ARK Invest buys $373.4M in Circle’s NYSE IPO, as CRCL stock surges 200% to over $96, reflecting strong demand for the USDC issuer.

Circle’s initial public offering on the New York Stock Exchange has resulted in ARK Invest, managed by Cathie Wood, investing $373.4 million in the stablecoin issuer. Wood’s investment behemoth has acquired 4,486,560 shares across its Innovation (ARKK), Next Generation Internet (ARKW), and Fintech Innovation (ARKF) funds with this bold move.

Circle’s expansion objectives are stimulated by Ark Invest’s $373 million investment

ARK Invest made a bold move by purchasing nearly 4.5 million shares of Circle (CRCL) for $373.4 million, just as the USDC issuer’s initial public offering (IPO) went live on the NYSE. The stablecoin issuer was incorporated into the asset manager’s portfolio of crypto-exposed companies, where it joins existing holdings such as Block, Robinhood (HOOD), and Coinbase (COIN).

Circle’s official emergence as a public company was driven by a vision to facilitate “frictionless value exchange” through its products, including Circle Payments and USDC. The company’s CEO, Jeremy Allaire, stated, “Our transition to a public company is a significant and powerful milestone. The world is prepared to upgrade and transition to the internet financial system.”

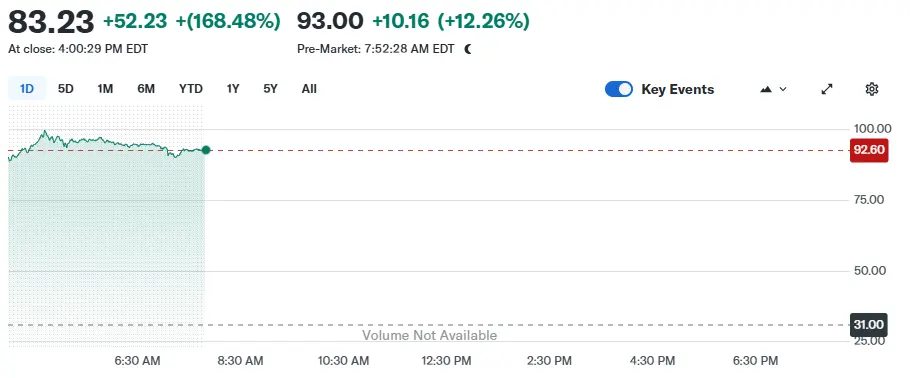

The Circle stock soared nearly 200%, reaching a climax of over $96 on its first trading day, although it opened at $69, a 123% increase from the IPO price. The stock closed at $83.23 under the ticker CRCL, representing a 168.5% increase from its $31 IPO price. This significant increase resulted from an increased initial public offering, which illustrated robust investor demand.

Circle’s IPO Journey: From Obstacles to Success

Circle’s journey to the IPO was distinguished by two preliminary endeavors: a confidential S-1 filing in 2024 and a 2021 SPAC merger. Although Circle submitted its initial IPO prospectus to the Securities and Exchange Commission (SEC) in April, President Donald Trump’s tariff proposals prompted apprehension regarding potential market disruptions. Rumors regarding the acquisition of the USDC issuer by Ripple or Coinbase followed these endeavors. Billionaire Chamath Palihapitiya regards this transaction as “a steal.”

The company has effectively concluded its public offering, with the shares reaching remarkable highs despite its challenges. Allaire conveyed his appreciation to the community for their assistance during the expedition. He observed,

To every single person, project and firm who’s been part of this journey, thank you. I am humbled and deeply grateful. This is not only a moment for each of us personally, I believe it’s a significant moment in the future development of our global economic system as it inexorably synthesizes with the internet.

Kraken and Animoca Brands, which are currently preparing their public offerings, are expected to monitor this significant development closely.