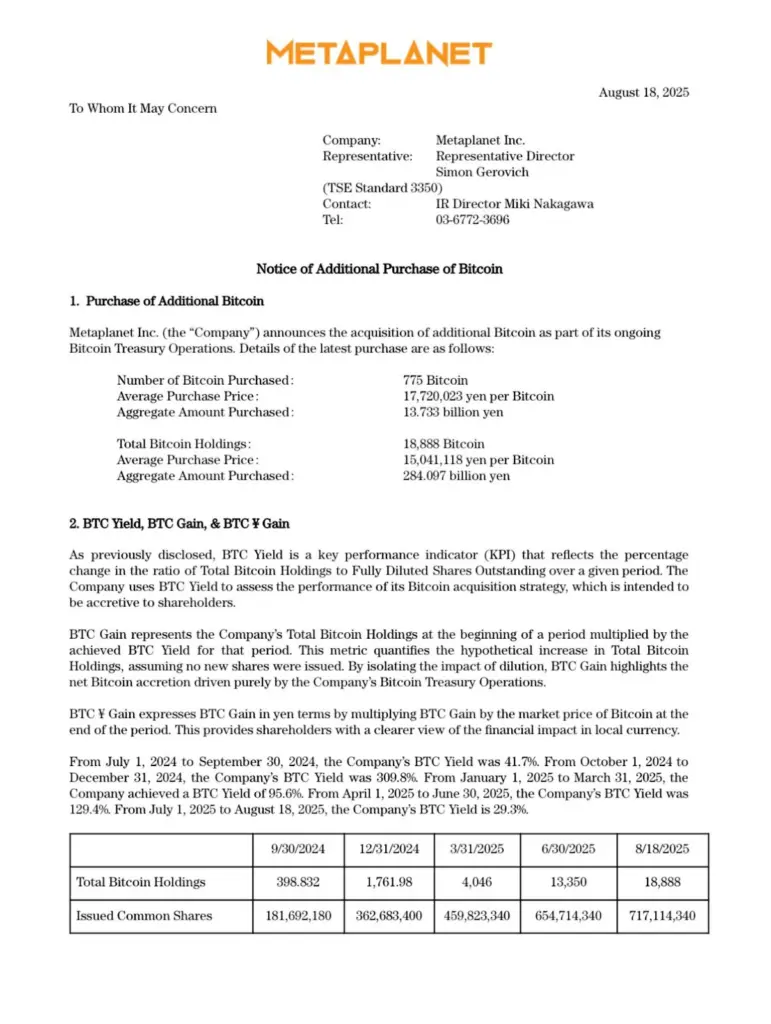

With the help of the Japanese investment firm Metaplanet, corporate Bitcoin usage is gradually increasing in Asia outside Europe and the US.

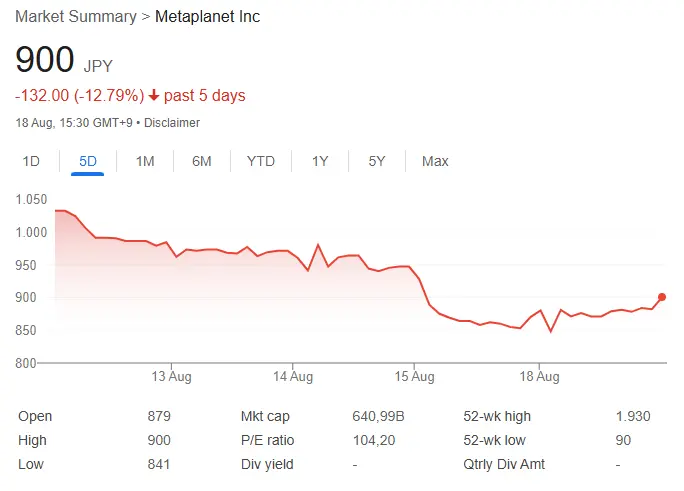

According to a report released by Cointelegraph on Wednesday, Metaplanet’s stock has risen about 190% so far this year, surpassing the 7.2% increase of Japan’s top and most liquid blue-chip businesses, as measured by the Tokyo Stock Price Index (TOPIX) Core 30.

Google Finance data indicates that Metaplanet’s stock price dropped by more than 12.7% during the last five trading days, to trade at 900 Japanese yen, or $6.11 a share, despite an optimistic earnings report released last week.