Bitcoin experienced a significant decline earlier today, momentarily falling below $67,000 to a low of approximately $66,800; this represents a 3% decrease in the past 24 hours

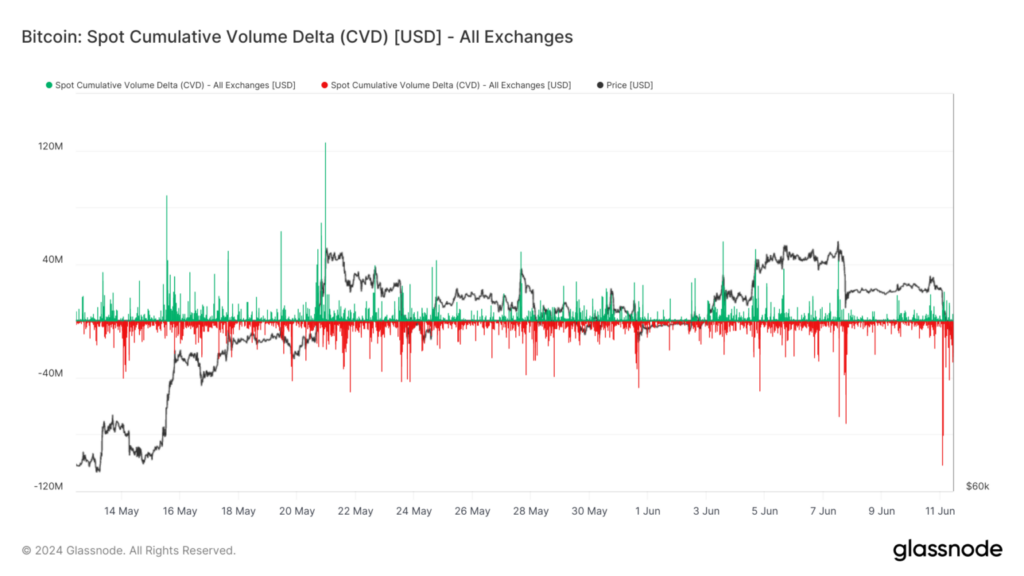

Significant spot-selling activity contributed approximately $200 million in selling across all exchanges, as indicated by Glassnode data. Binance was the source of the preponderance of this selling activity. This activity is quantified by the Spot Cumulative Volume Delta (CVD), which monitors the net disparity between purchasing and selling volumes, thereby highlighting the market’s primary drivers—buyers or sellers.

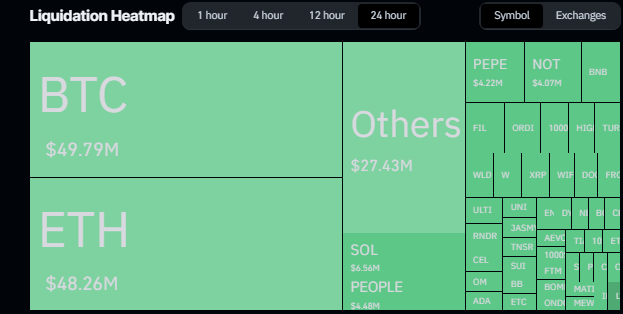

Substantial liquidations have been the consequence of the elevated selling pressure. Coinglass data indicated that $185 million in liquidations occurred within 24 hours, with $160 million originating from long positions. During this period, both Bitcoin and Ethereum experienced substantial liquidation impacts, with each experiencing approximately $50 million in total liquidations.