Bitcoin drops to $112,200 despite the US-EU 15% tariff trade deal, as investors favor stocks, and gold falls 2.8%.

Bitcoin is experiencing a downtrend today, forfeiting all the gains it achieved yesterday. Despite the U.S. and E.U. disclosing the specifics of their trade agreement regarding the Trump tariffs, this price decline has occurred.

Despite a deal between the United States and the European Union, Bitcoin has plummeted below $113,000

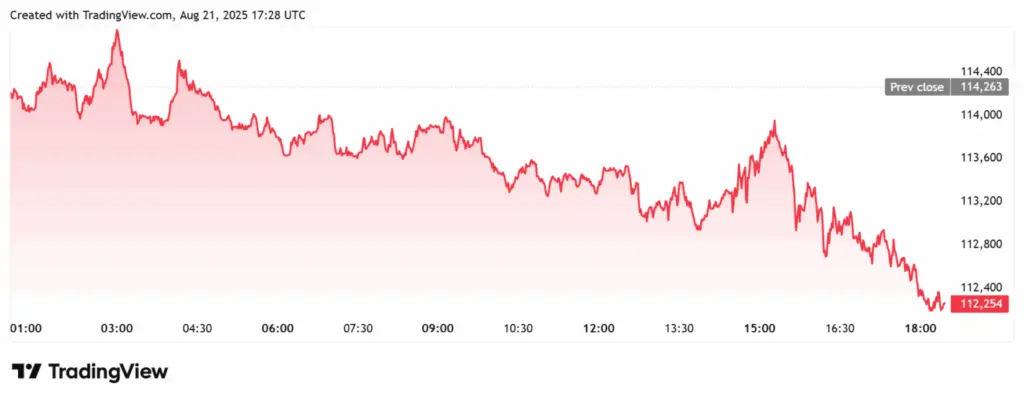

TradingView data indicates that the flagship cryptocurrency has declined below the psychological threshold of $113,000. The price of Bitcoin (BTC) has dropped from an intraday peak of approximately $114,800 to roughly $112,200.

Despite the U.S. and the E.U.’s joint statement on the trade agreement regarding Trump tariffs, this Bitcoin price decline has occurred. The statement indicates that the United States will now impose a 15% tariff on goods from the European Union, as opposed to the 30% tariff that Trump had initially implemented.

Nevertheless, this tariff would not apply to U.S. cars and other industrial products imported from the region. Furthermore, the tariff does not apply to aircraft, aircraft parts, generic pharmaceuticals, or pharmaceutical ingredients imported from the European Union to the United States.

On July 27, a tariff agreement was reached between the United States and the European Union. At that time, neither party had executed a contract, which was the subject of the most recent discussion. The news had probably already been factored in since Bitcoin and the broader crypto market experienced a rally at that time.

U.S. Commerce Secretary Howard Lutnick stated that the Framework Agreement on Reciprocal, Fair, and Balanced Trade has been finalized in his commentary on the agreement. He also mentioned that the European Union has consented to opening its $20 trillion market.

Possible Reasons For The BTC Decline

The decreasing likelihood of a 25-basis-point (bps) Federal Reserve rate cut in September is likely to be the reason for the decline in the Bitcoin price and the broader crypto market. From as high as 99% to 71%, the likelihood of an incision has decreased.

The market had already begun to anticipate the possibility of the initial rate cut of the year. An increase in risk-on sentiment and the potential for increased liquidity in these assets are characteristics of a cut generally beneficial for crypto prices.

In the interim, Bitcoin is also experiencing a decline due to the substantial outflows that the BTC ETFs are presently experiencing. As previously mentioned, these funds have experienced net outflows for four consecutive days, resulting in nearly $1 billion being withdrawn from these ETFs.

Due to these outflows, the BTC ETF issuers have had to remove some coins from their respective funds. BlackRock sold just over $111 million BTC today following the $220 million outflows that its ETF recorded yesterday.