Ahead of the November U.S. election, institutional experts, including Bernstein, have issued bullish Bitcoin projections, highlighting market optimism.

As the cryptocurrency enters “a new institutional era,” the price of BTC, currently at $65,647, might reach $200,000 by the end of 2025, according to a report released by Bernstein Research on October 22.

In a post on the X platform on October 23, Matthew Sigel, head of digital asset analysis at VanEck, stated that Bernstein’s 160-page “Black Book” argues why Bitcoin miners will keep uniting the sector.

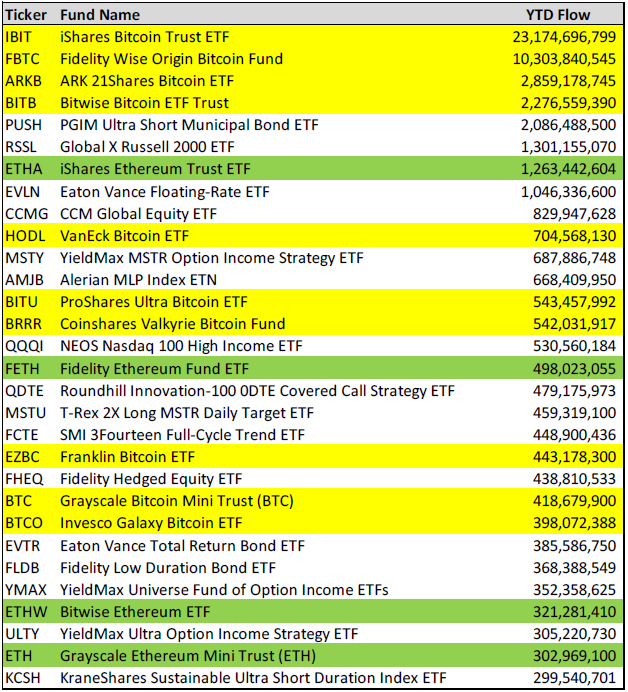

The research states that ten international asset managers already hold around $60 billion in regulated exchange-traded funds, up from $12 billion in September 2022.

Bernstein predicted that Wall Street would overtake Satoshi as the most-used BTC wallet by the end of 2024.

According to a post on the X platform by investment adviser Nate Geraci, president of The ETF Store, Bitcoin has dominated the ETF scene this year and is included in six of the top 10 most successful launches in 2024.

Ahead of the US presidential election in November, institutional analysts like Paul Tudor Jones, a seasoned hedge fund manager, JP Morgan, and Bernstein are growing more optimistic about Bitcoin.

According to a report by JPMorgan on October 3, investors are turning to gold and BTC in a “debasement trade” as they prepare for a “catastrophic scenario” due to escalating global tensions.

The analysis, which JPMorgan shared, states that “[R]ising geopolitical tensions and the coming [United States] election are likely to reinforce the ‘debasement trade’ thus favoring both gold and Bitcoin.”

According to JPMorgan, “structurally higher geopolitical uncertainty since 2022, persistent high uncertainty about the longer-term inflation backdrop, to concerns about […] persistently high government deficits across major economies” are some of the factors contributing to the so-called debasement trade, which is a spike in demand for gold.

Following the US presidential election, Jones, the founder of the hedge fund Tudor Investment Corporation, stated on October 22 that he desired Bitcoin and other commodities since “all roads lead to inflation.”

On CNBC’s Squawk Box, Jones stated, “I would own zero fixed income and probably have a basket of gold, Bitcoin, commodities, and Nasdaq [technology stocks].”

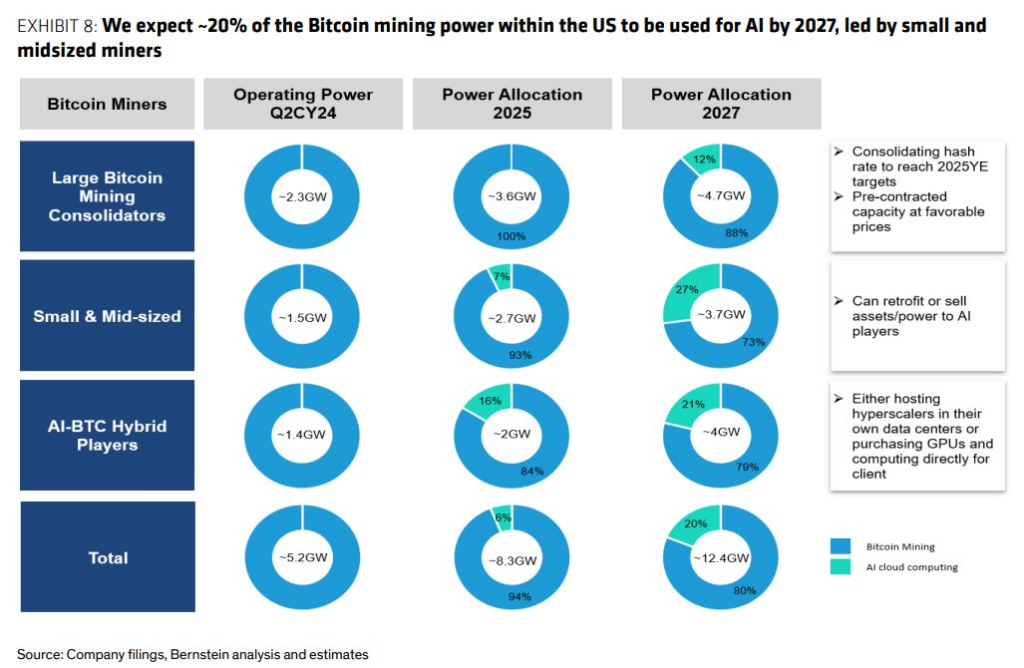

As the sector consolidates and capitalizes on artificial intelligence’s energy consumption, Bitcoin miners are expected to bounce back from a post-halving depression in mid-2024, according to Bernstein.

Bernstein stated, “We anticipate Riot, ClearSpark, and Marathon to consolidate the Bitcoin mining industry.”

Mining incentives were lowered from 6.25 BTC to 3.125 BTC per block during the April “halving” event on the Bitcoin network.

In the meantime, there is a growing need for computing power driven by AI.

According to reports, Nick Hansen, CEO of the mining company Luxor, said miners might make $2 to $3 using AI for every kilowatt-hour (kwH) of energy used instead of $0.15 to $0.20 from mining Bitcoin.

Several Bitcoin miners are using AI as a supplemental source of income, including Core Scientific, Hive Digital Technologies (HIVE), and Hut 8 (HUT).