Bitcoin developers defend the role of venture capital in accelerating layer-2 network growth, highlighting its importance in scaling Bitcoin’s ecosystem.

At Token 2049, Bitlayer’s CEO defended VC funding in Bitcoin, arguing that their investment and connections spur protocol and service development.

Despite opposition from some community members, venture capital firms are still essential to creating infrastructure in the Bitcoin ecosystem, according to builders who spoke at the Token2049 conference in Dubai.

The CEO of Bitlayer, a Bitcoin layer-2 protocol, Charlie Yechuan Hu, offered his thoughts on venture capital (VC) companies operating within the Bitcoin BTC$103,033 ecosystem.

Hu said that he has a favorable opinion of many venture capital organizations in the industry since they fund start-ups requiring infrastructure development.

“You must open up the entire ecosystem foundation; you need developers and other resources,” Hu stated. “Cloud services like AWS or RPCs, servers, etc., require payment.” Therefore, VC is required for that.

“It’s difficult to say, okay, let’s do a fair mint and then have a very successful, healthy treasury, and you have to pay all this stuff,” Hu said, challenging the typical Bitcoiner mindset that opposes outside funding.

“That’s not how it works,” he stated.

Lightning-only stance provokes discussion.

Not everybody agrees. Lightning is the only L2 that his company has invested in and is considering, Mike Jarmuz, a managing partner at Bitcoin venture capital firm Lightning Ventures, told Cointelegraph.

“You should avoid anything with a ‘token’ that allows you to ‘take’ and earn some ridiculous APY interest on your Bitcoin.”

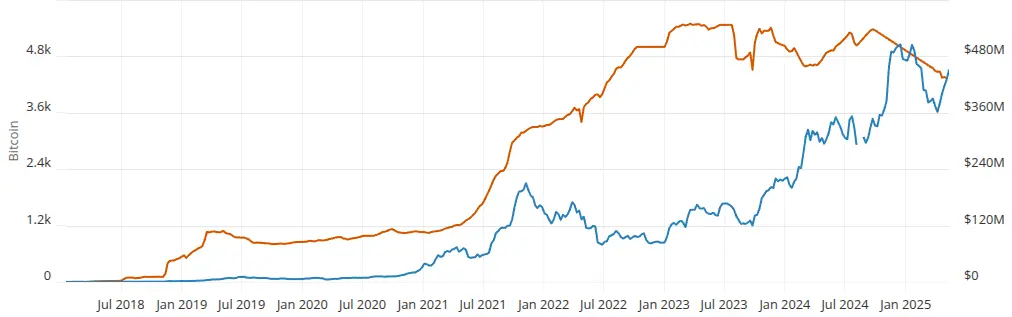

On the other hand, according to Jarmuz, Lightning Network is expanding rapidly and enables instantaneous, almost free, and scalable Bitcoin transactions. According to data from Bitcoin Visuals, the Lightning Network’s total capacity across all channels is close to $452 million as of this writing. He added:

“There is no ‘token’ when using the Lightning Network. It’s Bitcoin. That to me is the only real L2, at least as of right now.“

Projects that don’t fit his requirements, according to Jarmuz, are “masquerading as useful” while contributing nothing to Bitcoin. Although they “are not widely used,” he asserted that sidechains like the Liquid Network and more recent protocols like e-cash, federations, or Ark “are at least interesting.”

“Similar projects do not involve a staked token; they promise yield,” he acknowledged, while projects with similar characteristics are “just waiting for rug pulls and issues.”

He went on, “We don’t invest in that area.”

Venture Capital’s are considered boosters of Bitcoin growth.

Hu claims that VCs open “up all the institutional ideas and connections” and provide young firms with resources, experience, and liquidity. “We wouldn’t have that if those people didn’t invest in us,” he added, adding that there were significant increases to Bitlayer’s resources as well.

Additionally, he contended that venture capitalists typically support long-term infrastructure initiatives instead of speculative ventures like memecoins or non-fungible currencies.

Walter Maffione, lead engineer of Kaleidoswap, a decentralized exchange (DEX) based on the Lightning Network, repeated that experience when he told Cointelegraph that the protocol began as an open-source project and received a pre-seed investment from Bitfinex Ventures and Fulgur Ventures.

“Those funds were not used to create a token or seize governance rights, but rather to compensate open-source developers and speed up protocol development,” he stated”

According to Hu, VCs have substantially contributed to the development of wallets, layer-2 scalability solutions, Bitcoin lending, and staking protocols. He went on to say:

“All of them are VC-backed, including us. Some of them have listings on leading exchanges.

When choosing which Bitcoin layer-2 protocols to invest in, Vikash Singh, principal at Bitcoin venture capital firm Stillmark, said that they consider the application layer’s expansion, the proliferation and adoption of non-speculative use cases, and proven security and resilience. He stated that Stillmark, like Jarmuz, thinks proof-of-work is the best consensus model.

However, Singh stated that Byzantine fault-tolerant consensus or proof-of-stake “may be suitable for Bitcoin sidechains and rollups,” in contrast to Jarmuz.