In June, two Bitcoin ETFs were introduced in Australia; following the introduction of six Bitcoin and Ethereum ETFs in Hong Kong in April, we will shortly determine whether additional products will be introduced to the market

In June, two Bitcoin BTC $61,424 exchange-traded funds (ETFs) were introduced in Australia, following six Bitcoin and Ethereum ETH $3,440 ETFs in Hong Kong at the end of April.

The crypto ETF market is currently developing, and it appears to be a two-horse contest between Australia and Hong Kong as the competition for market share intensifies.

Monochrome Asset Management became the first and only Australian ETF to possess Bitcoin directly with its June 4 launch on Cboe. VanEck is the second company to introduce its product on the Australian Securities Exchange (ASX) as a sub-fund of its United States iteration on June 20. Numerous additional organizations are currently submitting applications.

A reasonable level of accessibility is available for all of these ETFs on international exchanges, contingent upon the platform they utilize. However, the Asian market is a true treasure.

ETF providers in both jurisdictions have long-term expansionist strategies. In countries where local institutions are unlikely to generate sufficient volume to justify the cost of launching and maintaining a standalone product, Monochrome, at least one Australian provider, is considering the broader Asian market. It is the ultimate objective of Hong Kong to access the vast market in mainland China.

These providers will likely have the market to themselves in the foreseeable future, as they were the first to market. Singapore is currently excluding itself from consideration. It is feasible that regulators in Japan and South Korea will also authorize crypto ETFs; however, Korea’s capital restrictions restrict their scope to their borders.

Think globally, act locally

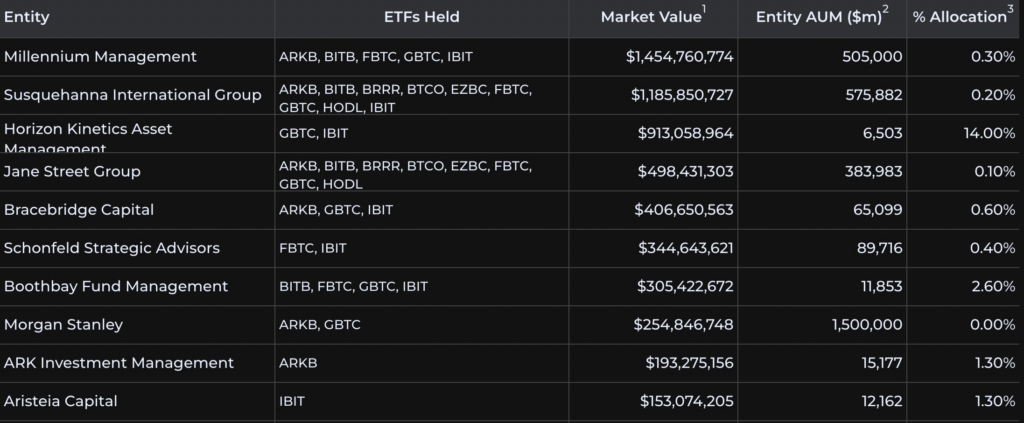

Therefore, what is the likely outcome of this two-horse race? The immediate objective of participants in both markets is to accumulate assets on a local level. This will require a longer timeframe than it did for their U.S. counterparts, who experienced $4.6 billion in trading on their inaugural day on January 11 and are currently approaching $30 billion in assets under management (AUM).

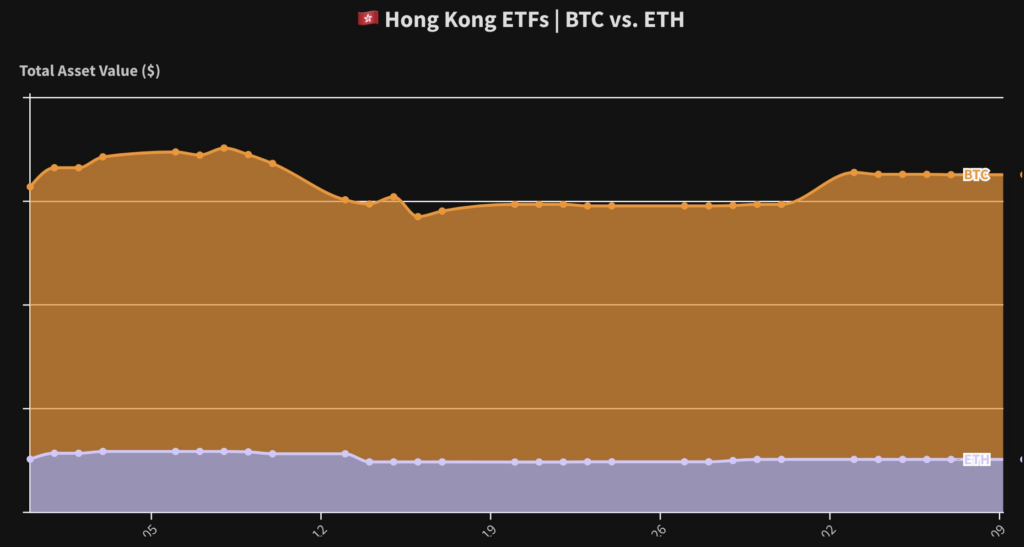

Even though the pre-launch hype has not been matched by the flow of funds in Hong Kong, the clamor may be more to blame than the products. Even though the ETF market in Asia has experienced a compound annual growth rate (CAGR) of 20% over the past decade, investor preference for ETFs remains lower than in the United States.

The combined AUM of all ETFs in the seven leading APAC markets is a mere 4% of their total combined market valuation. 16% of the total market in the United States comprises ETF AUM.

The strongest preference for ETFs is observed in Japan and Australia, where AUM comprises approximately 9% and 7% of the local market capitalization, respectively. ETF AUM comprises only 1% of the market capitalization in Hong Kong. However, the CEO of CF Benchmarks, a London-based organization that offers reference data for crypto ETFs, anticipates that the total assets under management (AUM) of crypto ETFs in Hong Kong will surpass $1 billion by the conclusion of 2024.

Disparities in strategy

The Hong Kong and Australian markets have distinct structures concerning crypto ETFs. Hong Kong is a global financial center, with institutional investors serving as the primary focus of activity. There are fewer innovators and regulated exchanges. In contrast to the United States, where a regulator was reluctant to approve crypto exchange-traded funds (ETFs) due to the pent-up demand for them, Hong Kong’s regulator was the one who was driving the ETFs forward.

Regulators are not frequently observed soliciting applications from fund managers. Hong Kong has elected to prioritize Web3 and cryptocurrency as key components of its economic strategy for the future. There is an abundance of events and consultation papers being published at a pace that exceeds the capacity of the public to comprehend them.

Although mainlanders are prohibited from purchasing Hong Kong ETFs by the regulator, they will likely be able to do so through the Hong Kong China Stock Connect. This serves as a conduit for mainland investors to invest in Hong Kong-listed investment products seamlessly, and the reverse is also true. Currently, this encompasses traditional securities and exchange-traded funds (ETFs).

If the reports of initial discussions to include the crypto ETFs are accurate, then the situation could become quite intriguing. That could require a few months or a few years. No one is aware. However, that is the concept.

If it occurs, or even if it appears probable, it could attract many providers to the Hong Kong market. At present, there are a few applicants who are awaiting approval, and there are numerous providers who are observing and waiting to determine if demand increases. This is likely a three- or four-player market if the Stock Connect does not occur. If this occurs, we will observe an increasing number of applicants vying for a small portion of the world’s largest market.

ETF as a service?

The local market in Australia is less than half the extent of that in Hong Kong. However, there is a generalized increase in interest in ETFs, and there is a diverse array of participants, including retail and institutional investors, crypto exchanges, and innovators like gaming companies and fintech platforms.

An active involvement in the promotion of ETFs was not taken by Australian regulators. In fact, they have been litigating against specific cryptocurrency entities in certain cases. However, they have also implemented a custody regime that ensures the protection of consumers and offers a clear understanding of the infrastructure considerations that regulated businesses should consider. Their strategy is more reactive, adapting to industry trends and consumer demand.

The immediate objective of the Australian ETFs is to capture as much of Australia’s professional and institutional flow as possible. However, if Monochrome’s strategy as the sole directly held spot Bitcoin ETF is successful, it will benefit from its status as an Australian-listed instrument in good standing under ASIC’s retail crypto asset licensing rules. This will enable it to serve as a master fund for feeder funds in other regions. Consider ETF as a service.

That would likely necessitate additional approval in each jurisdiction where they intend to launch, but approval from the Australian regulator offers a high level of assurance.

There is a sense that the Stock Connect agreement is either a success or a failure for Hong Kong. However, even in this absence, the market is sufficiently substantial to underpin crypto ETFs at a standalone level. The Australian market is less viable but still likely to be viable.

Regardless of the outcome, this is a highly positive and thrilling development that will foster innovation and differentiation in the market and provide a wealth of lessons as the market continues to evolve.