The Smart Money Concept Trading Strategy has gained viral attention over the past few years, and it’s mostly for good reasons: it seems to be working

At least for some people. But what’s unique about this SMC strategy anyway? To be accurate, the SMC is not just a strategy but a strategy that works.

Now, you are curious about this new concept. So, in this beginner’s guide, we reveal everything you need to know about the Smart Money Concept (SMC) trading strategy.

What is the Smart Money Concept (SMC) Trading Strategy?

Smart Money Concept Trading Strategy centers on the principle that the movements of large institutional investors in financial markets can offer valuable clues to beginner traders about future market trends.

Market makers, or the “smart money,” often leave footprints of their trading decisions on the chart, and smart money concept traders are to follow these footprints.

Market makers such as banks, hedge funds, and other prominent market participants who can move substantial amounts of capital can allegedly manipulate the market against beginner traders. While this may sound like a conspiracy theory, it is worth looking into.

These institutions are in the business of making profits or supplying the needs of a country or a big corporation. They are open about using their vast resources and market knowledge to their advantage, including setting traps for beginner traders to part with their money.

Beginner traders, often ignorant of these activities, are likelier to fall victim to the market’s unpredictable swings.

However, that’s not the entire idea of SMC Trading Strategy. Very often, these big players enter the market with good intentions. For instance, a government that must purchase large quantities of a commodity, such as wheat, soybeans, or crude oil, can push prices in a specific direction.

So, based on the SMC Trading Strategy, financial markets are primarily controlled by financial institutions, hedge funds, and governments. They significantly impact price movements in the market, and therefore, beginner traders must be alert to their intentions to predict where the market is heading.

How Does the Smart Money Concept Trading Strategy Work?

The Smart Money Concepts, often abbreviated as SMC, owe their origins to The Inner Circle Trader (ICT), a program developed by Michael J. Huddleston. It was initially developed as a theory. But in the world of trading, theories turn into strategies.

ICT’s teachings have been instrumental in popularizing SMC as a trading strategy among traders seeking a deeper understanding of market dynamics – beginners.

In essence, SMC trading strategy is not merely about following the “money” but understanding the strategic placements and movements of these large volumes of capital.

Institutional investors typically conduct extensive research and deeply understand the market dynamics before making substantial trades.

Therefore, their actions often indicate a broader market sentiment or an impending significant market move. By deciphering these signals, beginner traders can gain insights into market trends before they become apparent to the broader market.

Understanding SMC trading strategy requires a shift from focusing solely on technical indicators and price action to considering the market’s psychological and strategic elements.

For beginner traders, leveraging the Smart Money Concept means navigating the market with a more informed approach, using the trails left by institutional investors as a path to smarter trading decisions.

Here are some key price action concepts that are used in SMC Trading Strategy:

- Supply and Demand: At the heart of SMC’s trading strategy lies the age-old concept of supply and demand. SMC trading strategists are adept at identifying levels on price charts where significant buying or selling orders are concentrated. When prices approach these zones, it often results in a rapid price movement as market makers execute their orders.

- Price Patterns: Like traditional technical analysis, SMC trading strategists look for chart patterns that explain future price movements. These patterns can include breakouts, reversals, and consolidations.

- Support and Resistance: Support and resistance levels are vital in SMC Trading Strategy. Traders identify key areas where prices tend to stall or reverse. In SMC terminology, these levels are sometimes called “mitigation blocks.” When prices reach these zones, SMC traders anticipate potential changes in market direction. However, unlike price action traders who use Fibonacci levels and supply and demand zones, SMC traders rely heavily on order block areas, break of structure, and Choch patterns.

SMC Trading Strategy Guides for Beginners

The Smart Money Concept introduces several foundational ideas that provide beginners with a guide to interpret market movements through the lens of institutional activities.

Order Blocks

Represent areas where institutional investors have placed significant orders, usually in a range. These blocks often precede a strong market move in the direction of the block, serving as a signpost for areas of interest to “smart money.”

When the price returns to this zone, it’ll often reverse (similar to an area of support or resistance). These zones are pivotal points in price action trading, influencing the market’s future direction.

When many buy or sell orders cluster at a specific price level, it establishes a robust support or resistance capable of absorbing pressure and triggering price reversals or consolidation.

Breaker Blocks

These are essentially failed order blocks. When an order block fails to hold the price, it breaks through, potentially indicating that the “smart money” direction has changed.

When the price breaks above or below the order block, it can act as a barrier for future prices (similar to how an area of support can become resistant and vice versa) and beginner traders should always pay attention to this.

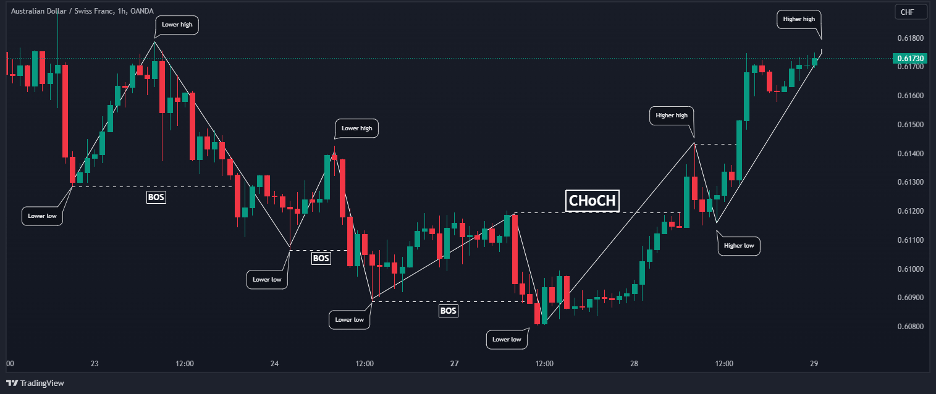

Breaks of Structure (BOS)

A BOS occurs when the price surpasses a significant high or low, indicating a potential change in market trend. It signifies the end of one market phase and the beginning of another, offering clues about “smart money”’s influence on market direction. Recognizing BOS can be crucial for determining trend direction.

Change of Character (ChoCH)

This concept refers to a notable alteration in the market’s behavior, often seen through an abrupt increase in volatility or a shift in price direction.

A ChoCH usually follows a BOS, confirming a potential trend reversal and suggesting a new phase of market sentiment driven by institutional activities. Often, beginner traders are caught unaware during these sudden trend reversals.

Fair Value Gaps (Imbalances)

These gaps represent areas on the chart where price moves quickly, leaving a gap that indicates an imbalance between supply and demand. Institutional traders often target these gaps for potential returns, so prices move back to fill them over time.

Please clarify whether your current trading style suits you. If you don’t have time to look at charts during the day, you should not focus your strategy on intraday trading using 1

5-minute or 30-minute charts. It is better to develop an approach that works on a 4-hour or daily chart so that you have enough time to analyze the charts before or after work.

Ideal time and timeframe – this phrase describes an imbalance in the market. It occurs when the price departs from a specific level with limited trading activity, resulting in one-directional price movement.

In the case of a bearish trend, the Fair Value Gap represents the price range between the low of the previous candle and the high of the following candle.

This area reveals a discrepancy in the market, which may indicate a potential trading opportunity. The same principle applies to a bullish trend but with the opposite conditions.

Liquidity

In the context of SMC trading strategy, liquidity refers to the areas where “smart money” is likely to execute large orders due to the availability of opposite market orders.

In these areas, stop losses and orders (to capture a breakout) are likely resting, usually around key highs or lows, trendlines, and equal highs/lows.

The concept states that “smart money” will likely push the price into these areas to execute large orders before the market direction unfolds, as in a bull or bear trap.

How liquidity is handled varies depending on the trader. One of the most common approaches is to use a pivot high or pivot low. For better understanding, a pivot high or low is formed when several adjacent candlesticks have a higher low or lower high.

Accumulations/Distributions

These phases indicate the period during which “smart money” is either accumulating (buying) or distributing (selling) their positions.

Rooted in the Wyckoff theory, an accumulation occurs at lower price levels, often before a significant uptrend, while distribution occurs at higher price levels, typically before a downtrend. Identifying these phases can provide insights into the future market direction institutional investors favor.

SMC Trading Strategy vs Wyckoff’s Theory

The term Smart Money was first introduced and mentioned by Richard D. Wyckoff, a renowned stock market authority, trader, and educator who contributed significantly to the field of technical analysis.

He is known for his work on the Wyckoff Method, which aims to reveal the intentions of “smart money” in the market. In Wyckoff’s framework, “smart money” refers to large, well-informed investors, institutions, and professionals with the financial capacity and knowledge to strategically move markets.

Wyckoff’s analysis seeks to detect the footprints of smart money through price and volume analysis, enabling traders to make more informed decisions based on the actions of these influential market participants.

In essence, Wyckoff’s concept of smart money revolves around understanding the behavior and motives of key players to gain a competitive edge in trading and investing.

When we closely study Wyckoff’s price cycle, we can see that in each cycle, whether accumulation or distribution, some points are similar to those laid out in the SMC Trading Strategy.

The Wyckoff Price Cycle consists of four main phases:

Accumulation

In this phase, informed investors (smart money) quietly accumulate positions while the general public is still bearish or unaware of the potential upward movement. Prices may trade within a range, and volume tends to be low. The goal is to accumulate a substantial position without causing noticeable price increases.

Markup (Advancing or Bullish Phase)

After accumulating a significant position, smart money starts to push prices higher. This phase is characterized by a strong uptrend, increasing volume, and positive sentiment. The public notices the price movement and may start entering the market.

Distribution

Smart money players sell their accumulated positions to the less-informed public during the distribution phase. Prices may trade within a range or show signs of weakness. Volume might decline as the market loses momentum. This phase is marked by a shift from bullish sentiment to uncertainty or bearishness.

Markdown (Declining or Bearish Phase)

In the markdown phase, prices decline, and the market enters a downtrend. Volume may increase, reflecting increased selling pressure. The public sentiment turns increasingly bearish as losses accumulate.

SMC Trading Strategy vs Price Action

The Smart Money Concept Trading Strategy and price action are popular, yet they approach the market from distinct angles.

Price action focuses on analyzing past and present price movements to identify patterns or trends without considering external factors. It relies heavily on candlestick patterns, chart formations, and support and resistance levels, making it a strategy based on the technical aspects of trading.

This approach is favored for its simplicity and direct reliance on price data, allowing traders to make decisions based on the immediate market environment.

On the other hand, SMC’s trading strategy delves deeper into the underlying market dynamics, emphasizing the influence of institutional investors or “smart money.”

It seeks to identify where these major players are likely to enter or exit the market, using concepts like order blocks, liquidity zones, and fair value gaps.

Smart money trading strategies are grounded in the belief that understanding the actions of institutional traders can give beginner traders insights into potential market movements before they become apparent to the broader market.

While price action is straightforward and relies purely on technical analysis, SMC’s trading strategy incorporates a more strategic view, considering the psychological and strategic maneuvers of the market’s most influential participants.

Traders might find price action appealing because of its clarity and focus on the charts, whereas SMC’s trading strategy offers a more profound, albeit more complex, analysis of market forces. Integrating the two can provide a comprehensive trading strategy, leveraging the simplicity and technical focus of price action with the strategic depth offered by SMC trading strategy.

Pros and cons of SMC Trading Strategy

Pros of SMC Trading Strategy:

- Smart money concepts trading strategies work for some traders. If it works for you, there is no reason not to use it. Being able to grasp what the price is doing consistently and profit from its behavior is more important than knowing why the price is moving the way it is.

- Price action has a decades-long history of producing results for many people across currencies and other assets. Since SMC is repackaged price action, it does have a solid core.

- Some people find price action more straightforward to understand when presented as SMC.

- While the theory that large institutions target beginner traders is dubious, it seems plausible to suggest that larger institutions may sometimes go after smaller ones.

- Liquidity grabs exist, even if the SMC trading strategy presents them in a questionable framework. Some of the strategy elements of SMC may be viable, just not as SMC describes them.

Cons of SMC Trading Strategy:

- Some of the theory elements of SMC trading strategy do not make much sense when you think logically about how irrelevant beginner traders are to the big players. Believing wholeheartedly in everything SMC presents could result in misunderstanding market fundamentals.

- One must prove and disprove the theories behind SMC trading strategies. They are purely speculative, and only an insider can produce concrete evidence in either direction.

- That means no one can verify that the SMC trading strategy’s model of reality is correct, but no one can 100% refute it. All anyone can do is argue based on their beliefs about what institutions do.

- Switching up all the terminology the SMC trading strategy uses can make for an unnecessarily convoluted learning process for price action, especially if you are already familiar with the standard language of price action.

- It may also make it harder for you to share what you learn with others who speak the regular price action language.

- Many people are turned off by the elitist mystique surrounding SMC trading strategy and feel it is deceptive to sell old concepts as new.

- Also, we are using the word “sell” here very literally. While there are a lot of free SMC trading strategy resources, you will run into plenty of pay gates while trying to learn SMC trading strategy.

Conclusions

In conclusion, the Smart Money Concepts (SMC) Trading Strategy provides beginner traders with a strategic guide that focuses on understanding the actions and motives of market makers, particularly institutions such as banks and hedge funds.

This approach involves replicating the trading behavior of influential entities, focusing on variables such as supply and demand dynamics and the structural aspects of the market.

Smart Money Concepts trading strategy would probably not be as popular as now if some traders did not find it intuitive. If you like how SMC trading strategy expresses its terminology and techniques, go ahead and try it.

Just be aware that the strategy is a repackaged form of suitable old-fashioned price action trading and that you are doing the same thing as many other retail traders. But there is nothing wrong with that because suitable old-fashioned price action trading is a tried and true method that has been profitable for many traders for decades.