Crypto arbitrage bots enable beginners and experts to profit from little price differences across exchanges, eliminating the need for manual monitoring.

Crypto arbitrage bots automate the process, allowing beginners to enter the crypto industry without being exposed to the volatility and emotional decision-making that typically accompany manual trading.

Before discussing “Best Crypto Arbitrage Bots for Beginners: Easy-to-Use Options,” let’s look at what crypto arbitrage bots are.

- 1 What are Crypto Arbitrage Bots?

- 2 How Crypto Arbitrage Bots Work:

- 3 Factors to Consider When Choosing the Best Crypto Arbitrage Bots for Beginners:

- 4 Best Crypto Arbitrage Bots for Beginners: Easy-to-Use Options

- 5 Risks Associated with using Crypto Arbitrage Bots:

- 6 Concussion

What are Crypto Arbitrage Bots?

Crypto arbitrage bots are automated software that capitalize on price differences between cryptocurrencies across various exchanges. These bots find arbitrage opportunities and execute trades to capitalize on price fluctuations, allowing traders to make quick, low-risk returns.

Type of crypto arbitrage bots

There are various types of arbitrage strategies used in cryptocurrency trading, each of which aims to capitalize on price differences across exchanges or pairs. Here are some of the major types of arbitrage:

Spatial Arbitrage (Inter-Exchange Arbitrage)

Spatial arbitrage is the practice of buying a cryptocurrency on one exchange at a lower price and selling it on another at a higher price. This is the most straightforward type of arbitrage, taking advantage of price differences between trading platforms.

- Example: Buy Bitcoin on Binance for $25,000 and sell it on Kraken for $25,100 to profit from the difference.

Triangular Arbitrage:

Triangular arbitrage exploits price differences between three different cryptocurrency pairs on the same exchange. This method involves the trader converting one crypto into another, then into a third, and lastly, back into the original crypto, taking advantage of exchange rate inefficiencies.

- Example: Trading BTC → ETH → XRP → BTC on a single exchange, where BTC’s value is mispriced in comparison to ETH and XRP.

Convergence Arbitrage:

This technique involves traders betting on the convergence of crypto prices across many platforms.

If the price of a cryptocurrency is temporarily higher on one exchange than another, traders short the overpriced asset on one platform and buy the undervalued asset on the other, with the expectation that the values would eventually converge.

- Example: Shorting Bitcoin on one exchange and buying it on another, with the expectation that prices will eventually equalize.

Statistical arbitrage

The technique identifies short-term market mispricings by using mathematical models and historical data. Statistical arbitrage bots can automate trades based on statistical probability, performing a high volume of trades to take advantage of slight differences.

- Example: Using historical price trends to predict when an asset’s price will differ from its average and subsequently return to the mean, allowing returns from the temporary anomaly.

Cross-border Arbitrage:

Cross-border arbitrage arises when pricing differences exist due to market inefficiencies across countries. This could be due to currency controls, regulations, or differences in market maturity.

- Example: During a currency crisis or inflation, you may buy Bitcoin on an exchange in a low-demand country and then sell it on another exchange in a high-demand country.

Decentralized Arbitrage:

This entails arbitrating price differences between decentralized exchanges (DEXs) and centralized exchanges (CEXs). Because liquidity varies widely between DEXs and CEXs, prices may not line perfectly, creating arbitrage opportunities.

- Example: Buy an altcoin on Uniswap at a lower price and sell it on Binance at a higher price.

Futures Arbitrage:

Futures arbitrage makes use of price differences between a cryptocurrency’s spot price (current market price) and its futures contract price. Traders purchase cryptocurrency at the spot price while concurrently selling a futures contract to lock in the difference when prices converge as the contract expires.

- Example: If you buy Bitcoin at the current spot price of $25,000 and sell a futures contract with a price of $25,500, you will profit by $500 when the contract closes.

Cash and Carry Arbitrage

This technique entails purchasing a cryptocurrency at the spot price while also selling a futures contract for the same cryptocurrency. The goal is to lock in a risk-free profit by holding the asset until the futures contract ends and profiting from the price difference.

- Example: Buy ETH at $1,800 in the spot market and sell a futures contract for $1,850, then hold the ETH until the contract expires and profit from the $50 difference.

Each type of arbitrage has its own set of risks and rewards, including market volatility, exchange fees, and latency concerns, but they all seek to capitalize on temporary inefficiencies in the cryptocurrency markets.

Benefits of Crypto Arbitrage Bots

Here are the main benefits of crypto arbitrage bots:

1. Speed and Efficiency

Crypto arbitrage bots work significantly faster than humans. They can monitor numerous exchanges and execute trades in milliseconds, allowing traders to capitalize on price differences before they disappear. In fast-moving cryptocurrency markets, speed is essential for securing profitable trades.

2. 24/7 operation:

Cryptocurrency markets operate 24 hours a day, seven days a week, and bots can monitor exchanges and execute trades while the trader is offline or sleeping. This ongoing monitoring maximizes the chances of finding profitable arbitrage opportunities at all time.

3. Emotion-free Trading:

Bots make trades based only on algorithms and data. Unlike human traders, they are unaffected by emotions like fear or greed, resulting in more consistent and rational decision-making. This helps to avoid impulsive decisions during market volatility.

4. Optimizing Small Price Differences:

Even small price differences between exchanges can be beneficial when traded at high speeds and in big volumes. Arbitrage bots are especially beneficial for leveraging these small margins, which would be impossible to take advantage of manually due to the volatility of the crypto market.

5. Minimal Supervision Required:

Crypto arbitrage bots require little supervision once set up and configured correctly. Most procedures can be automated by traders, such as tracking market prices, executing deals, and monitoring profits, saving time for other tasks.

6. Scalability:

Bots can handle a high number of trades on multiple exchanges at once. This scalability enables traders to monitor several assets and exchanges, boosting the possibility of spotting arbitrage opportunities.

7. Reduced human error:

Arbitrage bots help to reduce errors that can occur during manual trading, such as mistiming a deal or entering wrong statistics.

8. Customizable Strategies:

Many crypto arbitrage bots can be customized to match certain strategies or market conditions. Traders can adjust parameters such as trading thresholds and risk limitations or even use advanced strategies like triangle arbitrage, which takes advantage of price differences between three pairs of cryptocurrencies.

These benefits make crypto arbitrage bots an intriguing tool for traders trying to improve their trading efficiency and increase profits in the volatile world of cryptocurrency.

How Crypto Arbitrage Bots Work:

Market Monitoring: Crypto arbitrage bots consistently monitor cryptocurrency prices on several exchanges (such as Binance, Coinbase, and Kraken).

Identifying Arbitrage Opportunities: When a price difference is identified, the bot looks for an arbitrage opportunity, which usually includes purchasing a cryptocurrency at a lower price on one exchange and selling it at a higher price on another exchange.

Execution: The bot executes trades across exchanges almost instantly, benefitting from the price difference.

Profitability Factors: Transaction speed, fees, and market volatility all have an impact on arbitrage bot profitability.

Choosing the best crypto arbitrage bot for beginners is critical for boosting profits while reducing risks.

Factors to Consider When Choosing the Best Crypto Arbitrage Bots for Beginners:

Here are some crucial aspects beginners should consider:

Easy to Use

For beginners, the user interface should be simple and easy to use. This means that the platform should have simple menus, clear instructions, and pre-configured options that do not require advanced technical knowledge.

A simple and visually appealing dashboard can assist users in effectively monitoring transactions, setting parameters, and analyzing trading results.

- Reason for Choosing: A clunky or too complicated interface might overwhelm beginners, resulting in errors or missed opportunities. A user-friendly bot allows traders to focus on strategy rather than navigating complicated settings.

Automation features

Arbitrage bots must function well without frequent operator intervention. The best bots have customizable strategies that can be implemented automatically even when the trader is not there. Some bots allow you to set trade triggers based on specific price movements, profit margins, or market conditions.

Furthermore, bots that provide 24-hour monitoring across various exchanges enable traders to capitalize on opportunities at any time, even while sleeping.

- Reason for Choosing: Automation ensures that traders do not lose out on arbitrage opportunities, particularly in the volatile and fast-moving crypto market.

Security

When it comes to crypto arbitrage bots, security is important. The bot must provide strong protection of user data and funds.

API key encryption protects against illegal access, and two-factor authentication (2FA) assures that only the trader can carry out transactions. Look for bots with a good reputation in the market and no history of security breaches.

- Reason for Choosing: Weak security can lead to hacking or unauthorized access to your exchange account, resulting in financial losses.

Supported Exchanges

The more exchanges a crypto arbitrage bot supports, the more opportunities it has to identify price differences. The ideal bot should be compatible with numerous popular exchanges, including Binance, Kraken, Coinbase, and others.

This improves the chances of finding profitable arbitrage opportunities. Furthermore, cross-exchange support ensures that customers are not limited to only the biggest platforms, which frequently have lower price fluctuations than specialized exchanges.

- Reason for Choosing: A bot that operates on fewer exchanges has fewer arbitrage opportunities. Wide exchange support allows traders to diversify their trades and capitalize on various market opportunities.

Cost

Arbitrage bots are often available in two pricing models: free and paid. Free bots may have limited features, whereas paid bots typically provide more advanced functionalities such as custom strategy creation, detailed analytics, and premium customer service.

Some bots need a subscription fee, while others request a percentage of your profits. Beginners should think about how much they are willing to invest in their bot and compare it to its features and success rates.

- Reason for Choosing: While free bots are ideal for beginners with low capital, paid bots frequently offer better features, support, and reliability, which can result in bigger long-term profits.

These characteristics can help beginners make informed choices about crypto arbitrage bots, increasing their chances of profitability while limiting risks.

Exploring the best crypto arbitrage bots for beginners will help you automate your trading strategy and profit from price differences between exchanges.

Best Crypto Arbitrage Bots for Beginners: Easy-to-Use Options

Each of these crypto arbitrage bots provides beginner-friendly features, automation, and ease of use, allowing new traders to begin with minimal learning curves. Here are the best crypto arbitrage for beginners:easy-to-use options:

- Pionex:

- Bitsgap

- Coinrule

- HaasOnline

- Quadency

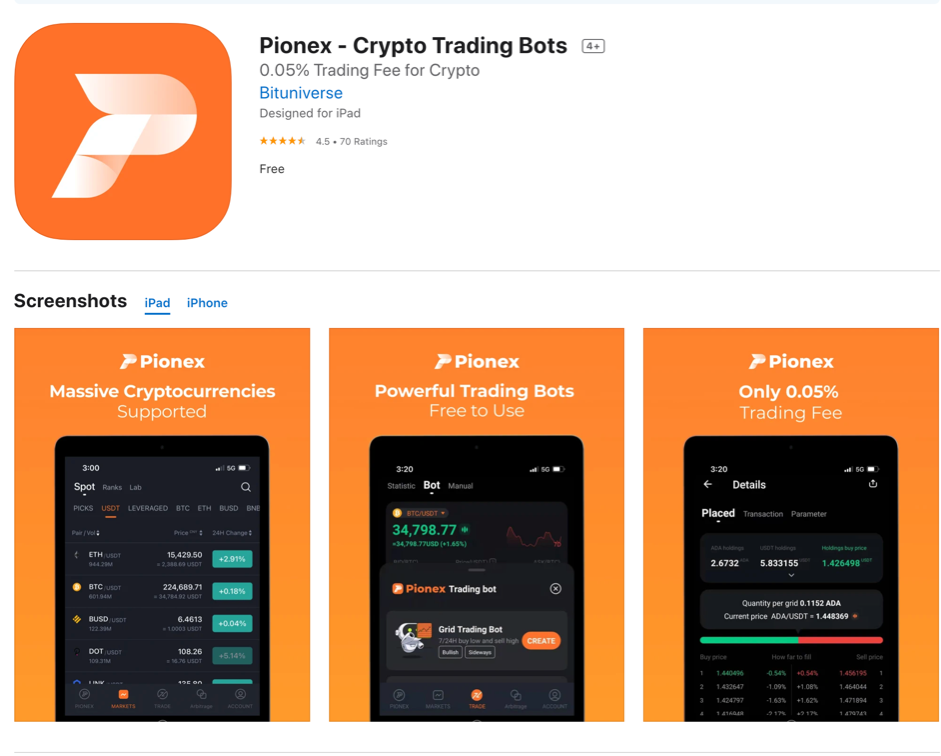

Pionex: The Built-in Arbitrage Trading Bot:

Pionex is one of the most popular options for beginners, with 16 built-in trading bots, including an arbitrage bot that facilitates profiting from price differences between exchanges. Its cheap fees and free-to-use model make it ideal for new traders.

Key features:

- Free-to-use, with low trading fees.

- Simple arbitrage strategies (easy to set up).

- Other common trading options include Grid Trading and Dollar Cost Averaging (DCA).

Bitsgap: The Versatile Arbitrage Bot:

Bitsgap provides a versatile arbitrage bot that supports more than 25 major exchanges. Its user-friendly interface and integrated risk management features make it an excellent choice for beginners.

The bot enables traders to automate their arbitrage strategies and capitalize on real-time opportunities across many markets.

Key features:

- Supports several exchanges, enhancing arbitrage opportunities.

- Integrated portfolio management allows for easy tracking.

- Advanced security with two-factor authentication (2FA) protects your funds.

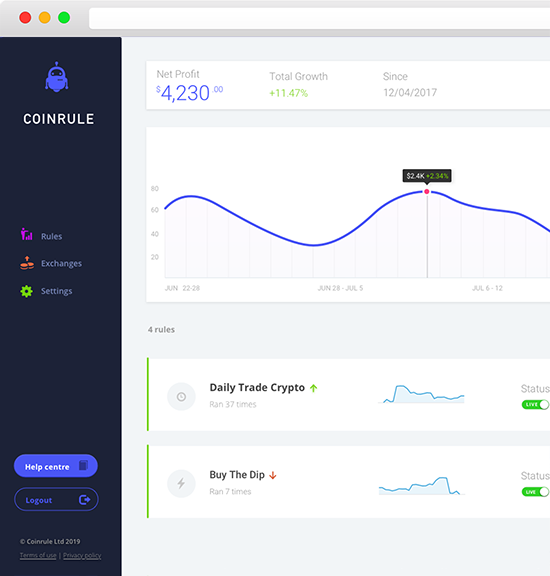

Coinrule: Rule-Based Arbitrage:

Coinrule is a rule-based automation bot that allows users to design custom strategies without requiring coding experience. It enables beginners to execute arbitrage by defining basic criteria like “if-this-then-that” and automates the process across many exchanges.

Key features:

- A simple, easy interface with pre-configured templates for beginners.

- Customizable rule-based trading without the need to code.

- Supports various exchanges, including Binance, Kraken, and Coinbase.

HaasOnline: An Advanced Arbitrage Trading Bot:

HaasOnline is known for providing advanced arbitrage strategies while also catering to beginners. It has significant customization options and back-testing capabilities, allowing users to test strategies before implementing them in real-time markets. This bot works seamlessly with several prominent exchanges.

Key features:

- Highly customizable interface with various arbitrage strategies.

- Provides back-testing to simulate strategies in historical markets.

- Strong emphasis on security, including strong encryption protocols.

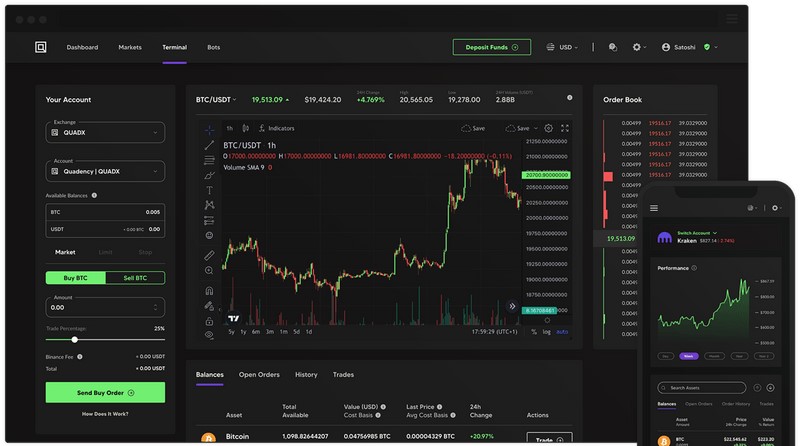

Quadency: The Beginner-Friendly Arbitrage Bot

Quadency is a modern and beginner-friendly platform that offers both manual and automated trading alternatives, including arbitrage.

With pre-configured bots and advanced charting tools, beginners can easily get started in arbitrage while also having access to more advanced tools as they acquire experience.

Key features

- Pre-configured bots for easy setup.

- There is a free plan accessible for beginners.

- Advanced charting and analytical tools enable more educated trading decisions.

Risks Associated with using Crypto Arbitrage Bots:

- Transaction fees:

While bots exploit minor price differences between exchanges, transaction fees can drastically deplete profits. Each trade often has fees, such as withdrawal, deposit, and trading fees, which can offset potential profits, particularly in high-frequency or low-margin trades.

- Latency and Execution Delays:

Crypto markets are extremely volatile, and price differences can disappear in seconds. If a bot’s execution of trades is delayed due to network latency, sluggish transaction confirmations, or exchange unavailability, the price advantage could be lost before the transaction is completed. This could lead to a loss rather than a profit.

- Slippage:

Slippage happens when the price at which an order is executed differs from the expected price. This can occur in volatile markets when the price fluctuates between the time the bot detects an arbitrage opportunity and the time the deal is performed. Slippage can turn a seemingly beneficial arbitrage into a loss.

- Exchange Liquidity:

Not all exchanges have equal liquidity levels. In markets with insufficient liquidity, the bot may struggle to acquire or sell the necessary amount of cryptocurrency without producing substantial price changes. This can lead to lower-than-expected profits or unexecuted trades.

- Market volatility:

While arbitrage usually involves leveraging price differences, severe market volatility can pose a major risk. If the market moves swiftly in an unfavorable direction, the bot may execute deals that result in losses, particularly if the price difference closes before the trade is completed.

- Exchange Withdrawal Limits:

Many exchanges impose daily withdrawal limitations, which may prohibit the bot from properly implementing arbitrage strategies. If the bot reaches these restrictions, it may leave funds stranded on one exchange, preventing additional arbitrage deals until the limit is reset.

- Exchange downtime or issues:

Exchanges can encounter downtime due to maintenance, technical difficulties, or security issues. If the bot relies on an unavailable exchange, it may become trapped in the middle of a trade, potentially resulting in missed chances or losses.

- Security risks:

Using a bot involves providing it access to your trading accounts via API keys, which poses a security risk. If the bot’s or API keys are hacked, your funds could end up stolen. Furthermore, arbitrage bots are vulnerable to phishing attacks or rogue software that manipulates trades to impact the user negatively.

- Regulatory issues:

Some exchanges or jurisdictions may impose regulatory limits on arbitrage trading, especially with cryptocurrency assets. Changes in regulations or exchange policies could have an impact on the profitability and even legality of arbitrage strategies.

- Bot Misconfiguration:

Incorrectly configured bots can cause faulty or unprofitable transactions. If the bot’s parameters (such as trade thresholds and timing) are wrongly specified, the bot may perform transactions that result in losses.

Frequent monitoring is essential to verify that the bot functions properly in changing market conditions.

Concussion

Crypto arbitrage bots are a priceless asset for beginners navigating the complex and fast-paced world of cryptocurrency trading.

By automating the process of discovering and exploiting price differences across several exchanges, these crypto arbitrage bots assist users in simplifying their trading efforts while eliminating emotional decisions and human monitoring.

For new traders, this makes arbitrage a more accessible and less risky way to enter the cryptocurrency market.