Crypto exchange Binance has officially introduced BFUSD, a reward-bearing margin asset, for futures traders.

The biggest cryptocurrency exchange in the world, Binance, declared on Tuesday that its reward-bearing asset, BFUSD, has officially launched.

With a yield of up to 19.55%, the exchange confirms that users will get returns on qualifying balances in their future accounts from the cryptocurrency asset.

One of the leading cryptocurrency exchanges, Binance, offers users BFUSD as a reward-bearing asset to give them returns on their qualifying amounts in their future accounts.

In the multi-asset scenario, it can also be utilized as a margin and still yield profits.

Introducing High-Yield On Binance Margin Asset For BFUSD

In a formal release on November 26, Binance Futures disclosed the debut of the BFUSD reward-bearing asset. On November 27, users can begin buying the margin asset at 2 AM UTC.

Based on a user’s VIP status, the cryptocurrency exchange has a fixed limit quota for the margin asset. Transfer USDT to the UM wallet to take part.

Only holders who traded UM futures the day before will receive an increase in APY. Users’ UM Futures accounts will get interest payments every day.

With a collateralized percentage of 101.32%, the supply is 120 million.

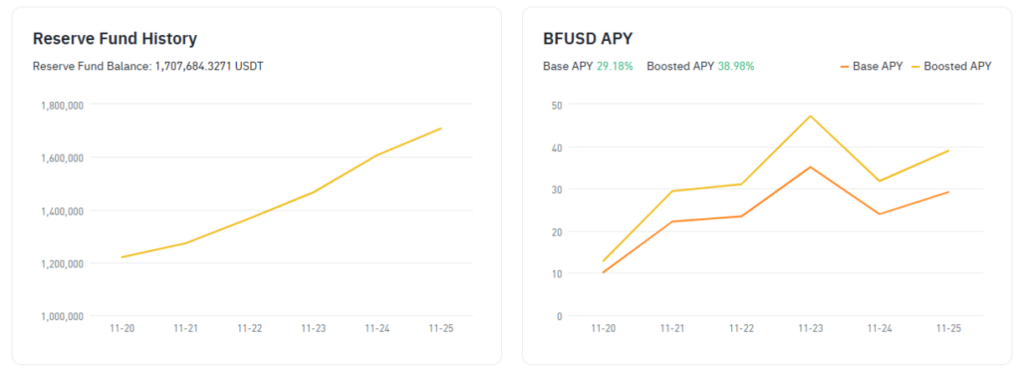

According to Binance statistics, it will provide a basic annual percentage yield (APY) of 29.18% and a boosted APY of 38.98%.

Advantages, Dangers Of Keeping Asset

The USD stablecoin can be exchanged for BFUSD. Because users may exchange it for US dollars, it’s a great option for anyone looking for a reliable cryptocurrency market solution.

Additionally, the exchange has established the BFUSD Reserve Fund expressly to cover possible funding dees expenses, assisting in the upkeep of the Hedging Portfolio and the Collateral Pool.

Using it as a margin to trade USD-M contracts in multi-asset mode is one of the main advantages.

The base rate and the boosted rate are the two reward rates that are offered every day.

The exchange will implement investment techniques that yield passive income using the revenues from BFUSD sales.

Negative funding rates and the absence of any rights, claims, entitlements, or other interests from the reserve fund, hedging portfolio, or collateral pool are some of the dangers associated with owning margin assets.

Users are also subject to viable fees, redemption failure, and Binance credit risk.

CoinGape was previously informed by Binance that BFUSD is not a stablecoin.

An offer for early adopters has also been announced by the exchange. These consist of token vouchers worth $100,000 USDT and no fees at the time of purchase.