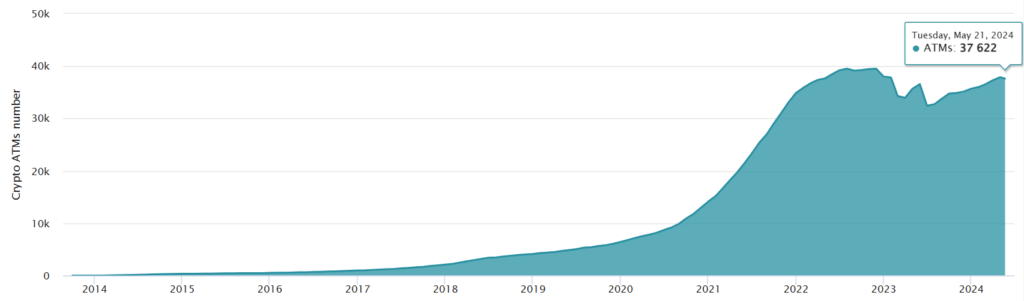

Bitcoin ATMs experienced a decline globally for the first time since July 2023 as the United States shut down.

After a period of inactivity since July 2023, the global count of operational Bitcoin ATMs has declined.

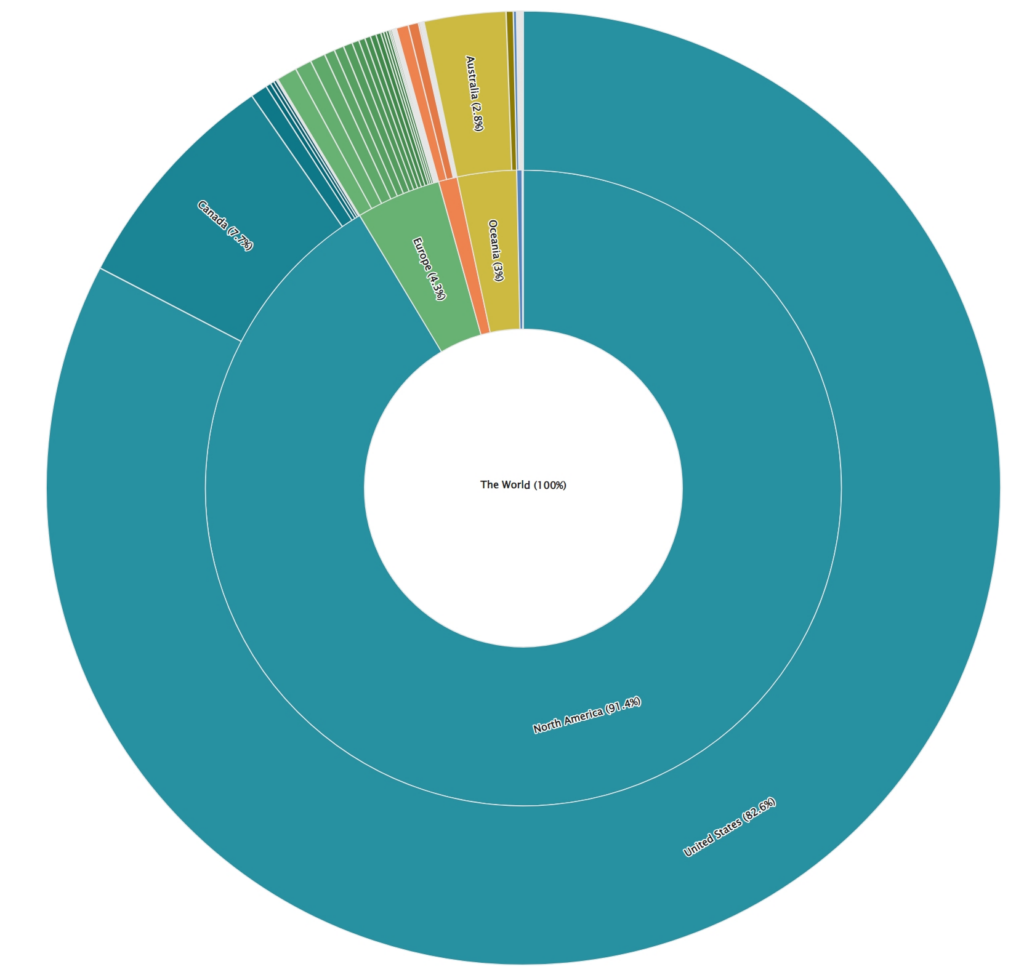

The Bitcoin BTC tickers down $70,921 network is dominated by the United States and Canada, which collectively house 31,089 (82.6%) and 2,909 (7.7%) machines, or 91.4% of the total.

The monthly growth of Bitcoin ATMs in 2024 was substantially influenced by the contributions of countries across the globe, nearly recouping the 38,000 mark that was lost in January 2023.

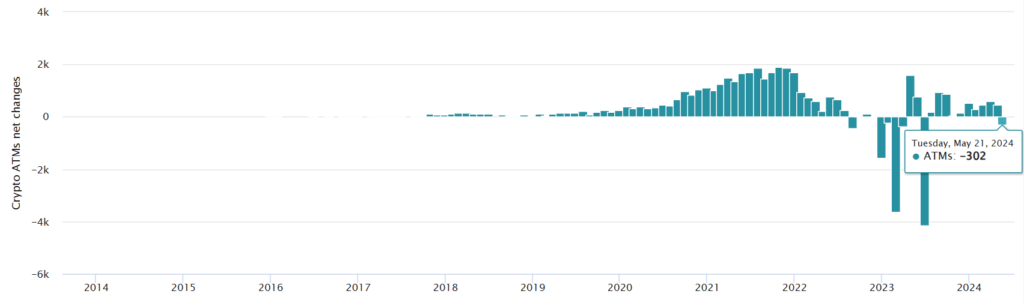

In contrast, the 10-month-long expansion of cryptocurrency ATMs worldwide ceased in May 2024, when more than 300 ATMs ceased operations. The U.S. market lost 302 Bitcoin ATMs for the month as of May 21, whereas Canada lost 28 machines.

With the addition of 280 Bitcoin ATMs in Europe, Switzerland, and Australia, the net decline in cryptocurrency ATMs has been mitigated.

Bitcoin ATMs commonly utilized for extortion and fraud are actively pursued and shut down by law enforcement agencies in the United States. Nevertheless, the precise causes for the recent precipitous decrease in their population remain enigmatic.

With 1,041 (2.8%) machines, Australia has the third-largest network of active Bitcoin ATMs, following the United States and Canada.

Consult the crypto guide by Cointelegraph for more information on Bitcoin ATMs.

Bitcoin Depot, the largest ATM operator in the United States, maintained consistent earnings in 2024. Historical analysis revealed no correlation between the firm’s revenues and the price of Bitcoin, according to its 10-K annual report, which was filed on April 15.

Bitcoin Depot wrote, “According to our user surveys, most of our users utilize our products and services for non-speculative purposes, such as online purchases, money transfers, and international remittances, among others.”

As per the ATM operator, a portion of the absence of correlation between Bitcoin Depot’s revenues and the BTC price can be attributed to the distinctive characteristics of the services rendered.