The largest cryptocurrency exchange by trade volume, Binance, plans to delist multiple tokens in weeks

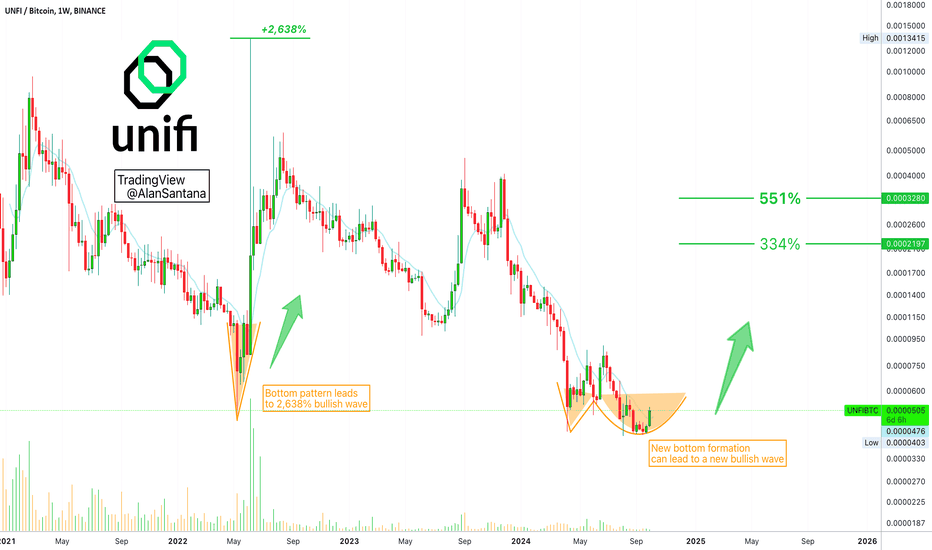

The exchange announced today that Unifi Protocol DAO (UNFI), Ooki Protocol (OOKI), Keep3rV1 (KP3R), and Rupiah Token will be removed.

This follows the company’s regular asset checks to ensure all listed tokens satisfy their high criteria.

Delisting occurs at 03:00 UTC on Nov. 6. UNFI/BTC, OOKI/USDT, KP3R/USDT, and other token trading pairs will stop at that moment.

Binance said they judge project progress, network stability, and regulatory compliance. Their goal is to safeguard users and promote a healthy crypto trading environment.

Users of these tokens should act before deadlines. Binance has set various milestones for margin trading, futures contracts, and other services before spot market trading closes on Nov. 6.

These coins’ isolated margin borrowings will be suspended on Oct. 25, and positions closed on Oct. 31. Users should settle positions and transfer assets to avoid losses.

From Nov. 7, token deposits will not be credited after delisting. However, Binance will accept withdrawals until Feb. 6, 2025. The exchange has mentioned changing delisted tokens into stablecoins, although this is not guaranteed.

It follows a similar trend in the crypto market, where assets delisted from Binance regularly experience price volatility. Binance delistings have caused large price reductions for TrueUSD, Tornado Cash’s TORN, and Monero. Reef Finance showed that coins might rise after Binance delisting.