Binance to face compliance monitoring, and all cryptocurrency exchange activities will be overseen by FRA.

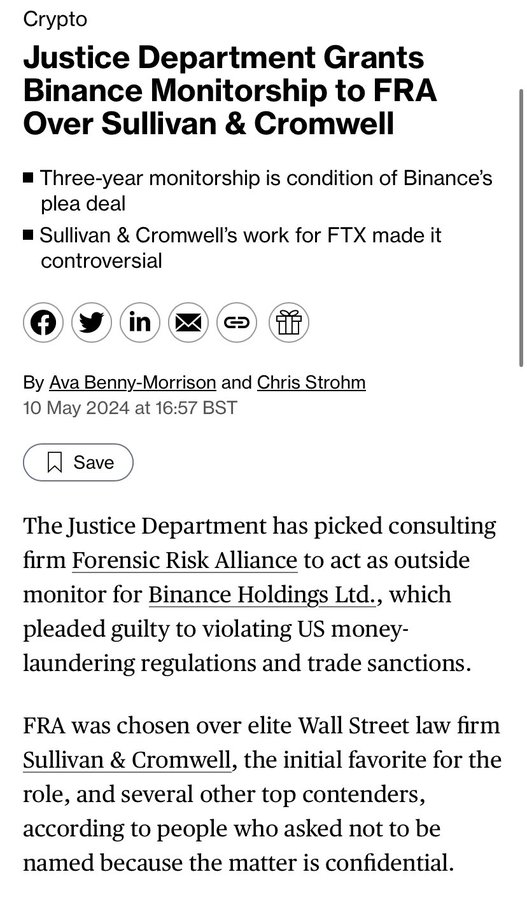

According to sources, the United States Department of Justice (DOJ) has purportedly appointed the international consulting firm Forensic Risk Alliance (FRA) to ensure Binance complies with regulatory requirements over the next three years.

Binance’s plea agreement from November 2023, which admitted to money laundering and additional federal charges and paid a $4.3 billion fine, stipulated that the exchange must designate a third-party firm to oversee its compliance for the following three years.

Bloomberg reported on May 10 that the FRA will have access to internal records, premises, and personnel to update the DOJ on the organization’s activities.

Reportedly, Sullivan and Cromwell were the initial frontrunners of the contract; however, the DOJ ultimately appointed FRA due to the firm’s previous involvement with rival cryptocurrency exchange FTX before its bankruptcy.

Cointelegraph reported on February 17 that Sullivan & Cromwell was actively involved in the “multibillion-dollar fraud” of the FTX Group, as alleged by FTX creditors.

“S&C was cognizant of the misappropriation of Class Members’ funds, omissions, and fraudulent and dishonest behaviour of FTX US and FTX Trading Ltd.,” the creditors claimed in a court filing supporting the class-action lawsuit.

Sullivan & Cromwell is reportedly expected to be selected for a distinct five-year monitoring role for Binance on behalf of the Financial Crimes Enforcement Network of the Treasury Department.

The alleged appointment is made mere weeks after the incarceration of former Binance CEO Changpeng “CZ” Zhao.

Zhao was imposed a four-month prison sentence on April 30 for neglecting to uphold a functional anti-money laundering program at the cryptocurrency exchange.

Judge Jones reduced the initial prison sentence of three years sought by the prosecution to that amount because Zhao was not explicitly informed of particular illicit activities occurring on Binance.