BlackRock and Ark Invest offload over 1,000 BTC as veteran traders warn of a possible dip below $100K.

It is said that BlackRock and Cathie Wood’s Ark Invest have sold some of their Bitcoin stocks.

This came after a seasoned trader said they thought the price of Bitcoin would fall below $100,000.

BlackRock, Cathie Wood’s Ark Dump BTC As Market Drops

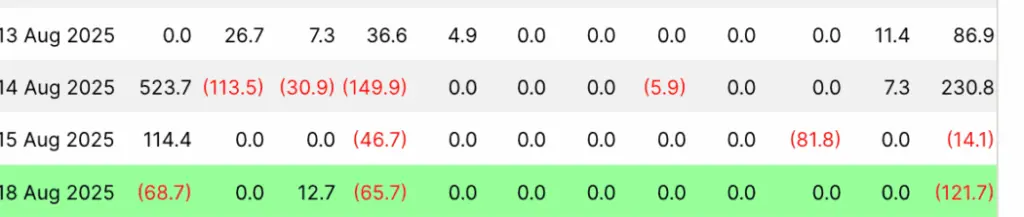

A short time ago, BlackRock sold 490 Bitcoin worth $68.7 million and Ethereum worth $87.2 million.

Even though prices have dropped, BlackRock still has 749,500 BTC, which shows how well it is positioned for the long term in the market.

It is important to note that the sale occurred at the same time that BlackRock’s spot Bitcoin ETF (IBIT) set a new high.

It is now in charge of more than $91 billion in assets.

This shows that buyers still want to be able to invest in Bitcoin in a controlled way.

Based on what Whale Insider said, Ark Invest, which Cathie Wood runs, also made money when it sold 559 BTC worth about $64.4 million through its Ark 21Shares Bitcoin ETF.

This aligns with a larger trend of red ETF moves in August.

It makes people wonder if the recent selling is just people taking profits as usual, or if it’s an early sign of a bearish trend.

However, her latest actions show her optimism about Bitcoin’s future.

Cathie Wood said in an interview earlier this year that she thought the price of Bitcoin would rise to at least $1.5 million in the next few years.

Wood says that the fact that businesses and prominent investors are becoming more interested in Bitcoin will be a significant factor in its growth.

This would make it less volatile and make it a long-term investment.

Seasoned Trader Says Bitcoin Price Will Drop

A well-known trader named Dr. Profit said he was “more than confident” that the price of Bitcoin would drop below $100,000 in September.

He said this would happen before the coin returns and hits new all-time highs in the coming months.

Another analyst, Bull Theory, agreed with this statement.

They think that the price will drop to a support zone around $98,000.

If bulls can hold on to critical levels, the cost could increase to $160,000–$200,000 in the next six months.

Even though there has been a selloff, some people see opportunity in the present correction.

Strategy bought 430 BTC for $51.4 million to increase the amount of bitcoin it owned.

Metaplanet from Japan bought 775 BTC, bringing its overall amount of bitcoin to 18,888 BTC.

The company has an aggressive accumulation plan with a BTC rating of 18.67x. This makes it less vulnerable to volatility.

Based on these moves, BlackRock and Cathie Wood’s Ark Invest may be locking in profits while companies like Strategy and Metaplanet benefit from the drop in the price of Bitcoin.

Bitcoin’s short-term path depends on whether exchanges get more buyers and sellers, and bears can hold the $109,000–$112,000 range.