By 2025, Bitcoin could draw $2 trillion in investments as the global money supply expands to $127 trillion.

Bitcoin may garner an additional $2 trillion in investment during 2025, as a result of the anticipated continuation of liquidity injections in the world’s largest economy.

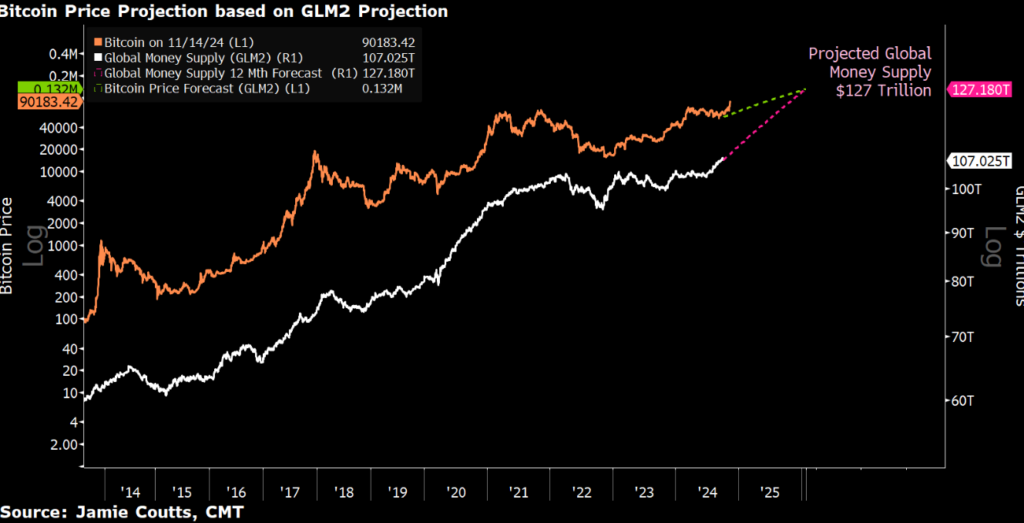

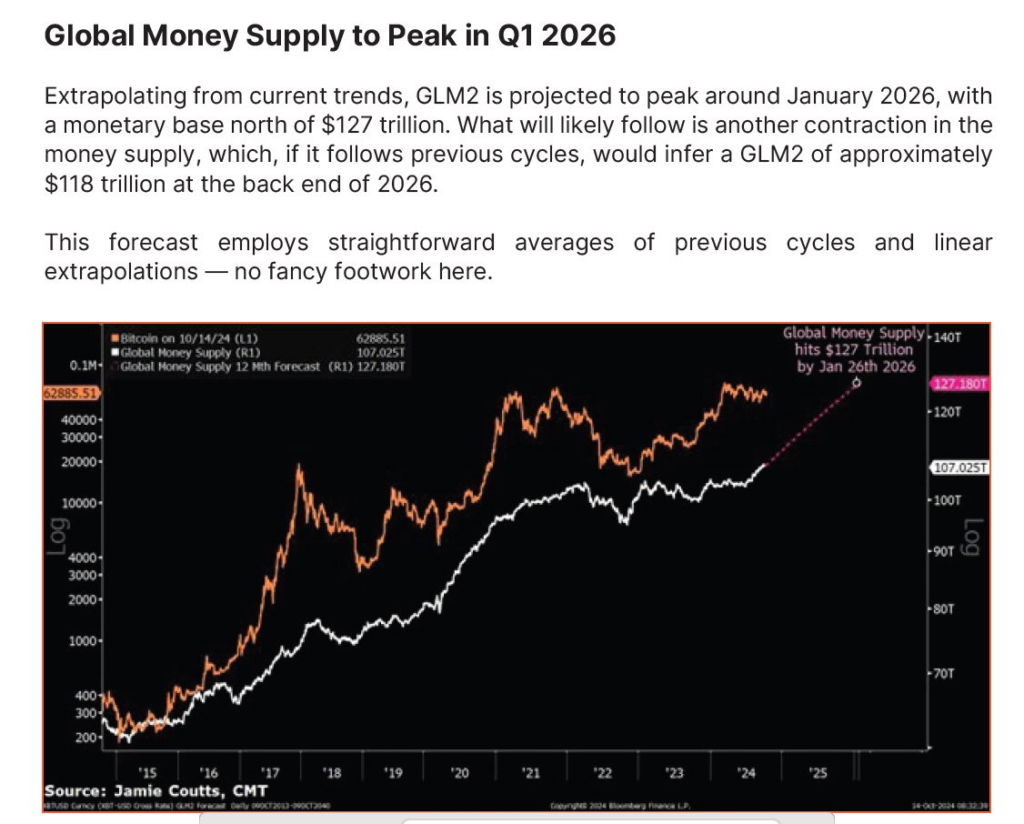

Jamie Coutts, principal crypto analyst at Real Vision, shared that the US Federal Reserve is projected to increase the global money supply to over $127 trillion during 2025, up from the current $107 trillion, due to liquidity concerns. This represents a potential 18% increase.

The $20 trillion liquidity injection has the potential to serve as a substantial catalyst for Bitcoin’s price in 2025, potentially attracting an additional $2 trillion in investment into the world’s first cryptocurrency.

Coutts wrote in a Nov. 28 X post that the $2 trillion may flow into BTC based on historical data, which saw BTC garner approximately 10% of the newly created money supply.

“Global M2 bottomed at $94T in Q4 2022 and has since climbed to $105T. During this period, Bitcoin’s market cap 5x’ed, adding $1.5T. In other words, 10% of the new money supply has leaked from the fiat system into the emerging global reserve asset of Bitcoin…”

The global M2 money supply, which is an estimate of all cash and short-term bank deposits across the United States, is expected to reach its zenith on January 26, 2026, according to Coutts’ predictions.

With M2 Money Supply Expanding, Will Bitcoin Reach $150k?

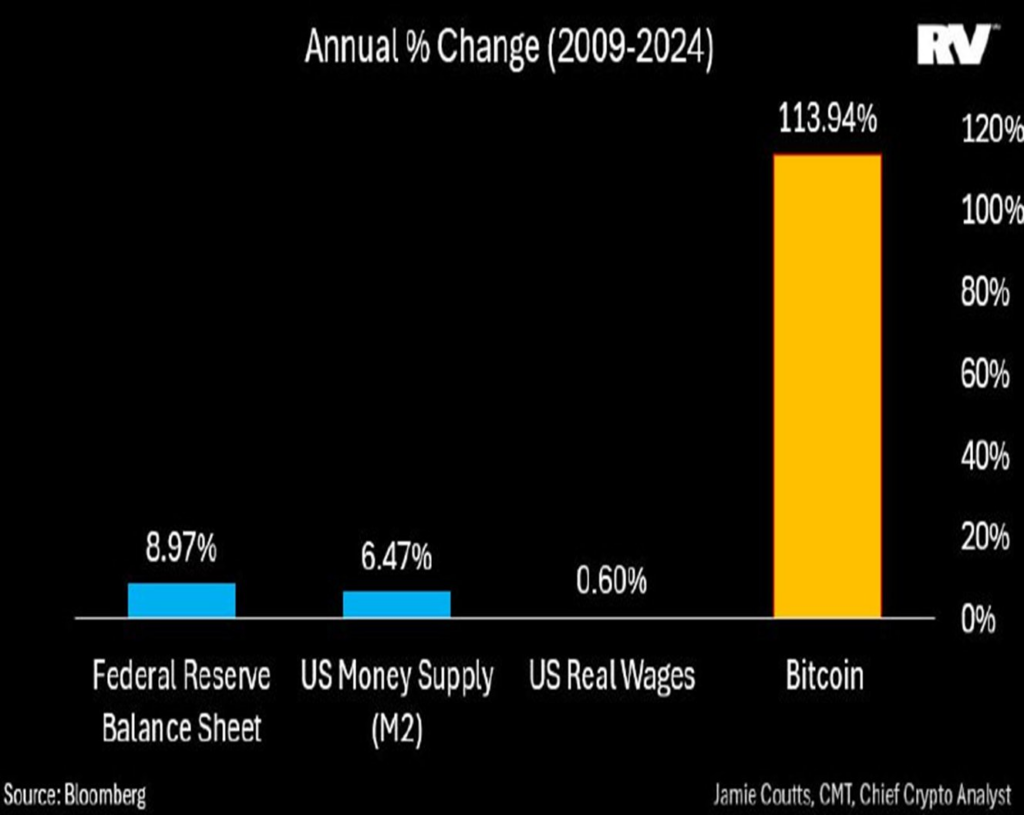

According to Coutts, the institutional adoption of BTC may be bolstered by the increasing monetary debasement, as Bitcoin has been outperforming traditional investment vehicles with an annual return of over 113%.

The Bitcoin 2025 rally is anticipated to be fueled by the potential weakness in the US dollar and the expanding money supply, which could result in a rise in BTC to as high as $150,000.

Ryan Lee, chief analyst at Bitget Research, has informed Cointelegraph that BTC may reach the peak of this bull cycle within the next six to nine months, based on the current market sentiment and technical patterns.

“This projection places a potential peak between late 2024 and mid-2025. Price target predictions vary significantly, but some analysts have mentioned the possibility of Bitcoin reaching $118,928 or even climbing as high as $130,000 to $150,000 by late 2025.”

This is perceived by some as a conservative assessment of Bitcoin’s potential.

VanEck, a prominent asset management company, anticipated that the price of BTC would exceed $180,000 within the next 18 months.

This prediction was influenced by the increasing market optimism that resulted from Trump’s presidential victory.

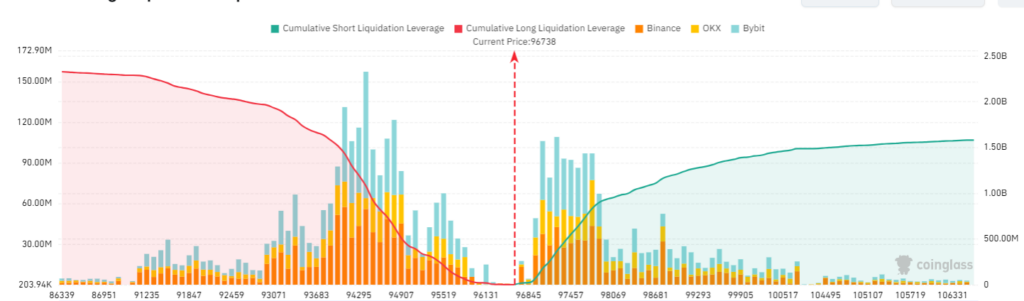

In the immediate term, Bitcoin encounters substantial resistance above $98,300.

According to CoinGlass data, a potential rise above would result in the liquidation of over $1.04 billion in cumulative leveraged short positions across all exchanges.