Arthur Hayes anticipates a Trump pump and liquidity boost in Q1 2025, which could propel the Bitcoin and crypto market to new heights.

Arthur Hayes, the co-founder of BitMEX, anticipates that the crypto market and Bitcoin will reach their zenith by mid-2025, followed by a significant decline. The US dollar liquidity environment that unfolds in Q1 2025, as Donald Trump assumes control of the White House on January 20, was the foundation of Hayes’ prediction.

Bitcoin and the Crypto Market in Early 2025

Arthur Hayes, the co-founder of BitMEX, anticipates that the crypto market will rally until Q1 2025, according to a new blog post published on January 7. He asserts that Donald Trump’s impending administration will foster a pro-business environment and pro-crypto policies, perpetuating the upward trajectory of Bitcoin and other crypto assets. Nevertheless, he also cautioned that the market could experience a crash once it reaches its peak in approximately March.

Specifically, he emphasizes that the liquidity of the US Dollar will persist in fostering optimism in the cryptocurrency market. According to Hayes, the trajectory of Bitcoin prices will be influenced by recent policy changes, particularly those implemented by the US Federal Reserve and the Treasury Department.

A surge in global liquidity was observed, similar to the peak of the Federal Reserve’s Reverse Repo Facility (RRP) in Q3 2022. Additionally, BTC has since reversed its trajectory after reaching its lowest point. Hayes anticipates that the Federal Reserve will maintain its quantitative tightening (QT) program at $60 billion monthly until mid-2025. This will result in a decrease in liquidity within the financial system. The recent decision to adjust RRP rates, in conjunction with this, is expected to reduce liquidity levels during the first quarter of 2025 significantly.

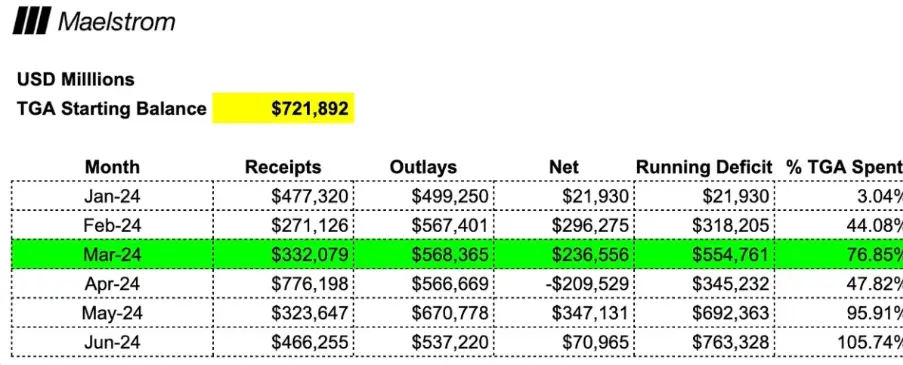

Nevertheless, Hayes does not anticipate this will be a significant concern, as he is confident that other sources of liquidity will mitigate the issue. He also stated that the US Treasury would inject liquidity into the market by spending funds rather than issuing debt through its General Treasury Account (TGA), mainly if the debt ceiling is raised promptly.

By the conclusion of March 2025, Hayes anticipates a net injection of $612 billion in US Dollar liquidity. If this occurs, Bitcoin and the broader crypto market will receive a substantial boost. He stated that observing whether Trump’s political influence will facilitate a prompt resolution of the debt ceiling crisis will be intriguing.

Suppose the Treasury can successfully address the debt ceiling issue and introduce liquidity into the market. In that case, it could drive crypto assets, such as Bitcoin, through the first quarter of 2025. Hayes advises investors to maintain their optimism regarding the cryptocurrency market, positing that the initial quarter could provide substantial gains.

A Corrective Phase Following Q1 2025

Arthur Hayes suggests that the bullish phase may not persist beyond Q1 2025 due to the waning of the Trump pump buzz and the tightening of liquidity conditions. Consequently, he anticipates that the market will undergo a corrective phase following the first quarter. He stated that Bitcoin and the entire crypto market could experience substantial declines due to the diminishing support of fiscal and monetary policies.

Furthermore, the TGA will be further depleted, and a liquidity squeeze will be created during tax season, which concludes in mid-April. Hayes suggests that this could further depress the investment sentiment. Arthur Hayes predicts that this correction may take the form of a pullback akin to the one that BTC experienced in mid-2024, which occurred after its local highs earlier in the year.

“In 2024, Bitcoin hit a local high of ~$73,000 in mid-March, then traded sideways, and began its multi-month decline on April 11th right before the 15th tax payment deadline.”

Hayes, optimistic about Q1 2025, has announced that his firm, Maelstorm, intends to transition into “DEGEN mode” and invest in emerging decentralized science (DeSci) projects. Tokens such as BIO, VITA, ATH, GROW, PSY, CRYO, and NEURON are included in his portfolio.

Bitcoin trades above $102,000, extending its weekly gains to over 10%. The 24-hour total liquidation has increased to $58 million during this recent surge, with $47 million of that amount in short liquidation, according to Coinglass data. Additionally, the open interest has increased by 4%, which indicates that futures traders are optimistic.