Bitcoin is down 10% this month, but analysts note it has previously dropped 25% to 30% in January during past post-halving markets.

According to analysts who have examined previous cycles, it is not uncommon for a significant Bitcoin correction to occur within the first month of a year following a halving of the blockchain.

On January 12, crypto analyst Axel Bitblaze informed his 123,000 X followers that “Bitcoin dumping in January has historically been a common occurrence in post-halving years.”

“We are all aware of the events that transpired following the 2017 and 2021 dumps.”

The value of Bitcoin has declined by 10% this month, from a peak of $102,300 on January 7 to just below $92,000.

It has since recovered slightly, hovering around $94,000.

Bitcoin experienced a more than 25% decline from over $40,000 to just above $30,000 by the end of January 2021, the most recent post-halving year. By November, it had risen by 130% to a new all-time high of $69,000.

Bitcoin experienced a 30% decline in value from $1,130 to $784 in January 2017, the year following the 2016 halving.

It subsequently experienced a 2,400% increase that year, reaching an all-time peak of $20,000 by December.

In the interim, Crypto Rover, a YouTuber and analysts, noted that Bitcoin has consistently experienced a decline in the first half of the month over the past year.

“This is merely a minor decline in comparison to previous data,” he stated.

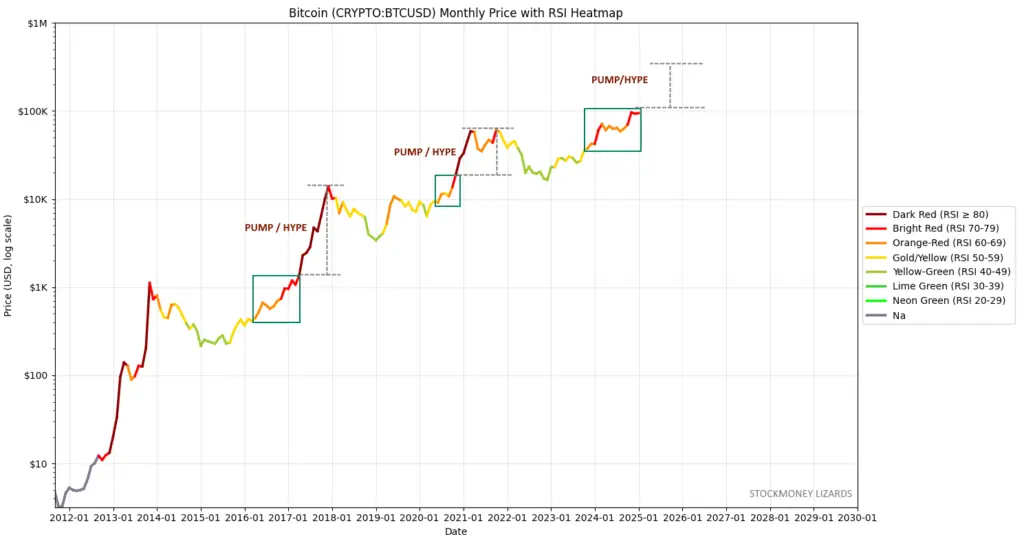

The finance analysis Stockmoney Lizards X account posted on Jan. 12 that “Bitcoin has NOT reached the ultimate hype/pump phase.” “The fuel for this cycle will increase in the upcoming year.”

The analysts acknowledged that the situation differed slightly in each cycle, but he also stated that “mass adoption, pro-crypto governments worldwide, ETFs, etc.

I believe it supports our hypothesis.”

Before the conclusion of 2025, Bitcoin prices could rise from their present levels to more than $200,000, a movement that is comparable to the 130% seen in the peak year of the previous cycle.

Conversely, a decline of the magnitude observed in January of the previous two cycles could result in prices falling below $70,000.