The adoption of tokenized financial assets has been slow, and it is far from widespread adoption. However, McKinsey predicts some will take off faster.

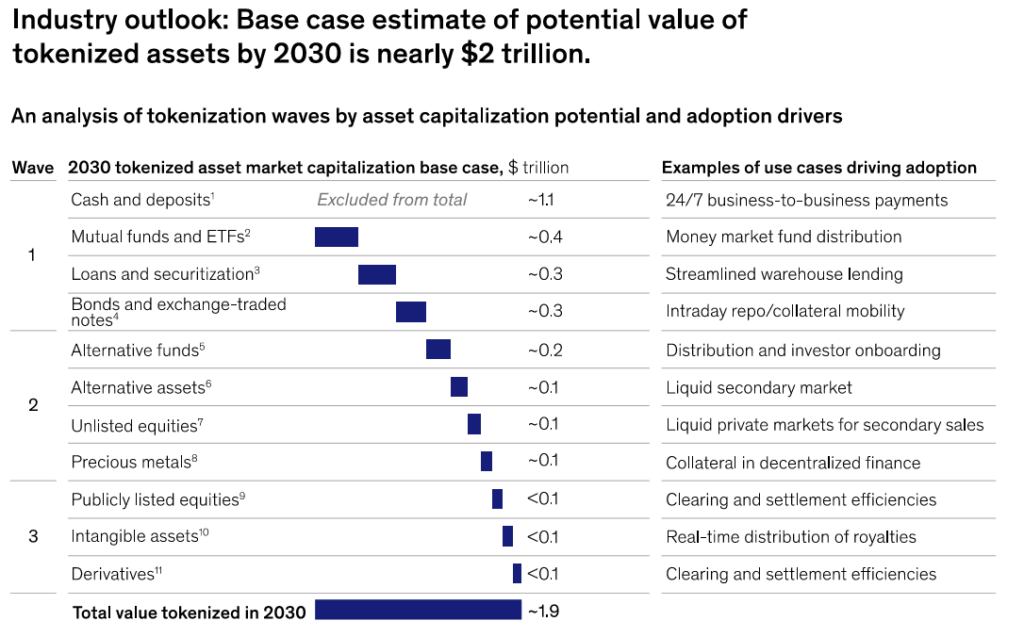

According to consulting firm McKinsey & Company analysts, tokenized financial assets have experienced a “cold start”; however, they are projected to attain a market size of approximately $2 trillion by 2030.

According to the analysts, this value could double to approximately $4 trillion in a favorable scenario, despite their “reduced optimism” as of June 20.

According to McKinsey’s analysts, tokenization has experienced “visible momentum.” Still, widespread adoption remains elusive due to the “challenges” associated with modernizing existing financial infrastructure, particularly in a regulatory-heavy industry like financial services.

The analysts anticipated that currency and deposits, bonds and exchange-traded notes (ETNs), mutual funds and exchange-traded funds (ETFs), loans, and securitization would achieve “meaningful adoption” first, which would equate to a $100 billion of tokenized market capitalization by 2030.

The analysts’ estimate excluded stablecoins, tokenized deposits, and central bank digital currencies (CBDCs).

Better use cases would thaw cold start

According to analysts at McKinsey, tokenization is currently experiencing the prevalent “cold start problem,” which necessitates that users value tokenized items.

The tokenized issuance is discouraged by the technology’s limited liquidity. Tokenized assets with a “parallel issuance on legacy technology” may also result from a fear of losing market share.

Tokenization necessitates a use case in which it provides an advantage over conventional finance systems, added the analysts.

“The tokenization of bonds is one such example.” The analysts at McKinsey reported that a new tokenized bond issuance was announced nearly weekly.

“While there are billions of dollars of tokenized bonds outstanding today, benefits over traditional issuance are marginal, and secondary trading remains scarce.”

The analysts, in their example, suggested that the slow start could be resolved by implementing “greater mobility, faster settlement, and more liquidity.”

According to McKinsey’s analysts, early adopters who “catch the wave” of tokenization may achieve a significant market share and the ability to establish standards and gain a reputation boost.

“However, a significant number of institutions are in a state of “wait and see,” they stated.”

According to the analysts, some indicators indicate when tokenization has reached a critical point, such as blockchains that are seamlessly connected and capable of supporting trillions of dollars in volume, as well as regulation that catches up to provide “clarity on data access and security.”