An Analysis of the Upcoming Day in the Global and U.S. Markets

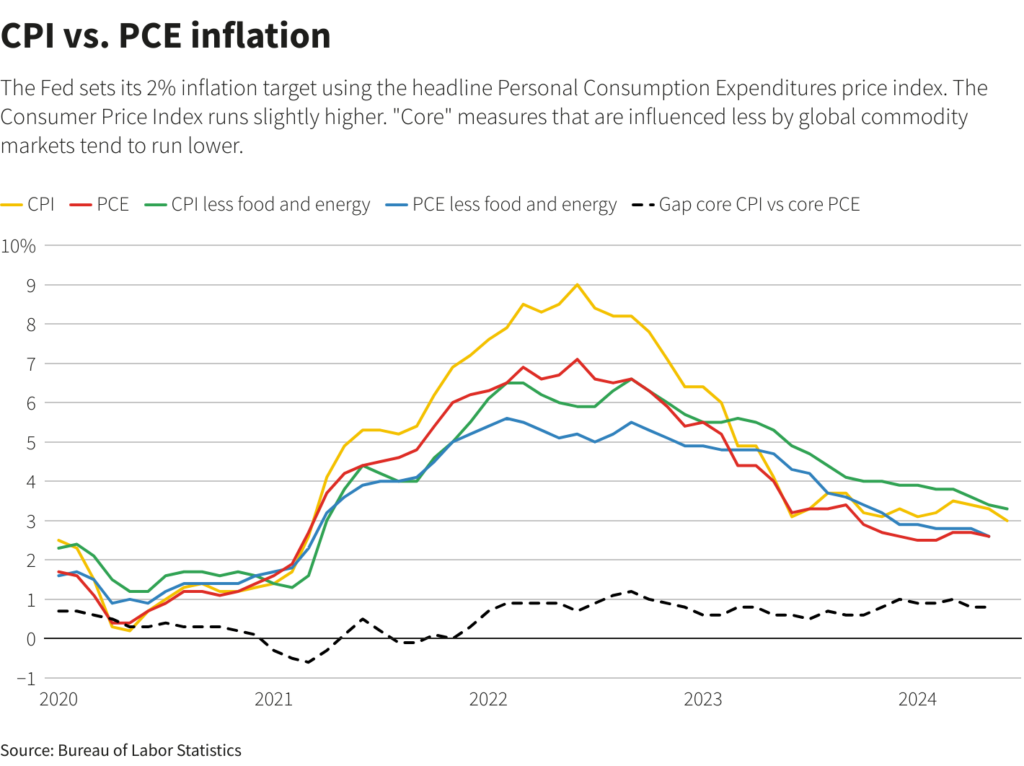

The Federal Reserve’s ability to meet heightened expectations for its first interest rate cut next month will be revealed by U.S. inflation updates this week, largely overlooked amid recent market turbulence.

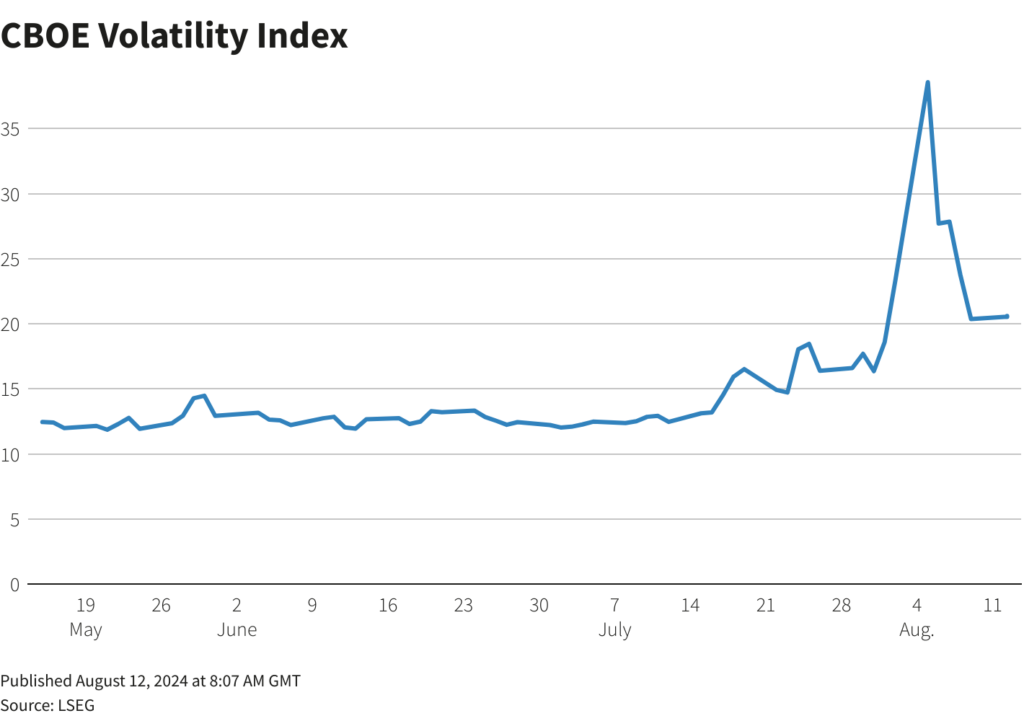

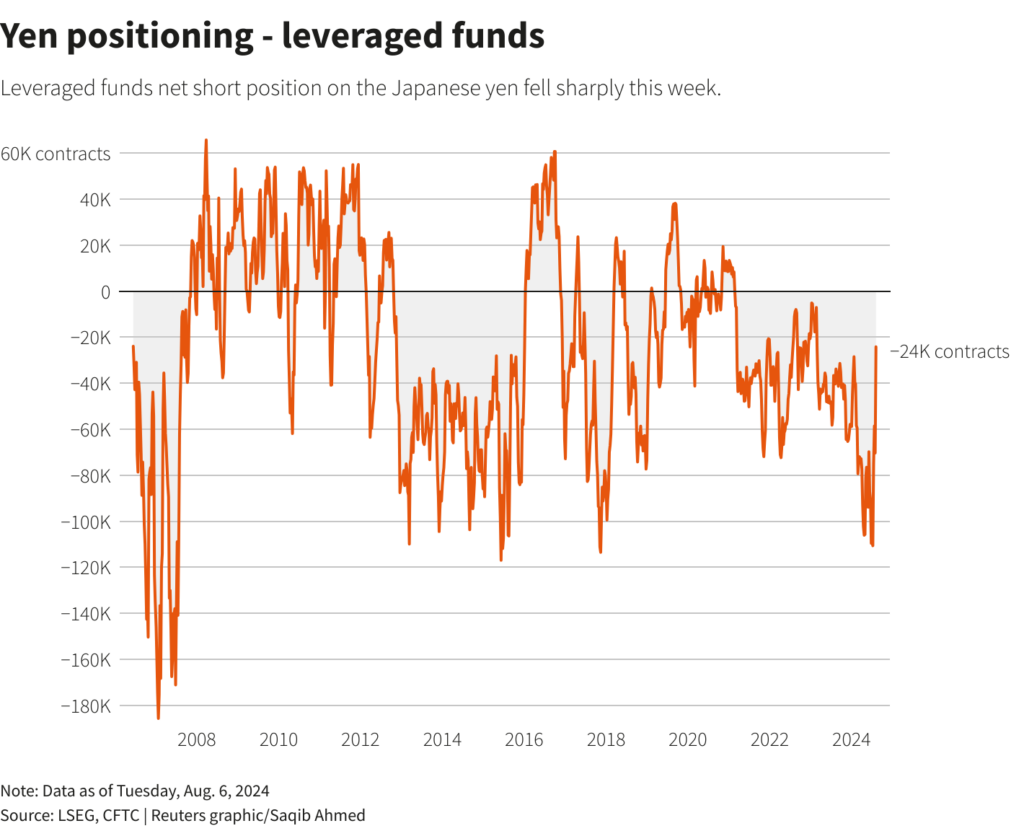

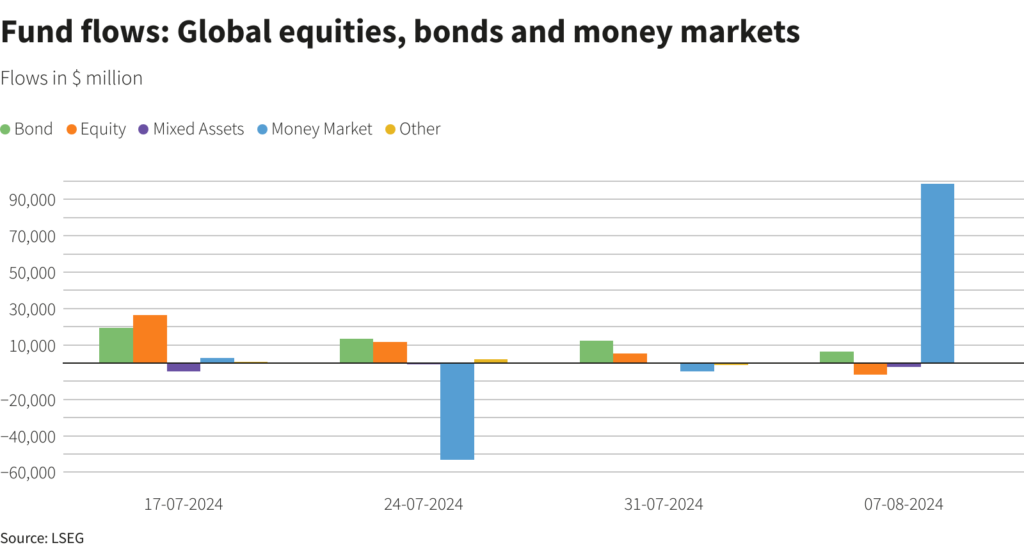

Global markets are scarcely recognizable from last Monday’s wild ride, partly due to the holiday in Tokyo, which was the epicenter of recent volatility. Despite significant fluctuations, the S&P 500 ended the week relatively unchanged, and the VIX volatility gauge has returned to its long-term average of around 20.

Corporate earnings remain robust, with S&P 500 profit growth close to 14% through the second quarter. Concerns about the U.S. labor market have been alleviated by declining weekly unemployment claims. The reporting season is now concluding.

Recent market turbulence and employment anxiety have led to increased bets on Fed easing. Futures still indicate a quarter-and-a-half-point cut next month, with 102 basis points of easing projected by year-end. The Fed’s confidence will depend on this week’s inflation readings.

The CPI update will follow Tuesday’s producer price inflation report, which is unusual. The headline annual PPI is expected to be as low as 2.3% in July. The Fed should find monthly CPI readings of 0.2% relatively benign, with the core annual inflation forecast slightly decreasing to 3.2%.

“Should the incoming data continue to show that inflation is moving sustainably toward our 2% goal, it will become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive on economic activity and employment,” said Michelle Bowman, Federal Reserve governor.

Bowman, who had previously considered an additional rate hike feasible, now advises against significant bets on rate reductions based solely on the July employment report, which may have overstated the extent of cooling.

Expectations for Inflation

On Monday, the New York Fed released its July survey, previewing household inflation expectations before the week’s CPI report. The median 3- and 5-year outlooks have recently fallen below 3%.

Markets have decreased their inflation expectations in response to recent turmoil. Last week, inflation-protected Treasury securities’ ten-year “breakeven” inflation forecasts reached their lowest level since early 2021, nearing the Fed’s 2.0% target and remaining at just 2.1%.

Treasury yields have increased slightly but remain below the 4.0% threshold breached over the past 10 days due to a subdued start to the week. The dollar index was slightly higher, while European and Wall Street stock futures were marginally higher.

The government’s bond market fluctuations over the past week focused on Chinese mainland equities, which underperformed. Shares of BT Group rose 6.6% after India’s Bharti Enterprises agreed to buy about 24.5% of the British telecommunications firm’s shares from its largest shareholder, Altice UK.

Key developments expected to guide U.S. markets later include the New York Fed’s inflation expectations survey and the issuance of three-month and six-month banknotes by the U.S. Treasury.