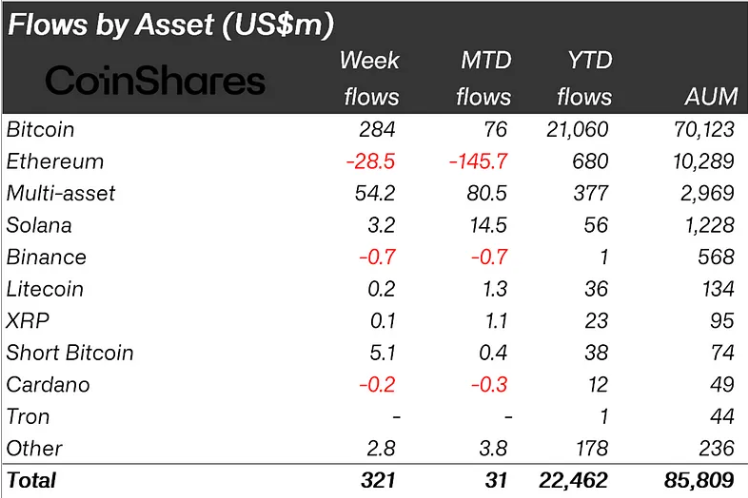

According to CoinShares, inflows into Bitcoin and digital asset investment products reached $321M last week, marking the second consecutive week of inflows.

The US Federal Reserve’s decision to decrease interest rates has resulted in significant inflows into cryptocurrency investment products, according to CoinShares, a cryptocurrency investment firm.

During September 15–21, digital asset investment products recorded inflows for the second consecutive week, totaling $321 million. The new weekly inflows are just less than the $436 million from the previous week.

The Federal Open Market Committee’s (FOMC) decision to lower interest rates by 50 basis points (bp) is likely what caused the rise, according to CoinShares’ most recent weekly report on digital asset movements, published on September 23.

Products for Ethereum versus Bitcoin: inflows of $284 million and outflows of $29 million, respectively

With $284 million in inflows last week, investment products based on Bitcoin BTC$63,497 were the main focus, according to CoinShares. According to the research, increased inflows of $5.1 million into short-Bitcoin investment products were prompted by recent swings in the price of BTC.

However, Ethereum continued to be an “outlier,” according to CoinShares, as investments based on Ether ETH$2,649 witnessed withdrawals for a fifth week, amounting to $29 million last week.

The Greyscale Ethereum Trust (ETHE) was the source of the recurring ETH outflows, according to CoinShares’ study, and the newly issued exchange-traded funds did not provide enough inflows.

CoinShares also said weekly inflows into Solana SOL$144 investment packages were modest but steady, totaling $3.2 million last week.

Market effects of a 50 basis point rate drop

On September 18, the US Federal Reserve formally announced the Board of Governors’ decision to approve a 50 basis point cut in a FOMC statement. With this action, the US lowered borrowing prices for the first time since the Fed lowered interest rates in March 2020 in response to the COVID-19 pandemic.

The reduction in interest rates, according to CoinShares, has spurred a bull run in the cryptocurrency markets, with total assets under management rising by 9%. The company reported that total investment product volumes increased by 9% over the previous week to $9.5 billion.

Despite the 50 bps drop, Bitcoin investment products witnessed a favorable trend, contrary to what several analysts had earlier expected.

In a joint analysis released September 18, Bybit and BlockScholes stated that “historical data suggest that BTC and other risk-on assets showed resilience during non-recessionary rate cut cycles.” The experts also mentioned:

“However, aggressive rate cuts during recessionary periods typically result in negative market outcomes […] These developments have the derivatives market on its toes, with notable volatility premiums assigned to BTC options expiring in late 2024 and early 2025.”

Arthur Hayes, co-founder of BitMEX, blasted the US central bank for lowering interest rates in the face of rising government spending and US currency supply, predicting that markets would crash immediately following the Fed’s announcement.

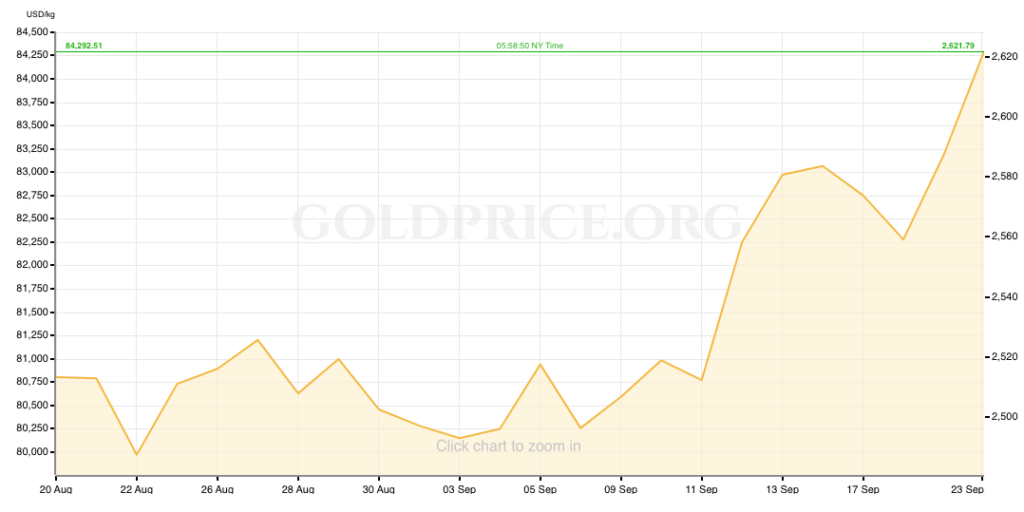

Investors have also been purchasing gold more frequently since the rate cuts, and the metal’s price has steadily risen to all-time highs.

The price of spot gold increased by more than 5% over the previous two weeks, reaching a new high of $2,629 per ounce on September 23.

The CEO and asset manager of DHF Capital, Bas Kooijman, believes that the 50 bps rate decrease may contribute to the continuation of the gold price upswing, which might establish new records in the presence of other bolstering factors.

“The decision could fuel appetite for assets like gold and others and acts as a start to the interest rate cut cycle that markets have been waiting for,” Kooijman said. The extent of the incision “also opens the way for more aggressive actions in the coming months,” he added. He continued, saying:

“In this regard, the Federal Reserve’s dot plot shows a steeper decline in interest rates than previously forecast by the central bank. This trajectory could further cement gains in gold prices.”