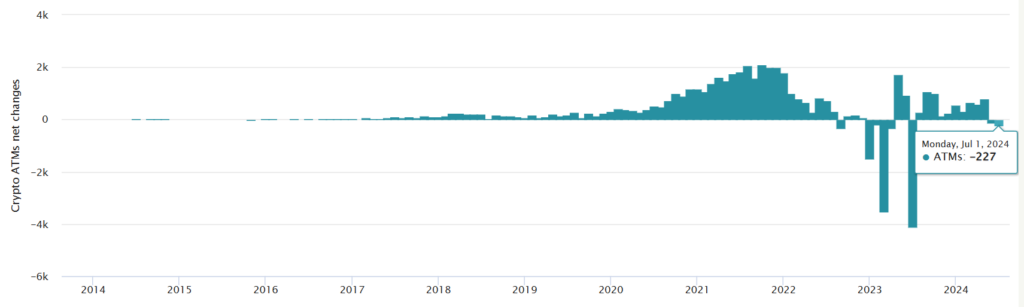

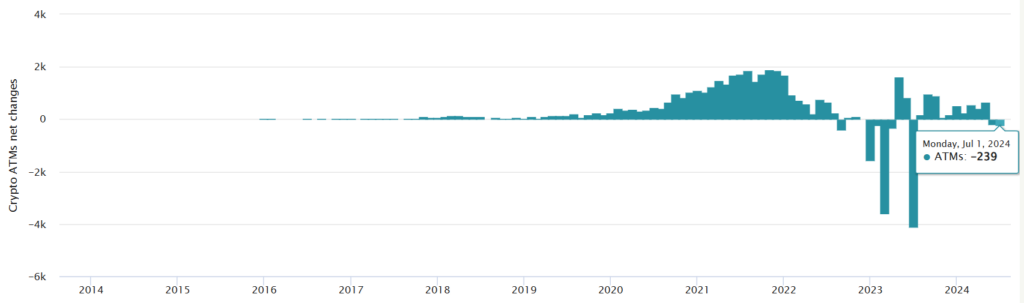

In less than 40 days, the number of Bitcoin ATMs worldwide drops by 334, with the US and Europe experiencing the most significant declines.

In less than 40 days, 334 BTC ATMs were removed from the global network of operational BTC ATMs, coinciding with the drop in Bitcoin values.

The 107 BTC $55,210 ATMs that went down in June stopped the 10-month trend of monthly rises in net installation. In July, there was another catalyst for the decline. As of July 5, 227 cryptocurrency ATMs had been taken down from the global network in less than five days.

The United States and Europe are major players in the global decline of BTC ATMs, even as nations like Australia and Spain are adding more of them. The United States, home to about 82.6% of all Bitcoin and cryptocurrency ATMs worldwide, lost 182 ATMs in June and 239 ATMs in just the first week of July.

Europe now has 1,589 cryptocurrency ATMs after losing 29 ATMs in July. However, Australia brought 77 more Bitcoin ATMs into the world’s network.

The continuous decrease in cryptocurrency ATMs may be related to an international government campaign to reduce financial crimes. Authorities have investigated Bitcoin ATM operators’ involvement in cryptocurrency frauds, including the US Secret Service’s Cyber Fraud and Money Laundering Task Force.

The largest American ATM company, BTC Depot, found no connection between the value of cryptocurrencies and their earnings.

Even with the volatility of BTC values, the company’s sales in 2023 and 2022 ($689 million and $647 million, respectively) have not been linked to the cryptocurrency’s price.

For instance, the company said Bitcoin Depot’s year-over-year sales growth was only 6%, even though Bitcoin increased in value by 155% in 2023. The ATM operator claims that part of the reason for the lack of relationship between Bitcoin Depot’s earnings and the price of BTC is the type of services offered.

According to its own user surveys, Bitcoin Depot stated that most of its consumers utilize its products and services for non-speculative uses, including online shopping, international money transfers, and money transfers.