Bitcoin is officially in the accumulation phase as traders anticipate a quick price breakout. Would this enable the price of Bitcoin to rise above $66,000?

By September, bitcoin might rise above $66,000 but will encounter strong resistance at $61,700.

Long-term Bitcoin holders are once again building up.

Famous analyst On-Chain College says that the long-term holder accumulation rate of (BTC$57,942) has hit a 15-month high. In an X post from August 15 August 15, he wrote:

“#Bitcoin Long-Term Holders are back to accumulating at levels that we haven’t seen since May 2023.”

In an August 15 August 15 X post, Glassnode stated that during the past month, BTC holders have returned to accumulating:

“The Accumulation Trend Score indicates a market shift back to accumulation, with the ATS reaching its maximum value of 1.0, signaling significant accumulation over the past month.”

A heatmap called the Accumulation Trend Score (ATS) examines market activity according to various cohorts of Bitcoin holders.

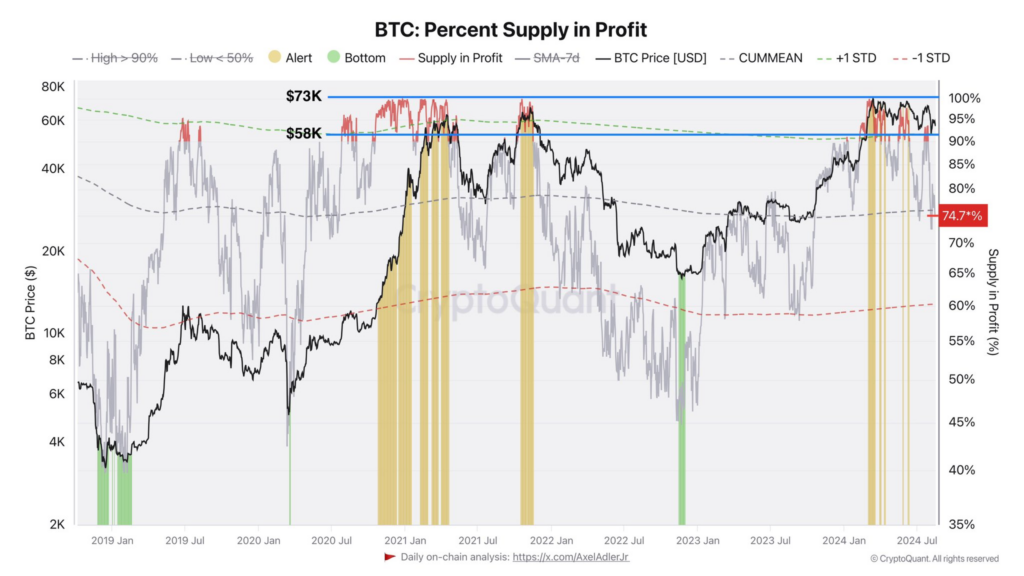

Furthermore, according to confirmed CryptoQuant author Axel Adler, in an article published on August 16 X, 25% of the whole BTC supply was purchased within the $58,000–$73,000 price range:

“25% of the total available Bitcoin supply was purchased at the price level of $73-58K. This represents a quarter of the total Bitcoin market capitalization, approximately $300 billion.”

Can September see Bitcoin reach $66,000?

Despite the ongoing gains, BTC lost 4.2% during the previous week and dropped below $58,000 on August 16 and 16.

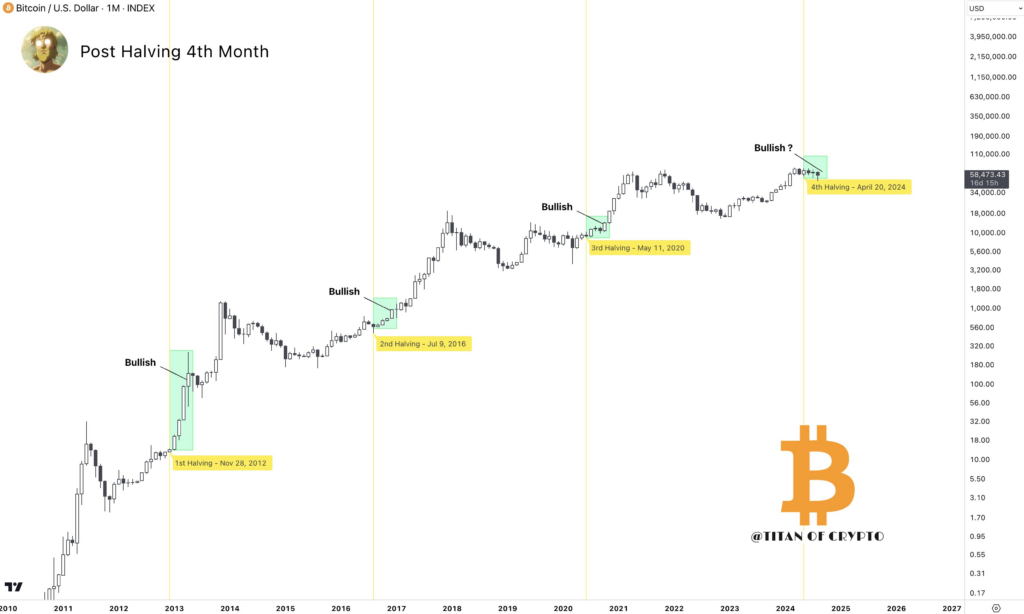

However, based on past post-halving chart trends, technical expert Titan of Crypto believes that BTC might still be headed beyond $66,000 by September.

In an X post dated August 15 August 15, the analyst wrote:

“Historically, the 4th month after the halving has always been bullish for #BTC, closing above the halving price. If this pattern repeats, September could be a bullish month above $66,000.”

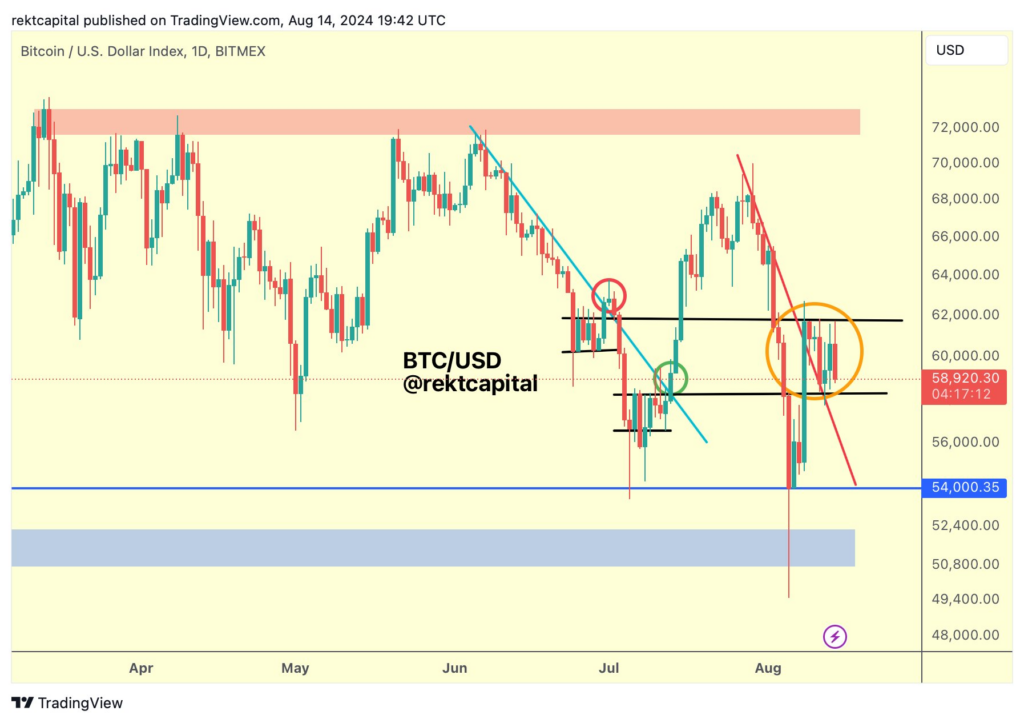

Rekt Capital, a well-known analyst, claims that a significant barrier level is before BTC’s price can move over $61,700. In an X post from August 14 August 14, the analyst wrote:

“Notice how the local highs of ~$61700 (black) are acting as resistance. Interestingly, BTC is consolidating between the late June wedge highs (~$62,000 black) which are back to figuring as resistance and the early July wedge highs ($58,280) which are now acting as support.”

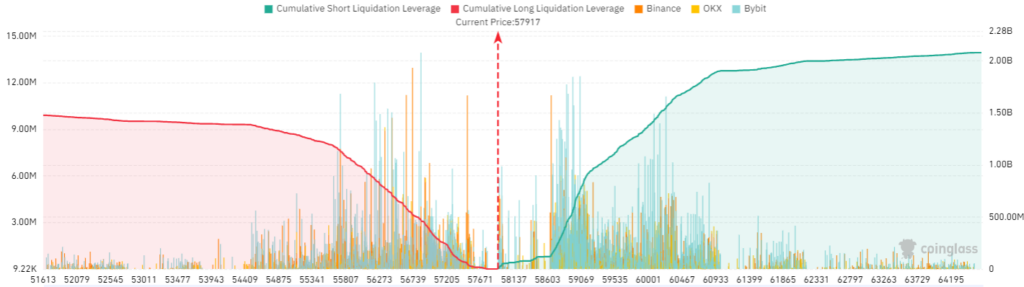

The next significant barrier is currently around $59,000. A rise above might liquidate cumulative leveraged short bets worth over $700 million, according to Coinglass statistics.

If the price of BTC increased above $59,300, short liquidations would total more than $1 billion.