The predictions from the analysts follow Bitcoin’s strongest weekly gains since the 2023 U.S. banking crisis.

Based on past chart trends and increasing investor demand since the elections, analysts estimate that Bitcoin may reach its much-anticipated $100,000 all-time high in November.

On November 13, a little more than a week after Donald Trump won the 2024 US presidential election, Bitcoin broke beyond the $90,000 mark.

Ryan Lee, principal analyst of Bitget Research, claims that the over 100% year-to-date rise in Bitcoin has outperformed the majority of conventional financial assets.

According to Lee, who spoke to Cointelegraph, November is traditionally the best month for Bitcoin returns, and the cryptocurrency might reach $100,000 before the month is out.

“If history repeats itself and Bitcoin prices grow as projected, a 14.7% from the current price level will push the coin well above the $100,000 target for the month. The post-halving cycle trend is also very positive when projecting the future of Bitcoin.”

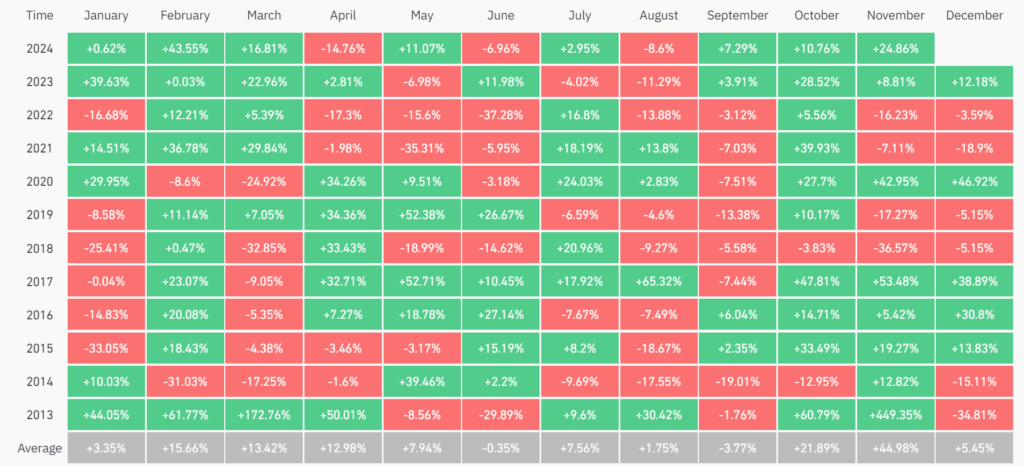

According to CoinGlass data, Bitcoin has historically had monthly returns of over 44%, and it is already up more than 20% for the month of November.

The analyst’s forecasts follow Bitcoin’s biggest weekly return since the March 2023 US banking crisis, when the first cryptocurrency in history topped the $90,000 mark and reached new all-time highs.

Bitfinex Analysts Predict That Bitcoin Will Reach $100,000 Next Months

The price trend of Bitcoin through 2025 is likewise seen favorably by other analysts.

According to Bitfinex analysts, Trump’s win will encourage the acceptance of cryptocurrencies in the biggest economy in the world, paving the way for Bitcoin to surpass $100,000 in the coming months.

Cointelegraph was informed by Bitfinex analysts:

“Predicting the price is a difficult bet, but we expect Bitcoin to have limited downside now given the bullish impetus, plus the fact that we avoided a recession, which at one point looked highly plausible. We expect Bitcoin to range and accumulate a bit, and in our view, a target of $100,000 in a few months doesn’t seem too far-fetched.”

According to Bitfinex experts, Bitcoin’s primary drivers, aside from Trump’s impending presidency, are the anticipated continuation of interest rate decreases in the US and the cryptocurrency’s decreased supply issuance following the 2024 halving.

Should Cryptocurrency Markets Deleverage Before Bitcoin’s Surge Reaches $100,000?

Despite hopeful forecasts, deleveraging of the cryptocurrency industry might be necessary before Bitcoin reaches the $100,000 milestone.

Kris Marszalek, the co-founder and CEO of Crypto.com, cautioned that the present leveraged ratios—that is, the amount of borrowed money used for trading positions—are approaching unsustainable levels.

In an X post on November 12, Marszalek wrote:

“Leverage needs to be cleaned up before attack on $100k. Please manage your risk carefully.”

According to CryptoQuant statistics, the expected leverage ratio for Bitcoin across all cryptocurrency exchanges was 0.215, the highest level since October 2023.