Windtree Therapeutics, a biotechnology firm, has secured up to $520 million in new funding to significantly expand its BNB cryptocurrency treasury.

Windtree Therapeutics has secured as much as $520 million in funding to establish one of the largest corporate BNB treasuries, thereby joining many public companies diversifying their reserves beyond Bitcoin and Ethereum into alternative cryptocurrencies.

In addition to an additional $20 million stock purchase with Build and Build Corp., the biotechnology company executed a $500 million equity line of credit agreement.

First Nasdaq-Listed Company to Target BNB Holdings

Pending stockholder approval to increase authorized shares, ninety-nine percent of the proceeds will be allocated to acquiring BNB cryptocurrency.

Windtree has the potential to become the first Nasdaq-listed company with direct BNB holdings as a result of the funding, which will enable the company to take advantage of the development of Binance’s ecosystem.

According to CEO Jed Latkin, the facilities will facilitate future BNB acquisitions as part of the company’s treasury strategy.

Public corporations increasingly incorporate altcoins, including Ethereum, Solana, XRP, and BNB, into their treasury holdings, indicative of a broader corporate trend away from Bitcoin-only strategies.

The market has responded strongly, with companies that disclose their altcoin holdings experiencing an average stock price increase of 150% in a single day.

The Altseason Index climbed to 51, and BNB reached a new all-time peak of $800, coinciding with Windtree’s announcement.

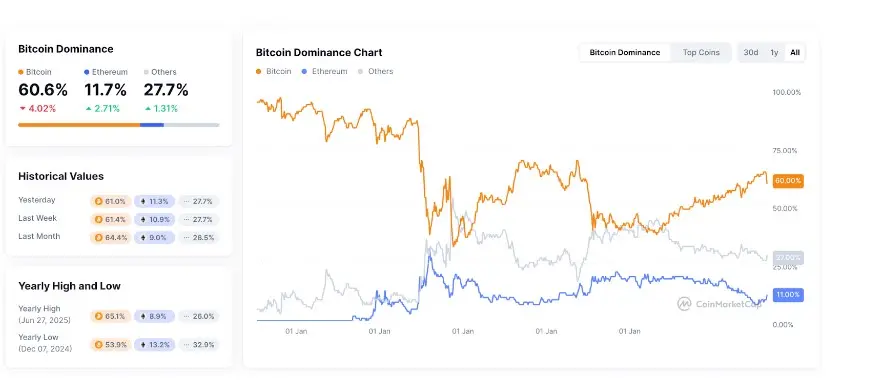

The steepest decline since June 2022 was evident in the 5.8% decline in Bitcoin dominance to under 61% in a single week, historically indicating a shift in capital toward alternative cryptocurrencies.

Corporate Rush to Build BNB Reserves Accelerates

With the acquisition of 74,315 tokens valued at $50 million at an average price of $672.45 per token, Nano Labs became the first significant public company to stockpile BNB at scale.

The Hong Kong-listed company intends to accumulate $1 billion in convertible notes to maintain a 5-10% stake in BNB’s circulating supply.

In June, the company engaged in a $500 million convertible note agreement to facilitate its acquisition of BNB. This transaction increased the company’s total digital asset reserves to $160 million, which includes Bitcoin holdings.

Nano Labs is the 36th-ranked public company in Bitcoin holdings, with over 1,000 BTC.

Similarly, 10X Capital established a BNB Treasury Company, which is supported by YZi Labs. This initiative is an independent U.S. digital asset treasury management initiative exclusively concentrated on investments in the BNB Chain ecosystem.

The organization intends to pursue a public listing on a significant U.S. stock exchange.

Build and Build Corp executives are also pursuing $100 million to acquire BNB through a publicly traded company, per the MicroStrategy model that was first implemented for Bitcoin accumulation.

Patrick Horsman, Joshua Kruger, and Jonathan Pasch, who Coral Capital Holdings previously employed, are the individuals who are spearheading the initiative.

Bhutan’s Gelephu Mindfulness City has also announced the incorporation of BNB in its official strategic reserves, alongside Bitcoin and Ethereum. This marks one of the first jurisdictions to recognize the token in government portfolios formally.

Altseason Momentum Drives Institutional Diversification

Over the past week, Bitcoin’s market capitalization dominance decreased from 63% to below 60%.

This represents one of the most significant weekly declines of the year, as institutional investors demonstrate an increasing interest in alternative cryptocurrencies beyond Bitcoin and Ethereum.

Binance is the leader in altcoin deposit activity, with up to 59,000 daily deposits during market peaks, which is more than double the volume of Coinbase.

The exchange also dominates stablecoin inflows on Ethereum, with 53,000 Ethereum-based stablecoin transactions, as opposed to 42,000 for Coinbase.

SharpLink Gaming’s Ethereum holdings were expanded by the acquisition of 32,892 ETH, which is valued at $115 million. This brings the total number of ETH in the company to 144,501, which is valued at $515 million.

In this regard, the business has surpassed the Ethereum Foundation to become the world’s largest corporate holder of Ethereum.

DeFi Development Corp acquired $2.7 million of Solana, while BIT Mining announced plans to raise $200-300 million to establish a Solana treasury.

Sol Strategies, a Canadian company, has filed to list on Nasdaq under the ticker “STKE” and currently possesses more than 420,000 SOL tokens.

It is worth noting that the total cryptocurrency market capitalization increased from $3 trillion to $3.8 trillion within three weeks, with Ethereum experiencing a 110% increase during the same 90-day period.

As capital transitions to alternative assets, meme coins such as BONK, PENGU, and FLOKI generate triple-digit returns.