Institutional demand surges in 2024 as Bitcoin and USDT deposits hit record highs on exchanges, led by Binance’s dominance and increased corporate interest.

The year-over-year increase in average Bitcoin and USDT deposits across cryptocurrency exchanges suggests that institutional demand for digital assets has increased.

Larger purchases from corporate and professional investors have caused a substantial rise in average deposits on cryptocurrency exchanges in 2024.

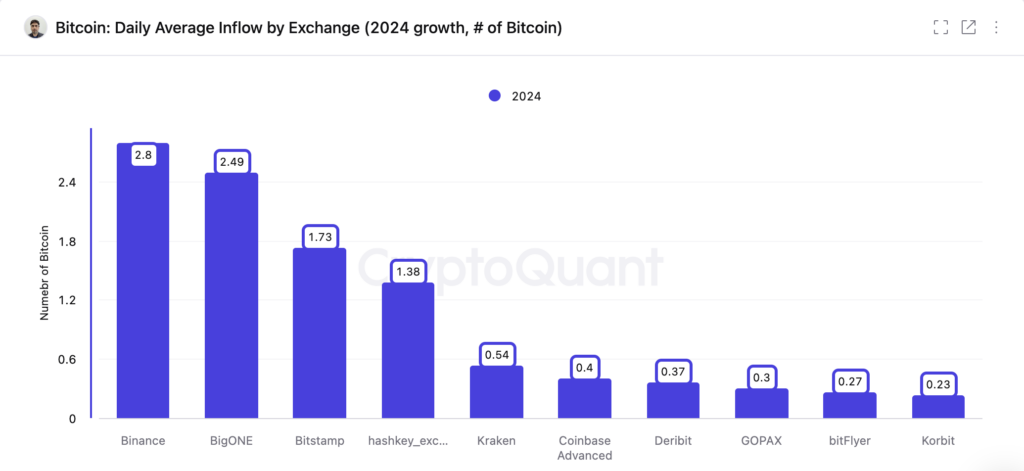

Binance’s average daily Bitcoin BTC$95,219 deposit increased by 2.77 BTC over the year, surpassing rivals Kraken and Coinbase, whose average daily deposits increased by 0.56 BTC and 0.41 BTC, respectively, according to a December 3 report by CryptoQuant.

According to data from several exchanges, average Bitcoin deposits increased from 0.36 BTC in 2023 to 1.65 BTC in 2024, while deposits with the Tether USD 1.00 stablecoin increased from $19,600 to $230,000. These trends suggest that institutional investors and market makers are becoming more involved in exchange inflows.

“Larger USDT exchange deposits are usually made by institutional investors or market makers, just like with Bitcoin,” according to CryptoQuant’s report.

On November 3, Binance broke the previous record with a daily deposit of 6.85 BTC, or $465,000, over ten times more than the previous high. Additionally, the exchange saw its most outstanding daily USDT deposits since March 2022, totaling $303,000.

According to CNBC, Binance CEO Richard Teng claimed in September that the company’s corporate clientele had grown by 40% in 2024.

Elections and ETFs boost crypto popularity.

Donald Trump’s reelection in the US is partly to blame for investors’ improved attitude toward digital assets. His upcoming administration is anticipated to promote more open and advantageous cryptocurrency laws in the nation.

During his campaign, Trump promised to create a strategic US Bitcoin reserve and replace the Securities and Exchange Commission’s leadership. In recent months, new products such as spot Bitcoin exchange-traded funds (ETFs) have encouraged institutional participation in digital assets. As of November, these funds collectively had assets valued at over $30 billion, with inflows totaling over $6.87 billion during the previous 30 days. More than 2.3% of all Bitcoin worldwide is currently under the control of asset management BlackRock. On December 2, the value of its iShares Bitcoin Trust (IBIT) holdings surpassed $500,380, or almost $48 billion at current rates. Related: Can Trump fulfill his lofty pledges about cryptocurrency in the US?