Volt Capital, Alliance DAO, and the Winklevoss twins supported Azura’s $6.9 million financing round.

Some of the most well-known cryptocurrency pioneers have endorsed the debut of Azura, a new all-in-one crypto application aggregation layer.

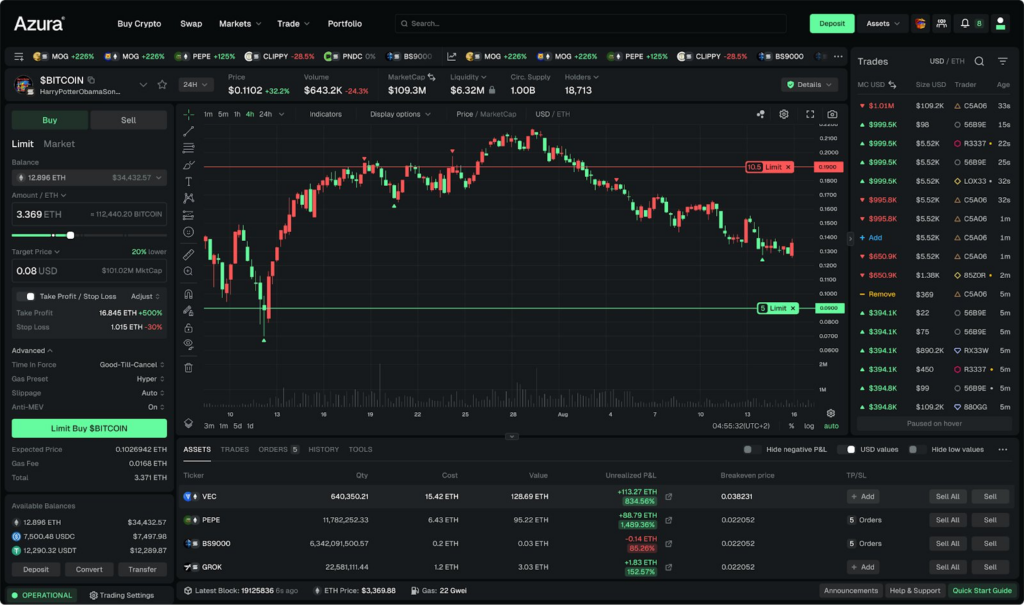

Launched on October 22, the platform bills itself as an onchain interface layer to facilitate the trading of any asset using decentralized finance (DeFi) applications, reducing the entry barrier for new investors.

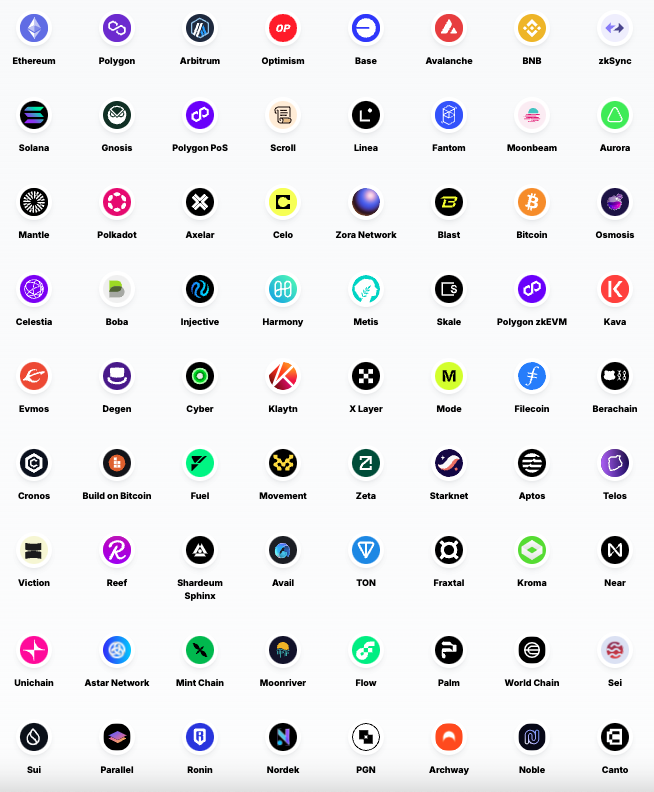

According to an X post from October 22, Azura wants to support all blockchains and protocols:

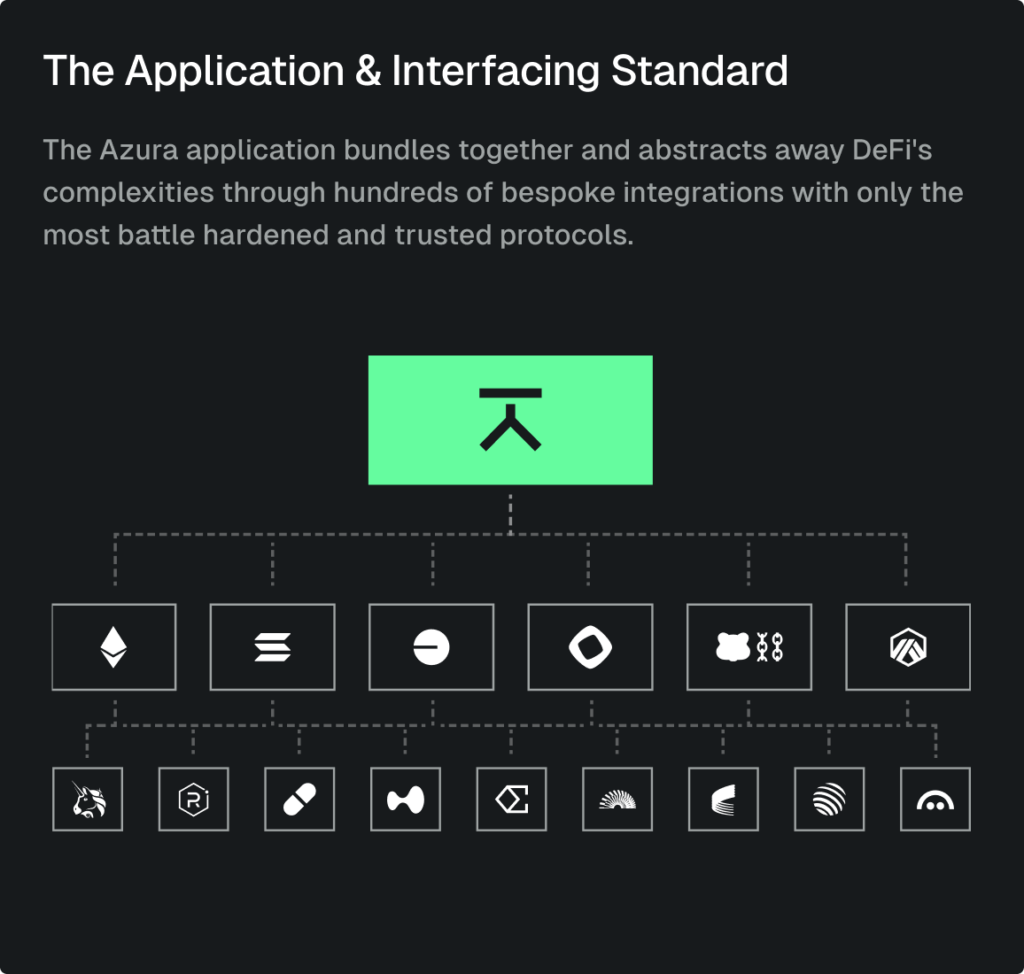

“Azura aggregates all major forms of decentralized infrastructure into a single application. By bundling functionality and abstracting away complexity, Azura preserves the benefits of DeFi—self-custody, decentralization, and transparency—while lowering its barrier to entry.”

DeFi users must communicate with multiple blockchains, protocols, Web3 wallets, and blockchain bridges to conduct cross-chain transactions.

Crypto novices are deterred from utilizing decentralization programs by this fragmentation of DeFi applications, which Azura claims is a “significant barrier to adoption.”

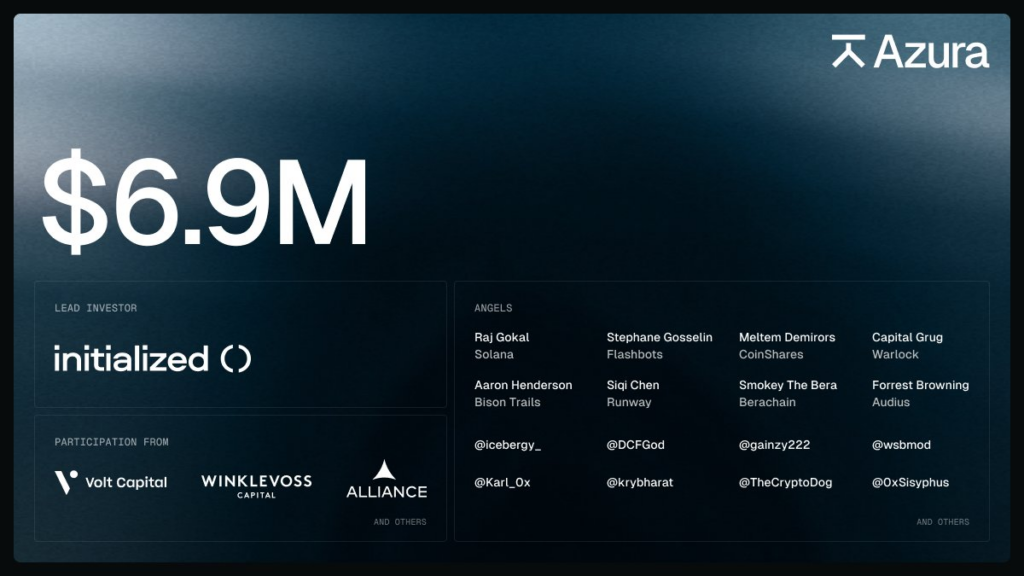

An early Coinbase investor, Initialized, led Azura’s $6.9 million round.

Azura announced the completion of a $6.9 million financing round to support its launch. The deal was led by Initialized Capital, an early investor in Coinbase, which CoinGecko reports is presently the sixth-largest cryptocurrency exchange by market share.

Volt Capital, Winklevoss Capital, Alliance DAO, Raj Gokal, a co-founder of Solana, CoinShares CSO Meltem Demirors, and others invested in the $6.9 million round.

American rowers and internet entrepreneurs Cameron and Tyler Winklevoss are twins. They gained notoriety for co-founding HarvardConnection and suing Mark Zuckerberg, the inventor of Facebook because Zuckerberg had stolen their concept for a social networking site. In the end, this case brought them $65 million.

DeFi in 2024 is comparable to the internet in the early 1990s.

The current DeFi ecosystem is similar to the internet in the early 1990s due to industrial fragmentation.

According to Azura’s release, this makes today’s DeFi applications as challenging to use as the internet was more than 30 years ago:

“Similarly, users are forced to navigate innumerable services to interact with DeFi. It’s a maze of blockchains, wallets, exchanges, bridges, and other protocols. This fragmentation increases friction and complexity, and serves as a significant barrier to adoption.”

Without the hassles of non-recoverable seed phrases or the need to set up several addresses, the new DeFi aggregation layer seeks to unify these decentralized apps under a user-friendly interface.