The Ownership of FTX EU is now a disputed issue between Backpack Exchange and the FTX estate.

Backpack Exchange, a centralized cryptocurrency platform, has responded to the FTX Recovery Trust’s assertions that it is disputing the legality of its acquisition of FTX EU.

Backpack Exchange announced on January 8 that it had acquired FTX EU following regulatory approval from the Cyprus Securities and Exchange Commission (CySEC) in December 2024.

In 2021, FTX acquired FTX EU, which was previously known as Digital Assets AG (DAAG), for $323 million.

Following the demise of FTX in November 2022, the subsidiary was entangled in the bankruptcy proceedings of the parent company.

In February 2024, FTX EU was resold to Patrick Gruhn and Robin Matzke, co-founders of DAAG, for $32.7 million as part of a court-approved settlement that was designed to optimize creditor returns. In May 2024, this transfer was finalized.

In June 2024, Backpack Exchange declared that it had acquired the same European assets from the co-founders.

“The FTX estate is required to transfer the shares by the court-approved sales and purchase agreement following such approval,” Backpack stated in a statement.

The new European entity of the corporation intends to provide crypto derivative services throughout the EU, including perpetual futures.

Backpack Exchange Assertions Are Denied By FTX Estate

On January 8, the FTX estate, which is headquartered in the United States, released a statement that refuted Backpack’s assertions.

The shares of FTX EU are still under the ownership of FTX Europe AG, a subsidiary of FTX, as per the estate.

The estate clarified that the previously disclosed transfer of shares to FTX EU’s co-founders, Patrick Gruhn and Robin Matzke, had not yet taken place.

FTX Europe AG, an FTX subsidiary, currently holds 100% of the share capital of FTX EU, according to the estate as of today.

The press release of The Backpack was issued without the knowledge or involvement of FTX, according to the statement.

Who Is Responsible For Paying Creditors?

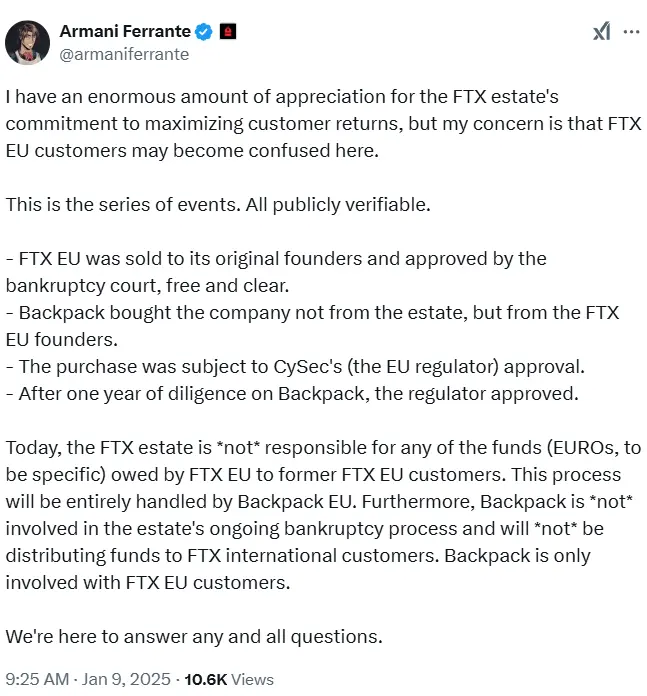

The responsibility for administering creditor repayments is another significant point of contention between the FTX estate and Backpack Exchange.

Backpack announced that it would assume responsibility for the distribution of funds to FTX EU’s erstwhile customers and rebrand the organization as Backpack EU.

“At present, the FTX estate is not accountable for any of the funds (EUROs, to be precise) that FTX EU owes to former FTX EU customers.”

On January 9, Backpack CEO Armani Ferrante announced on X that the entire procedure will be managed by Backpack EU.

Nevertheless, the FTX estate refutes this assertion, asserting that Backpack has not been granted the authority to oversee creditor repayments.

Creditors Are concerned

Creditors are experiencing anxiety regarding the repayment process.

The private transfer of FTX EU to Backpack has resulted in confusion among FTX EU customers regarding the repayment of their funds, according to FTX creditor activist Sunil Kavuri, as reported by Cointelegraph.

Kavuri stated that the private transfer of FTX EU to Backpack has resulted in additional confusion and anxiety among FTX EU customers regarding the repayment of their funds.

Additionally, he observed that Kraken and Bitgo had been granted permission to disseminate funds to FTX customers, which further exacerbated the uncertainty.

“Some FTX EU customers have signed up with these distributors and are uncertain about the distribution of their funds back to them—whether it be through Backpack, Kraken, or Bitgo,” Kavuri said.

By the time of publication, Cointelegraph had not received a response from FTX or Backpack, despite reaching out to them for additional information.