Although Biden’s withdrawal from the presidential contest contributed to Bitcoin’s recovery, experts predict the move will increase market turbulence.

Even if it increased market uncertainty, US President Joe Biden’s withdrawal from the presidential race helped the price of Bitcoin to stage a modest recovery.

Biden declared his withdrawal from the US 2024 presidential contest on July 21.

According to Bitstamp data, after the news, Bitcoin BTC$66,977 initially fell but staged an over 1.5% comeback the same day, reaching a daily high of $68,364, representing an over one-month high.

As a result of the uncertainty around Biden’s decision, there was a brief, reflexive decline in the price of Bitcoin, as Bitfinex experts said:

“Bitcoin initially declined 3% following Biden’s announcement but subsequently recovered. This was a knee-jerk reaction to temporary uncertainty in the market. By Monday morning, it had increased by 0.9% over the previous 24 hours, moving past $68,000, which is close to its all-time high of $73,666, reached in March.”

The results of the US election could significantly impact the cryptocurrency market in the biggest economy in the world and regulatory repercussions in other countries.

Because of the uncertainties around future policy changes, the Bitfinex analysts also pointed out that Biden’s withdrawal from the presidential race could be viewed as “neutral to slightly negative in the short term.”

Kamala Harris is a wild card in the crypto industry.

US Vice President Kamala Harris received promises from 2,668 delegates on July 23, surpassing the requisite number of delegates’ support to win the Democratic Party’s presidential candidacy.

However, Bitfinex experts believe Harris’ position on cryptocurrencies could be a wild card for the sector and lead to further governmental scrutiny:

“Harris’s stance on cryptocurrency isn’t well-documented, making it difficult to predict with certainty. However, Harris’s political positions suggest a focus on consumer protection and financial regulation, which might imply continued scrutiny of the crypto market.”

Billionaire businessman Mark Cuban, on the other hand, suggested that Harris would be more receptive to technological advancements and cryptocurrencies than President Joe Biden.

It is expected that investors will take a “wait-and-see” stance. Analyst

Investors in cryptocurrencies will probably take a more cautious stance until Harris clarifies her viewpoints on the subject, according to Bitfinex’s analysts:

“Investors might adopt a wait-and-see approach until Harris’s policies become clearer. The current administration has been relatively cautious regarding crypto, with a focus on regulation. A continuation of this stance under Harris might not be immediately positive for the market.”

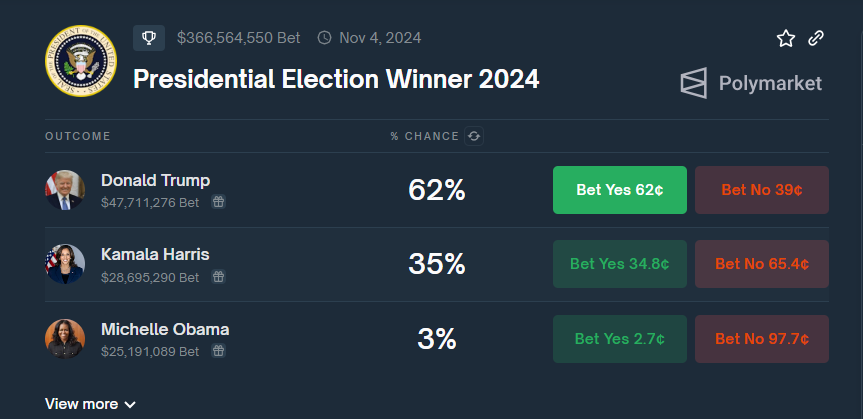

Prediction markets, however, still point to former US President Donald Trump as the front-runner to win.

Just 35% of users on Polymarket have gambled on Harris, compared to almost 62% who have bet on Trump to win the elections in November.