Veteran trader Peter Brandt claims that the decrease in Bitcoin since April 2024 halving is beginning to resemble market patterns preceding the 2016 bull run.

Bitcoin saw a comparable drop after the 2016 halving and before the 2017 bull run.

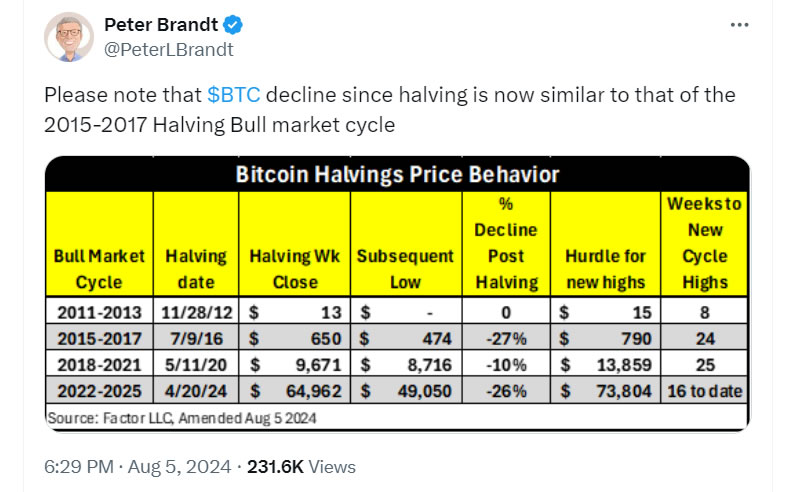

The analyst said that the “BTC decline since halving is now similar to that of the 2015-2017 halving bull market cycle” in a post on X on August 5.

Brandt noted striking similarities in the magnitude of the market corrections since the halving dates.

On July 9, 2016, the price of Bitcoin was $650, and the cryptocurrency was halved to $55,750. A month after a 27% post-halving dip, the markets fell during that cycle to a low of $474 before surging to a cycle high of $20,000 in December 2017.

Similarly, the current collapse of Bitcoin below $50,000 now signifies a 26% drop from $64,962 following the split.

Nonetheless, several analysts caution that Bitcoin may decline.

Bitcoin prices dropped by double digits to $49,221, as CoinGecko reported on August 5.

Although it has dropped 20% after hitting $70,000 in late July, it has already begun to show signs of life, regaining $56,000 in early Asian trading on August 6.

Benjamin Cowen, the founder of ITC Crypto, stated in a post on X on August 5 that the pattern had resembled that of 2019, in which markets saw a massive reversal in the second half of the year after experiencing a boom in the first.

In a statement, Tim Kravchunovsky, the founder and CEO of the decentralized telecom network Chirp, stated that cryptocurrency assets can recover far faster than risky assets, as they did in 2020.

He stated that “macroeconomic factors are in the driving seat” and that the significant selloff was not a crypto-specific problem.

“Over the coming hours and days, we may well see a decoupling of crypto from traditional stocks, similar to what we saw in 2020.”

He continued, “We may well see something similar this time. Back then, crypto staged a much faster and more pronounced recovery from the pandemic-driven collapse than traditional stock markets.“