Ether has surpassed Bitcoin in futures yields, hinting at increased ETF inflows that could drive a rally beyond $4,000 by Jan. 20.

The price of ether is expected to experience further upward momentum as a result of the increasing interest of investors and the anticipation of more favorable crypto regulations in the years leading up to 2025.

This could potentially lead to a rally exceeding $4,000.

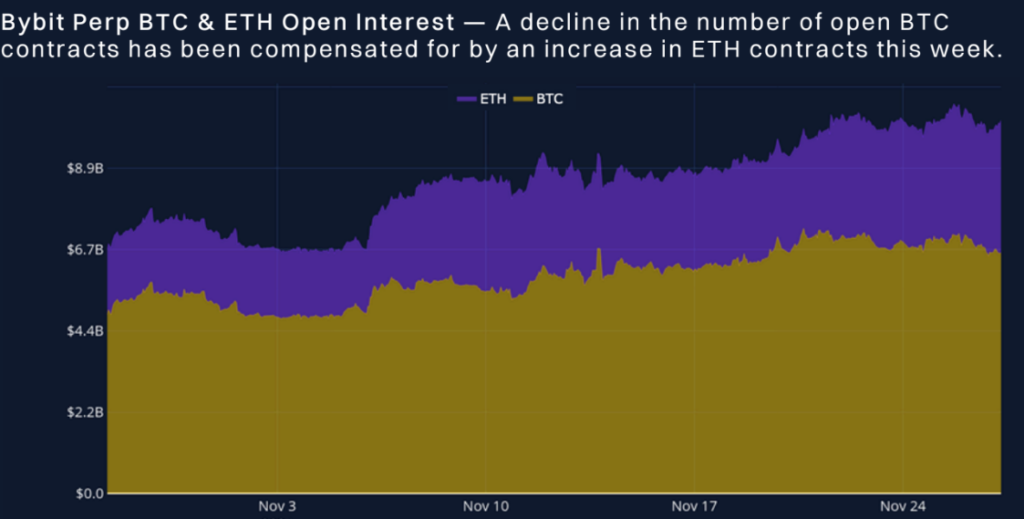

In terms of open interest, Ether has outperformed Bitcoin, with a total of over $8.9 billion in open contracts, as opposed to Bitcoin’s $6.7 billion.

According to a report published on November 28 by Block Scholes and Bybit Analytics, the present decrease in Bitcoin open interest is indicative of “considered repositioning,” rather than mass liquidations.

According to a spokesperson for Bybit, this phenomenon may propel ETH to a rally above $4,000 until January 20, the date on which President-elect Donald Trump assumes office.

“Bybit analysts see $4,000 on the horizon for ETH before Jan. 20.”

Since November 21, when Securities and Exchange Commission (SEC) Chair Gary Gensler announced his resignation from the regulatory agency, which will take effect on January 20, shortly before Trump assumes office, investor optimism regarding Ether’s price potential has been increasing.

Price Of Ether Has Increased To $4,000, Result Of Its Superior Yield Compared To Bitcoin

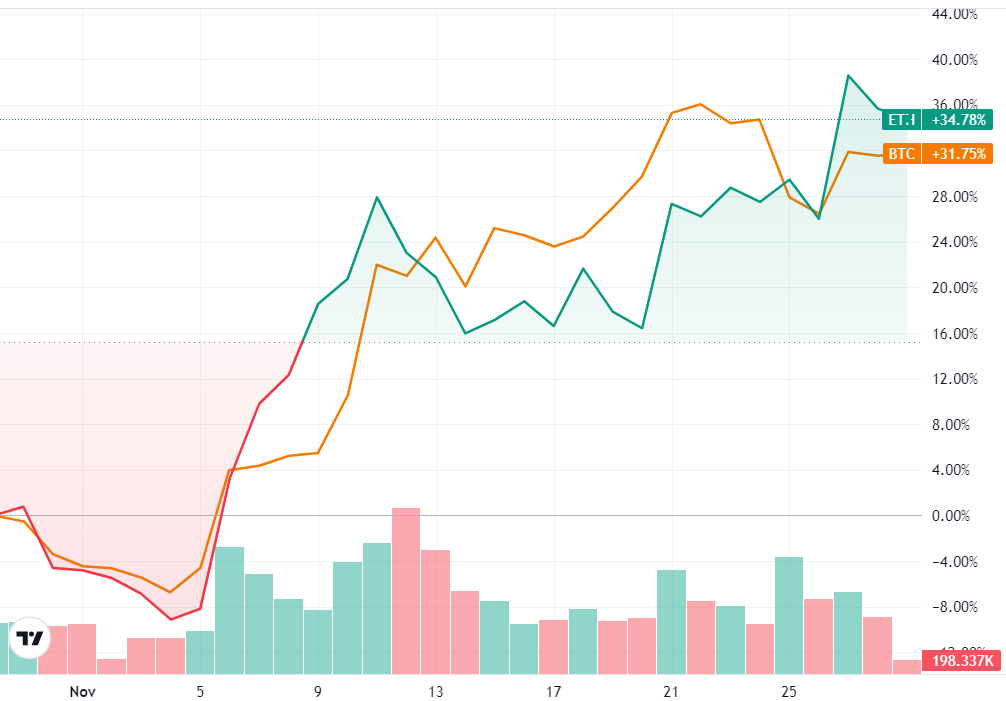

Despite the fact that ETH has underperformed Bitcoin’s price in the past year, it is beginning to catch up in the short term.

With a price increase of over 34%, Ether has outperformed Bitcoin in the past month, while Bitcoin has experienced a price increase of over 31%.

According to the report, ETH has demonstrated a “strongly inverted implied-yield curve,” outperforming BTC in terms of futures yield and providing another optimistic price signal.

“Futures with an expiration of just 1 week are trading nearly 25% above spot at an annualized rate. The act of capturing the ‘basis’ of futures prices to spot price by institutions, whereby a futures contract is sold to buy spot, has previously been floated as a driver of BTC’s strong spot ETF inflows.”

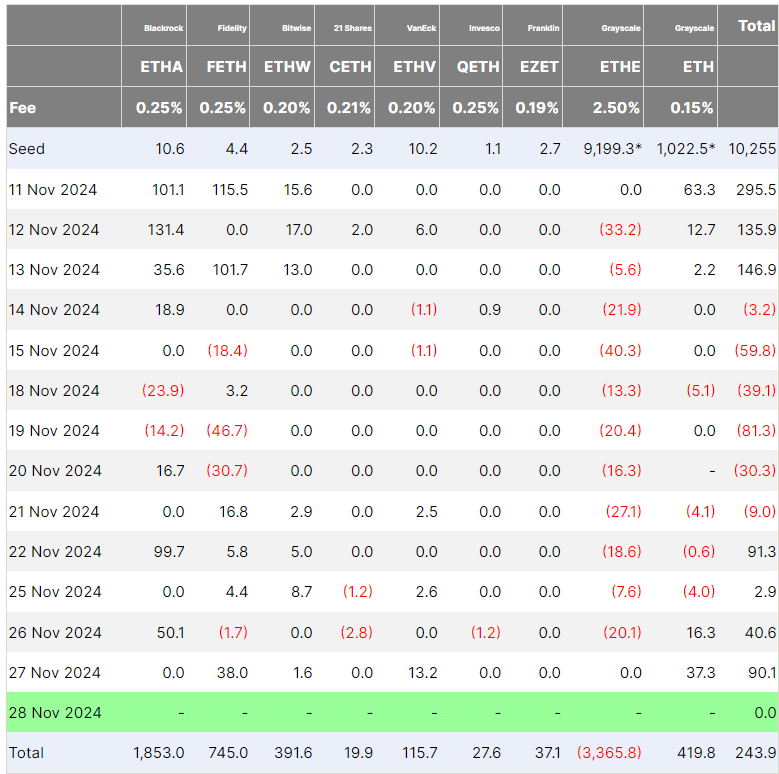

The aforementioned discovery may suggest that there is a potential for a substantial increase in the price of Ether due to the increased influx of institutional capital into the US spot Ether exchange-traded funds (ETFs).

After amassing over $90 million in Ether on November 27, the ETH ETFs are presently on a four-day winning streak, according to data from Farside Investors.

Investor demand for leveraged Ether ETFs has increased by more than 160% since Trump’s election, which is yet another encouraging indicator for the world’s second-largest cryptocurrency.

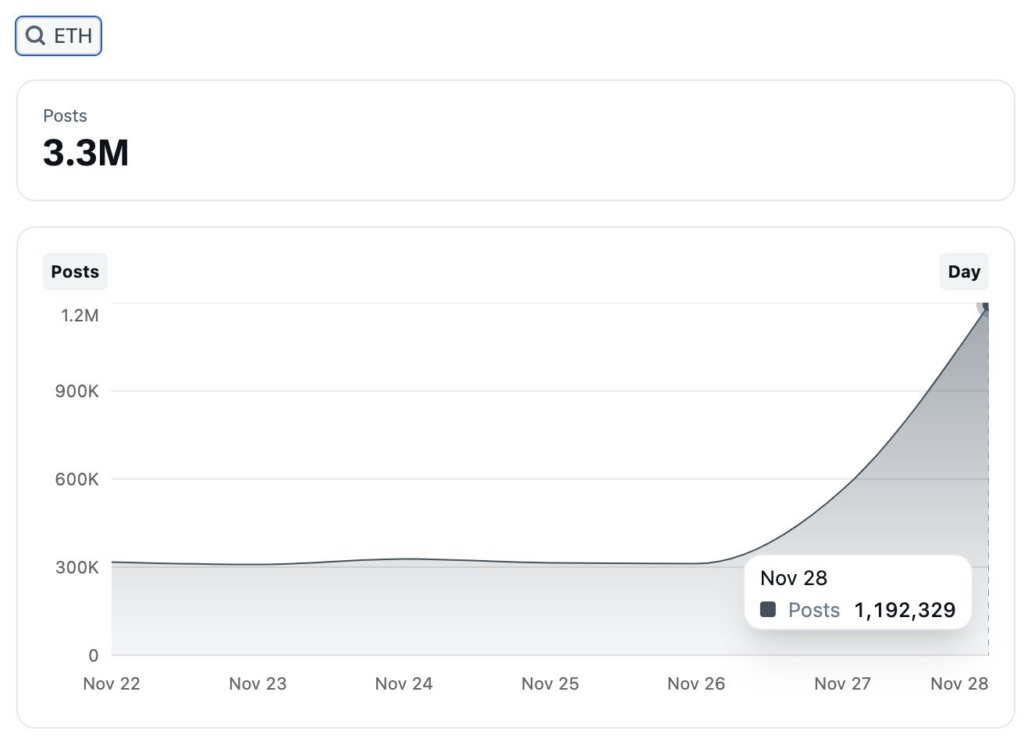

CryptoQuant founder Ki Young Yu, in his altcoin analysis account, shared that X posts related to Ether have increased by over 282% in the three days preceding Nov. 28, reaching over 1.1 million, demonstrating the increasing interest in the world’s second cryptocurrency.