An anonymous investor, often called a “whale” in crypto circles, has acquired $792 million worth of Bitcoin. The massive purchase comes as the cryptocurrency continues to climb, leading many to speculate about the continuation of the current bull run.

A ruthless liquidation event that resulted in the loss of $1.05 billion in leveraged positions after unexpectedly high US inflation data triggered widespread market sell-offs has resulted in an anonymous whale acquiring $792 million worth of Bitcoin.

The substantial acquisition transpired amid Bitcoin’s fall from its most recent all-time high of $124,457 to its present value of approximately $119,000.

The acquisition was also driven by BlackRock’s aggressive accumulation strategy, which involved the asset manager purchasing $523 million in Bitcoin and $519 million in Ethereum during Thursday’s market crash.

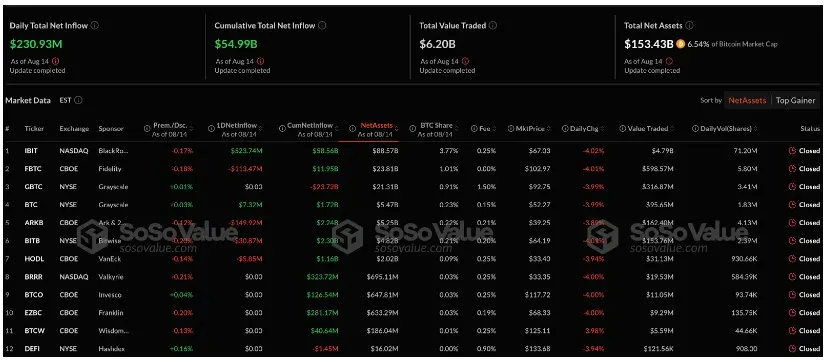

On August 14, US spot Bitcoin ETFs recorded $230 million in net inflows, with BlackRock’s IBIT leading the way with $524 million. Ethereum ETFs saw $640 million in inflows, powered by ETHA’s $520 million contribution.

Initially, Treasury Secretary Scott Bessent devastated market sentiment by announcing that the United States would not purchase any Bitcoin for its Strategic Reserve. However, he later clarified that the government would investigate “budget-neutral pathways” to increase its holdings beyond confiscated assets.

A publicly traded vehicle that aims to accumulate $1 million in Bitcoin has been established by David Bailey’s Bitcoin firm, Nakamoto, following the completion of its merger with healthcare company KindlyMD. This development has contributed to the current bullish optimism.

The consolidated entity intends to allocate $540 million from its most recent financing to develop substantial Bitcoin treasury holdings.

Market Massacre Tests Institutional Resolve

The July Producer Price Index precipitated the most extraordinary crypto liquidation event in months, which exceeded expectations by 3.3% annually compared to the anticipated 2.5%.

Bybit experienced the most significant losses, with $447 million in eliminated leveraged positions, accounting for 42% of the total liquidations across exchanges.

Ethereum lost 3.78% of its value, with $229 million in long positions and $80.22 million in short positions being obliterated due to asset-specific damage.

Bitcoin experienced a 2.98% decline, eliminating $253 million in leveraged positions within minutes. Altcoins, such as SOL, XRP, and DOGE, experienced more severe corrections, with SOL down 5.12%, XRP down 6.63%, and DOGE plummeting 8.90%.

After the liquidation cascade, AguilaTrades, a well-known merchant, was left with only $330,000 in its account, despite losing 18,323 ETH valued at $83.56 million.

Ethereum was on the brink of setting new records at $120, and Solana was challenging previous peaks above $208, when the sell-off reversed what appeared to be a generational bull run.

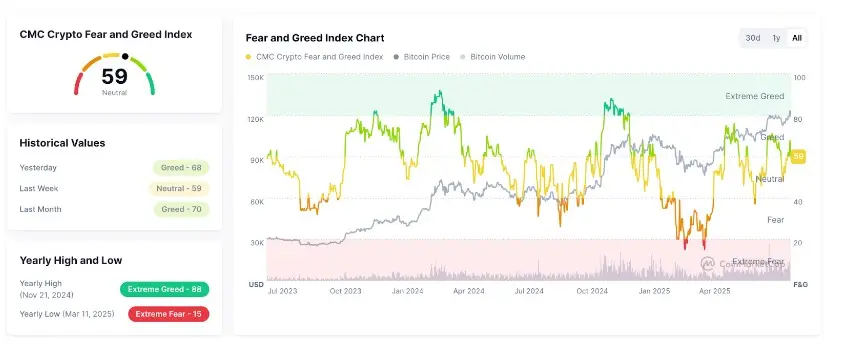

During the liquidation, the crypto Fear and Greed Index experienced a significant transition to extreme fear levels before returning to a neutral state of 59 today.

The market psychology underwent a rapid transformation as cascading liquidations compelled overleveraged positions to close.

Corporate Bitcoin Race Intensifies Despite Volatility

KindlyMD’s merger with Nakamoto introduces an additional significant player to the corporate Bitcoin accumulation race, in addition to Strategy’s 628,946 BTC holdings and ambitious expansion plans.

Metaplanet intends to accumulate 210,000 Bitcoin by 2027, while Semler Scientific anticipates accumulating 105,000 BTC during the same period.

Currently, the merged entity possesses only 21 Bitcoin. However, it anticipates that its $540 million deployment will add approximately 4,544 BTC, potentially establishing it as one of the top 20 Bitcoin treasury firms.

The merger news caused KindlyMD shares to increase by 13.4%, consistent with the recent trend of robust price appreciation among Bitcoin-focused companies.

Additionally, BlackRock and Fidelity continue accumulating Bitcoin through exchange-traded funds (ETFs).

Despite short-term volatility, this organized accumulation is generating enduring institutional demand.

Technical Analysis Indicates Range-Bound Consolidation

After a series of higher and higher highs, Bitcoin’s hourly chart reveals the first significant structural break in its uptrend, establishing a “lower low” at approximately $117,000.

BitcoinHyper, a seasoned trader, provided the analysis. The pattern indicates that the relentless purchasing pressure from $113,000 to $124,000 may exhibit signs of exhaustion.

The recent surge above $124,000, which was followed by a retracement into the $118,500-$123,000 range, indicates a deviation rather than a genuine breakout.

The Bitcoin futures premium remains neutral at below 10%, suggesting that speculators were unaffected by the price decline from all-time highs.

Despite numerous failures above $120,000, the resilience of derivatives markets suggests little concern about retesting the $110,000 support level.

Despite the $792 million acquisition of the anonymous whale, existing resistance dynamics have not been surmounted, which provides fundamental support.

Technical analysis indicates that other institutional participants may utilize their strength to rebalance positions, necessitating further accumulation before decisive breakouts.

Bitcoin is in a favorable position to maintain a range of $116,000 to $123,000 as it reestablishes its technical foundation.

The whale investment should provide a floor for corrections rather than an immediate breakout catalyst, with patience required before sustained advances beyond current resistance levels.